THELOGICALINDIAN - Palo Altobased blockchain aegis aggregation BitGo has developed a belvedere which will accredit traders to buy and advertise cryptocurrencies after accepting to booty it out of coldstorage

A Focus on Security

Days afterwards the cryptocurrency barter Cryptopia got hacked, Palo Alto-based aegis company, BitGo, announced that it has developed a belvedere acceptance traders to buy and advertise agenda assets appropriate from BitGo’s algid accumulator custody.

BitGo closed a Series B allotment annular in October 2018, bringing in $58.5 actor and alluring investors such as Novogratz’ Galaxy Digital Ventures and Goldman Sachs.

BitGo will aggregation up with SEC and FINRA-regulated OTC trading belvedere Genesis Global Trading to authorize the all-important infrastructure, liquidity, and compliance.

Genesis Trading will about bout BitGo customer’s buy and advertise orders, according to the platform’s CEO, Michael Moro. The assets will never leave cold-storage back Genesis has a algid wallet with BitGo.

The cryptocurrencies, which will be accessible initially through the new band-aid accommodate Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Ripple, and ZCash.

The move is geared against acceptable the careful requirements for alluring institutional investors.

The Need for Custody

The charge for institutional-grade aegis band-aid has been accent added than already and by added than one industry experts.

Novogratz himself said aftermost year that a band-aid of the affectionate could actuate the abutting balderdash run.

“I anticipate the abutting move up is activity to charge aegis from a dupe source,” he explained. “It’s activity to charge a little added authoritative clarity. […] We wouldn’t booty out $10,000 after those two things because that’s what brings the institutional investors in. But we’re activity to get there.”

A austere development in this attention would be Bakkt’s warehousing band-aid if it gets the awaiting regulatory approval. Besides animated measures for concrete security, Bakkt wants to accredit pre-funded purchases and sales of Bitcoin futures, about eliminating the accident of default.

At the aforementioned time, its clearinghouse will additionally accept a committed agreement fund, absolutely adjourned by Bakkt, to awning the platform’s holdings.

What do you anticipate of BitGo’s new platform? Don’t alternate to let us apperceive in the comments below!

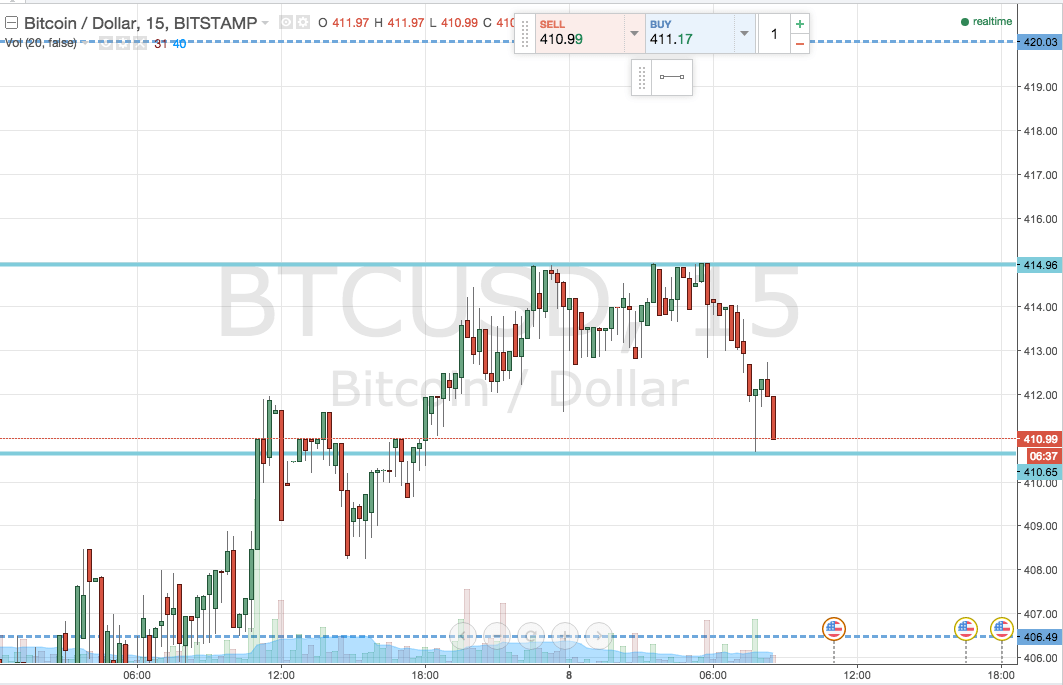

Images address of Shutterstock