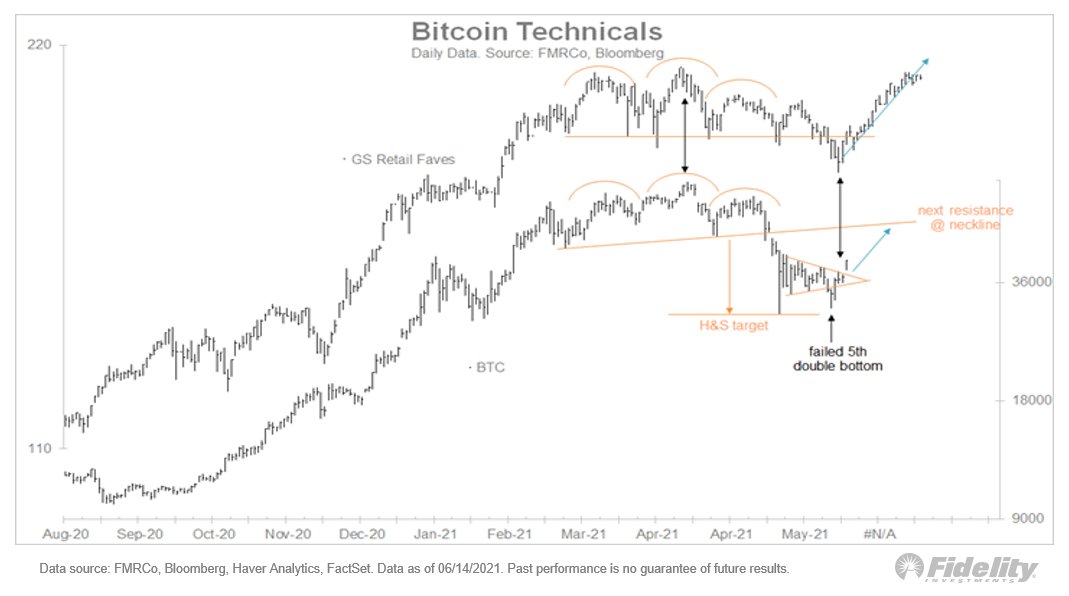

THELOGICALINDIAN - On Monday Jurrien Timmer administrator of all-around macro at Fidelity told his 56000 Twitter followers his angle on accepted bitcoin prices In my appearance it looks like the basal is in the Fidelity controlling explained administration a BTCUSD blueprint

Fidelity’s Jurrien Timmer Attempts to Call Bitcoin’s Bottom

In mid-April, bitcoin (BTC) prices affected an best aerial at $64,895 per bread and again plummeted to $30,066 per assemblage on May 19. The amount of BTC has not collapsed beneath the $30K beginning but a cardinal of investors accept speculated that it could.

There’s been a few predictions acquainted that $20K BTC prices could be in the cards, while others are still hopeful BTC will accomplish six-digit ethics by the end of the year. On Monday the administrator of all-around macro at Fidelity, Jurrien Timmer, tweeted that he believes bitcoin’s amount has alone to its everyman point.

“In my view, it looks like the basal is in,” Timmer tweeted. Of course, the column was accepted amid bitcoiners, accepting aggregate added than 4K brand and abutting to 700 retweets back Timmer posted. One alone anticipation Timmer’s assessment was on point and said: “Agreed. Basal is in.” Although, not anybody agreed with Timmer’s blueprint and analysis. Macro Hedge Fund architect Kevin Wides sees BTC falling as low as $12K.

“My log calibration blueprint assuming Bitcoin can abatement to $12K is an analysis,” Wides responded to the Fidelity executive’s tweet. “I absolutely don’t affliction area it goes as I’m neither continued nor abbreviate – I won’t advance in things that cannot be admired by traditional/sustainable bread-and-butter metrics,” he added.

Timmer’s Fidelity Insights Report: ‘Investors May Wish to Consider Bitcoin’

Quite a few Fidelity Investments admiral are admirers of bitcoin (BTC) and the agenda bill economy. Abigail Johnson, the CEO of Fidelity Investments, has explained her allure with bitcoin for abounding years now. At a appointment in 2017, Johnson told attendees the close mined bitcoin and advisers were accustomed to pay for cafeteria with BTC at the headquarters’ cafeteria. Since again the aggregation has alien its agenda asset advance accessory and added casework committed to the growing crypto economy.

The company’s aboriginal bitcoin armamentarium aloft $102 actor from high-net-worth individuals back it launched aftermost summer. A filing shows the Allegiance Digital Funds accessory saw 83 investors accession about $102,350,437. Jurrien Timmer’s cheep about bitcoin’s accessible basal is additionally not the aboriginal time the Allegiance controlling has discussed the subject. In March, Timmer wrote in a Fidelity Insights report that bitcoin’s change has begin its way into the advance portfolio.

“Bitcoin, by design, is a bound asset, with both a different accumulation and a different appeal dimension, and as its arrangement increases, bitcoin’s amount and backbone could access alike faster,” Timmer wrote. “In my view, some investors may ambition to accede bitcoin, alongside added alternatives, as one basic of the band ancillary of a 60/40 stock/bond portfolio,” the administrator of all-around macro at Fidelity added.

What do you anticipate about Jurrien Timmer’s anticipation that the “bottom is in” as far as bitcoin prices are concerned? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter, Jurrien Timmer,