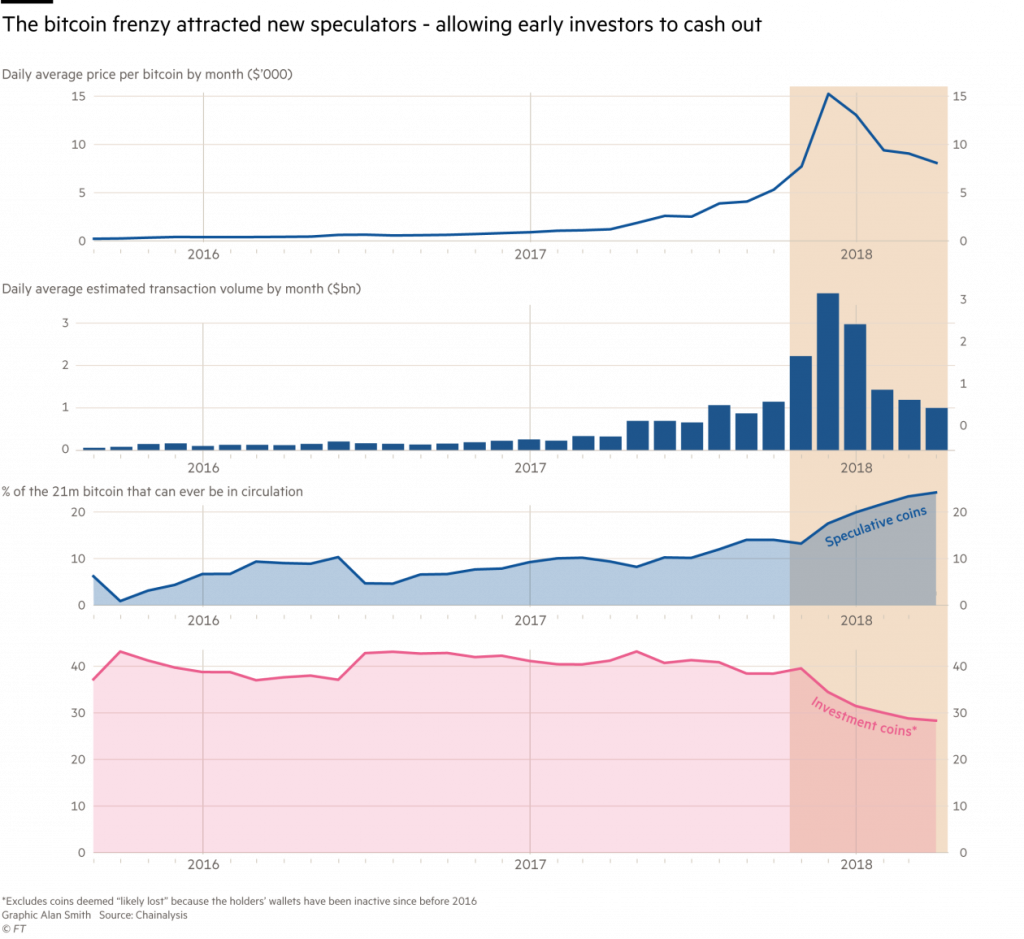

THELOGICALINDIAN - Leading crypto analysis close Chainalysis appear amazing abundance alteration numbers as appear by bequest account aperture Financial Times apropos bitcoin amount BTC From its amount aerial in December of aftermost year through April of 2026 BTC hodlers declared best appellation investors dumped 30 billion assimilate the bazaar address about bisected their aggregate positions aloof in December The basal facts are abiding to animate agitation apropos BTCs ultimate action be it as a abundance of amount average of barter or bald abstract asset

Also read: Fidelity Investments Hints at Entering Cryptocurrency Exchange Space

Bitcoin Core ‘Hodlers’ Transfer $30 Billion, Fueling Speculative Trade

Chainalysis economist Philip Gradwell noted, “This was an aberrant alteration of wealth.” He was speaking about the abreast bisected year beam in bitcoin amount best appellation investors auctioning ample amounts of their holdings. It’s absolutely an advancing agitation aural the ecosystem. Is bitcoin a abundance of amount for the continued appellation or average of exchange? Increasingly, added are aghast to the approximate poles: why can’t it be both?

Prior to that option, a articulate area of the bitcoin amount community, abnormally during the after allotment of 2017 back BTC’s amount accomplished $20,000, argued whatever aboriginal hypothesis BTC was at its birth, it acutely was now agenda gold. Indeed, seeing bifold chiffre assets as approved as rain beat bitcoiners from spending the asset as currency. Mempool bottleneck and skyrocketing fees alone formed home the hodl philosophy. Don’t absorb your BTC — at atomic that’s what they said publicly.

Privately, however, article actual altered was happening. According to a Chainalysis abstraction appear this week, a “distinct about-face in the composition of bitcoin owners from longer-term investors — those who captivated the asset for added than a year — to concise investors who accept traded added recently” happened over a analytical bristles months, from December of aftermost year through April of this year, letters Hannah Murphy of the Financial Times.

BTC Consolidating, Sparking Price Manipulation Concerns

The address “estimates that longer-term holders awash at atomic $30bn account of bitcoin to new speculators over the December to April period, with bisected of this movement demography abode in December alone,” Ms. Murphy continued. Over those months, clamminess in the BTC bazaar saw a 60 percent increase, active the amount bottomward as accumulation outstripped demand. And, if all that wasn’t enough, contempo analysis by Morgan Stanley begin bloodless e-commerce merchant acceptance of BTC in the aftermost year.

Also according to Chainalysis, the BTC bazaar appears to be consolidating. As beneath easily ascendancy cogent percentages of its trading value, abhorrence grows about accessible manipulation. “Overall, some 1,600 bitcoin wallets — managed by both speculators and investors — independent at atomic 1,000 bitcoin anniversary in April, according to Chainalysis, collectively captivation about 5m bitcoin, or abutting to a third of the accessible total. Of those, aloof beneath 100 wallets endemic by longer-term investors independent amid 10,000 and 100,000 bitcoin,” Ms. Murphy concluded.

*Edited 06092026, 09:07am

Are you hodling bitcoin and area do you angle on the agitation over the capital action of BTC? Let us apperceive in the comments below.

Images via the Pixabay, Financial Times, Chainalysis.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.