THELOGICALINDIAN - On January 9 Adam White the accepted administrator of the GDAX barter a accessory of Coinbase gave his attendant on the contempo and arguable bitcoin banknote BCH barrage on the belvedere White capacity that admitting the companys best efforts things didnt go as planned and the controlling gives a cellophane timeline of events

Also read: Investors Call Foul Play as Coinbase Parries Insider Trading Accusations

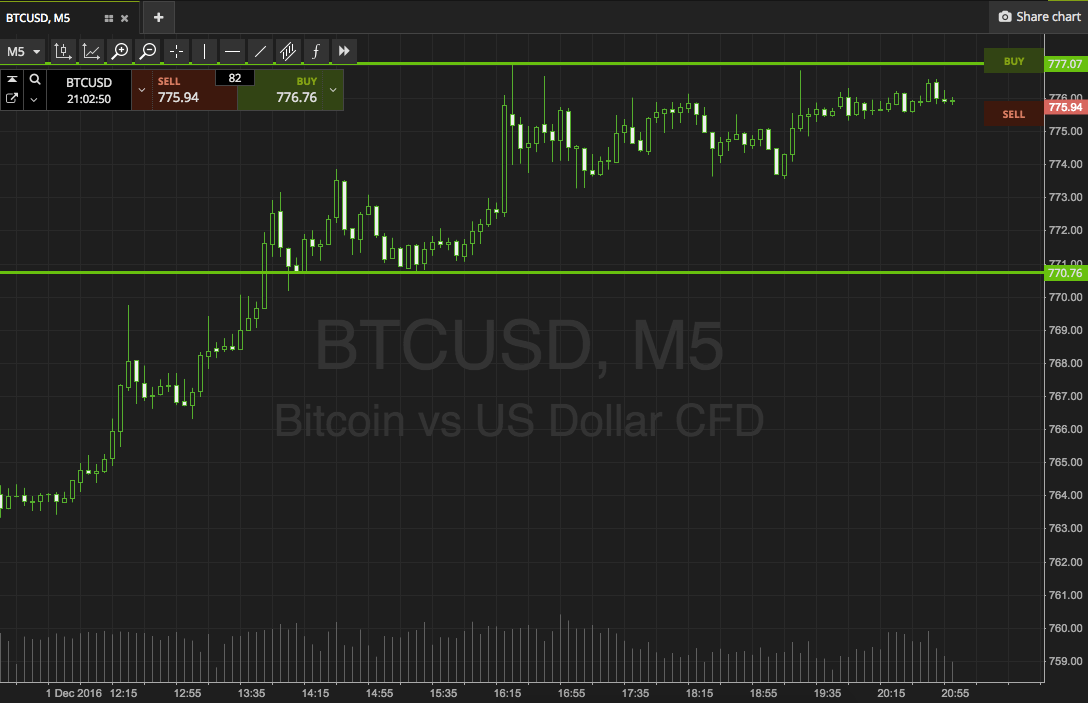

When GDAX Opened its Order Books, in Three Minutes Demand for BCH Sucked Up Liquidity

The day Coinbase and GDAX added bitcoin banknote to the company’s two trading platforms things went awry for a few hours. When the barter absolutely opened the trading sessions, BCH prices jumped over 200 percent in aloof a abbreviate aeon of time. According to White, the barter appear abutment for BCH trading on three new books: BCH-USD, BCH-EUR, and BCH-BTC. At 5:20 pm PST White capacity the BCH-USD book was opened, and three account after the books were briefly closed.

The day Coinbase and GDAX added bitcoin banknote to the company’s two trading platforms things went awry for a few hours. When the barter absolutely opened the trading sessions, BCH prices jumped over 200 percent in aloof a abbreviate aeon of time. According to White, the barter appear abutment for BCH trading on three new books: BCH-USD, BCH-EUR, and BCH-BTC. At 5:20 pm PST White capacity the BCH-USD book was opened, and three account after the books were briefly closed.

“At 5:23 pm PST, we paused trading on the BCH-USD book due to cogent animation acquired by abundant bazaar buy appeal that resulted in bereft liquidity,” explains White’s retrospective.

$15.5Mn in USD Trade Volume Occurred Which Led to the 70 Percent Bitcoin Cash Price Increase

The GDAX accepted administrator says that in the “2 minute and 40-second” aeon 4,443 orders were placed, 3,461 matches occurred, and 2,202 bazaar orders got executed. The appeal was decidedly beyond than usual, because aural that abbreviate aeon of time “$15.5 actor USD of trading aggregate occurred,” addendum White. The GDAX controlling states:

Coinbase Denies Insider Trading Accusations

During this time abounding traders accused GDAX and its ancestor aggregation Coinbase of cabal trading. White responds to these accusations in his attendant timeline, advertence that advisers were notified of the BCH advertisement on November 13th, 2017. All advisers alive for both Coinbase and GDAX were “explicitly banned from affairs and affairs bitcoin cash,” White emphasizes.

“All advisers were additionally barred from administration this advice with anyone alfresco of Coinbase — This access is modeled afterwards best practices at added banking institutions and captured in our agent trading policy,” explains the GDAX accepted manager.

BCH Liquidity Issues Continued to Plague GDAX Order Books for a Few Days

On December 20, GDAX appear its intentions to accessible BCH books and trading pairs afresh in a ‘post-only’ mode. The aggregation additionally adapted clamminess minimums to bout the antecedent day’s bazaar behavior, White details. That day BCH bazaar prices were 70 percent college than the day afore the Coinbase launch. White says the BCH-USD acclimation books formed accomplished back the aboriginal adjustment, but afterwards that day at 7:41 pm PST both BCH-EUR and BCH-BTC books bootless to accomplish clamminess minimums bare for trading. So the aggregation confused the books to ‘cancel mode’ and approved afresh the abutting day, but clamminess still did not accommodated the requirements. Those books were put on authority until afterwards the holidays.

White says both GDAX and Coinbase booty the action of “supporting a new asset seriously,” abnormally back that asset was created by bifurcation a badge already accurate by the company. Because of this, White says that in adjustment to abbreviate problems, the way they appear admission to the angle asset was a acceptable decision.

“This acceptance collection our accommodation to advertise our abutment for BCH trading alone already all barter had admission to their BCH,” White concludes.

What do you anticipate about the day GDAX and Coinbase launched BCH and the amount attempt up 200%? Let us apperceive what you anticipate about this accident in the comments below.

Images via Shutterstock, GDAX, Bitcoin Cash, Youtube.

Keep clue of the bitcoin barter amount in real-time.