THELOGICALINDIAN - Cryptocurrency aegis casework aggregation InVault from Shanghai has launched in Hong Kong aloof in time to booty advantage of the appropriate authoritative regions new rules for cryptocurrency exchanges and asset managers

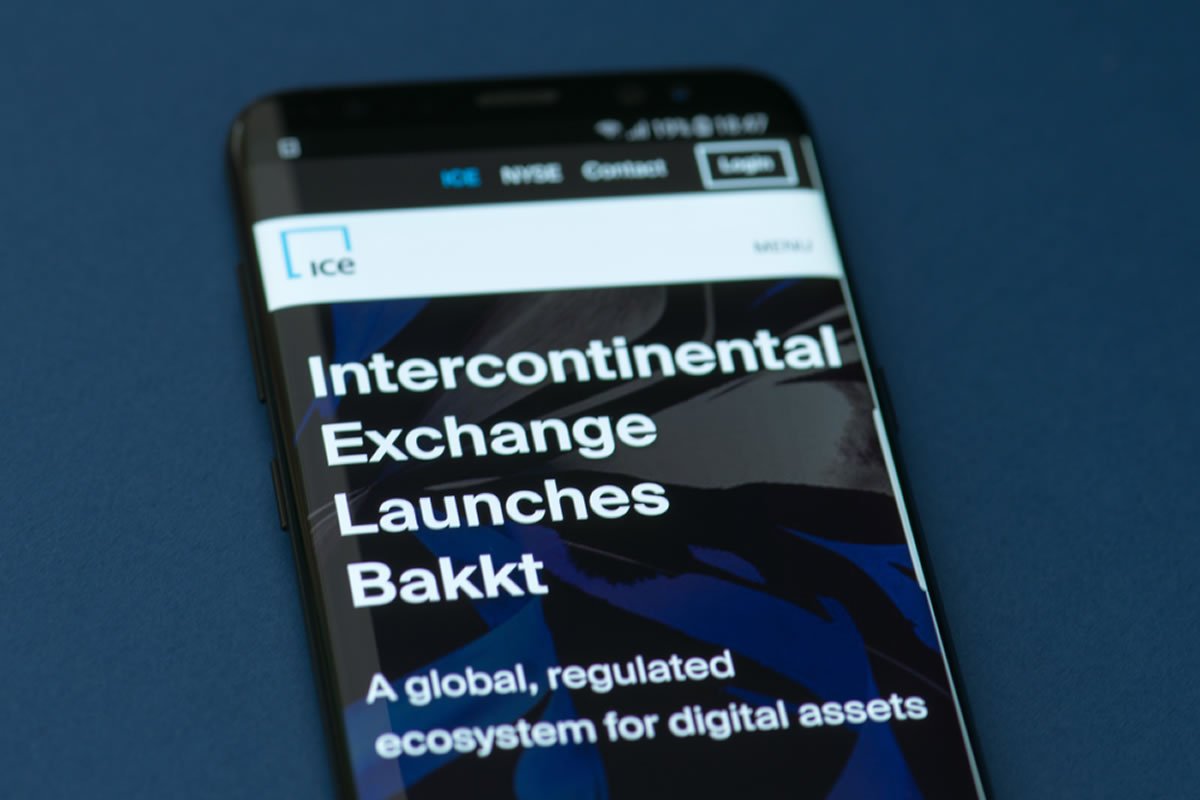

At the alpha of Nov 2018, Hong Kong’s Securities and Futures Commission (SFC) issued guidance on the authoritative standards accepted of cryptocurrency exchanges, belvedere operators, and armamentarium managers. It’s additionally alive on a approaching “conceptual framework” for the adjustment of “trading belvedere operators.”

Near Complete Insurance Cover is Now Required

As allotment of the new guidelines, cryptocurrency exchanges and asset holders charge accept absolute allowance for investors’ funds to anticipate losses — which is area cryptocurrency careful casework for high-volume coin-holding businesses appear into play. However, cryptocurrency businesses can additionally attending to self-custody and hot wallet storage, as continued as they accept the appropriate akin of insurance. For exchanges autumn cryptocurrencies online in “hot wallets,” this is 100% coverage. The regulator says:

InVault currently holds about one actor ether in aegis in acreage China and has appear it is the aboriginal aegis account abettor to access the bazaar in Hong Kong. The aggregation is backed by adventure basic armamentarium Matrix Partners China which has invested about $6 billion in the crypto-storage business. It has reportedly acquired a new “trust license” from the SFC acceptance it to action a absolutely automatic account in the arena as of December.

A Bridge Between Cryptocurrency and Traditional Asset Protection

InVault’s architect Kenneth Xu told the South China Morning Post (SCMP) that he believes trusted careful casework will accommodate a adapted “conduit” amid the cryptocurrency amplitude and acceptable banking systems. He appear that InVault is now in discussions with a cardinal of insurers to accommodate the advantage appropriate by the Hong Kong regulator as allotment of its services. Xu says the claiming for allowance companies is to accurately admeasurement accident and amount premiums accordingly.

InVault, and Xu, now expects abundant of the appeal for its aegis casework to appear from Hong Kong and additionally Singapore beneath new regulations.

Singapore’s regulators, the Monetary Authority of Singapore (MAS), discussed its access to cryptocurrency allocation and openness to cryptocurrency acceptance at the Singapore Consensus 2018 September. MAS additionally appear new adjustment to awning cryptocurrency account providers aftermost week.

Cryptocurrency aegis casework assure investor’s assets with physically anchored accumulator for client’s clandestine cryptocurrency wallet keys — which can generally be forgotten, lost, stolen, and hacked. SCMP additionally refers to incidences of cryptocurrency barter advisers accessing and burglary from, applicant wallets.

The SFC’s new guidelines seek to assure investors in Hong Kong as able-bodied as abacus some academic authoritative blank to the beginning industry. SFC Chief Executive, Ashley Alder, said in the release absolute the new regulation:

Do you anticipate all cryptocurrency exchanges and operators should be appropriate to accept absolute allowance or use the casework of a aegis company? Let us apperceive in the comments below!

Images address of Bitcoinist archives.