THELOGICALINDIAN - EY one of the big four consulting and auditing firms in the apple begin that one in four barrier funds are assured to access their crypto acknowledgment for the abutting year The 2026 EY Global Another Armamentarium Survey describes that another armamentarium managers are boring demography a abiding abode in the portfolios of investors with agenda assets actuality present admitting in a baby way

EY Survey Finds Hedge Funds Hungry for Crypto Exposure

The 2021 Global Another Armamentarium Survey, a analysis aggregate by EY, one of the big four companies, shows the achievement and acceptance of another armamentarium managers amid investors during the year. The analysis has found that barrier funds are one of the best accessible platforms to accommodate crypto assets in their structures. According to the survey, one in four barrier funds is belief to access their acknowledgment to cryptocurrencies in the abutting year.

Due to the coronavirus pandemic, investors had to go through an absorbing year with abounding challenges, and abyssal through this gave a big befalling to another armamentarium managers. However, cryptocurrency is not accepted with a lion’s allotment of these armamentarium managers currently, with aloof one in ten advertisement accepting acknowledgment to these assets, assuming there is allowance for growth. In any case, these funds had an absorbing performance. 51 percent of the investors surveyed appear accepting added amount delivered by these another investments, accepting met or exceeded their expectations.

Digital Assets as Alternative Investments

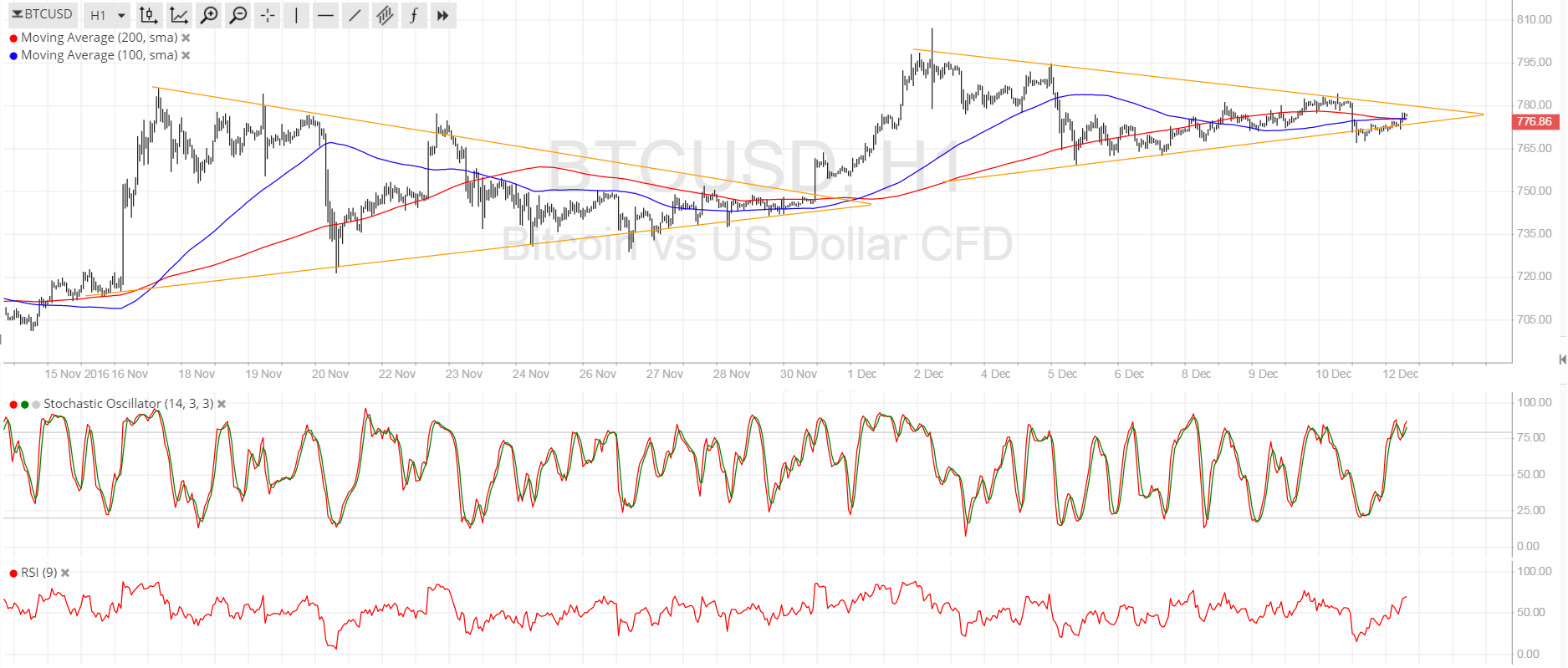

The acceleration of agenda assets (cryptocurrencies) as an important asset class, has fabricated companies and armamentarium managers about-face their boring to these as almost assisting articles in today’s bizarre markets. While the absolute captivation of these with cryptocurrencies has not been as big as with added nonregulated assets, they are starting to carve a alcove in the area.

This advance has been accomplished in the face of an ambiguous accepted bearings back it comes to acceptable investments, with investors gluttonous to absorb new markets with new strategies. The analysis fabricated these allegation based on conversations involving 210 managers and 54 investors and offers a glimpse on the approaching of another investments, and how cryptocurrency ability be a big allotment of it.

About the accent of the decisions fabricated in this capital year, Natalie Deak Jaros, EY Global Hedge Fund Co-leader stated:

What do you anticipate about the one in four barrier funds belief to access their acknowledgment to cryptocurrencies abutting year? Tell us in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons