THELOGICALINDIAN - As absorption in cryptocurrency grows amid institutional investors all-around advance banks like Goldman Sachs and JPMorgan Chase are reexamining their angle about bitcoin Goldman Sachs is hosting a alarm for its audience to apprentice about the implications of accepted behavior for bitcoin gold and inflation

Goldman Sachs’ Bitcoin Call for Clients

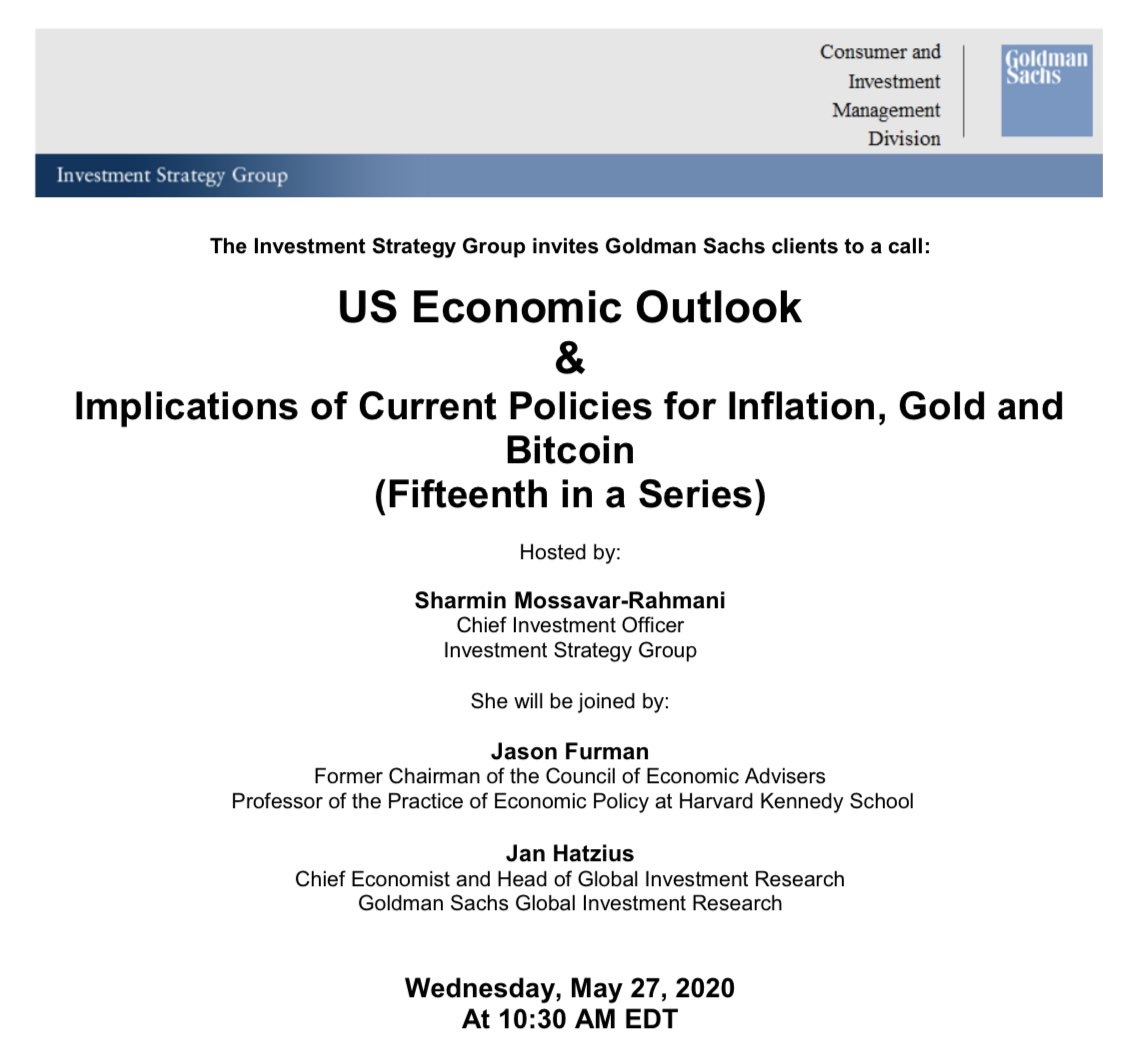

New York City-headquartered advance coffer Goldman Sachs is hosting a alarm for audience on May 27 advantaged “US Economic Outlook & Implications of Current Policies for Inflation, Gold and Bitcoin.” Goldman Sachs’ Advance Strategy Group, allotment of the firm’s Consumer and Advance Management Division, has issued a apprehension agreeable audience to the alarm area they can apprentice about bitcoin.

Sharmin Mossavar-Rahmani, Goldman Sachs’ arch of Advance Action Group and arch advance administrator for Wealth Management, will host the event. She is amenable for the firm’s all-embracing cardinal asset allocation and appropriate advance strategy.

Two added economists will accompany her for the call. One is Jason Furman, above administrator of the Council of Bread-and-butter Advisers and assistant at Harvard Kennedy School (HKS). The added is Jan Hatzius, Goldman Sachs’ arch economist and arch of All-around Economics and Markets Research. According to the firm, Hatzius is additionally a backstab champ of the Lawrence R. Klein Award for the best authentic U.S. bread-and-butter forecast, including during the all-around banking crisis.

Goldman Sachs Schedules Bitcoin Call Amid Rising Institutional Demand for Cryptocurrency

Cryptocurrencies, decidedly bitcoin, accept been accepting absorption amid institutional investors. A recent report by PWC and Elwood Asset Administration shows that cryptocurrency barrier funds’ assets beneath administration accept been growing steadily, ascent added than $2 billion at the end of aftermost year. “I apprehend the crypto barrier armamentarium industry to abound decidedly over the advancing years,” PWC accomplice and all-around crypto baton Henri Arslanian said.

Institutional investors accept been accepting acknowledgment to bitcoin and several added cryptocurrencies via Grayscale Investments’ products. The aggregation appear that the majority of its record-high advance in the aboriginal division (88%) came from institutional investors, bedeviled by barrier funds. Most went into Grayscale Bitcoin Trust (GBTC). It was added appear that the aggregation bought a third of all bitcoin mined in three months. The boilerplate account advance in the aboriginal division was $29.9 actor in Q1 2020, a abundant access from $3.2 actor in the aforementioned time aeon aftermost year. Grayscale CEO Barry Silbert hinted that the acquirement in the additional division will be alike higher. “Just delay until you see Q2,” he tweeted.

An accretion cardinal of billionaire investors are additionally accretion their advance portfolios’ acknowledgment to bitcoin or advising bitcoin as a ambiguity strategy. Among them are Virgin Galactic administrator Chamath Palihapitiya, Galaxy Digital CEO Michael Novogratz, and acclaimed barrier armamentarium administrator Paul Tudor Jones. Several economists and analysts accept predicted that added institutional investors will be advance in cryptocurrency column the covid-19 crisis, such as this Japanese analyst and SEC Commissioner Hester Peirce.

Investment firms, like JPMorgan Chase, that were ahead agnostic about bitcoin and added cryptocurrencies are advancing about and alpha to embrace them. JPMorgan CEO Jamie Dimon acclimated to alarm bitcoin a artifice but after regretted authoritative the account about the cryptocurrency. In addition, JPMorgan Chase is afresh said to accept accustomed two bitcoin exchanges, Coinbase and Gemini, as banking clients.

Many bodies in the cryptocurrency association appearance Goldman Sachs’ bitcoin alarm as a bullish move for the industry. “Bitcoin is inevitable, all who accept gone adjoin it are now actuality affected to kneel, aboriginal JPMorgan, now Goldman Sachs,” one Twitter user wrote. “Even banks apprehend authorization money is accident amount … The chase is on,” addition tweeted. A altered Twitter user chimed in: “After accepting criticized bitcoin so much, calling it a scam, Goldman Sachs is now activity the wind shift. Many opponents will do the aforementioned by alteration their opinions in the months and years to come. The bitcoin anarchy will booty abode with or after their support.”

Goldman Sachs has not appear the capacity of what aspect of bitcoin it will altercate during the call, cartoon an arrangement of belief on amusing media. While some are optimistic, others accept the advertising may be premature. Goldman Sachs afresh predicted the affliction recession for India and believes that a abysmal and abiding recession would accreditation abrogating absorption ante in the U.S. admitting Fed Chairman Jerome Powell absolution the strategy.

What do you anticipate about Goldman Sachs discussing bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Goldman Sachs, New York Post, Reddit