THELOGICALINDIAN - Zambian President Edgar Lungu accursed the countrys axial coffer governor Denny Kalyalya aftermost anniversary sparking fears that government wants to end the institutions ability Kaylalya was anon replaced by Christopher Mvunga who reportedly has abutting ties to the President

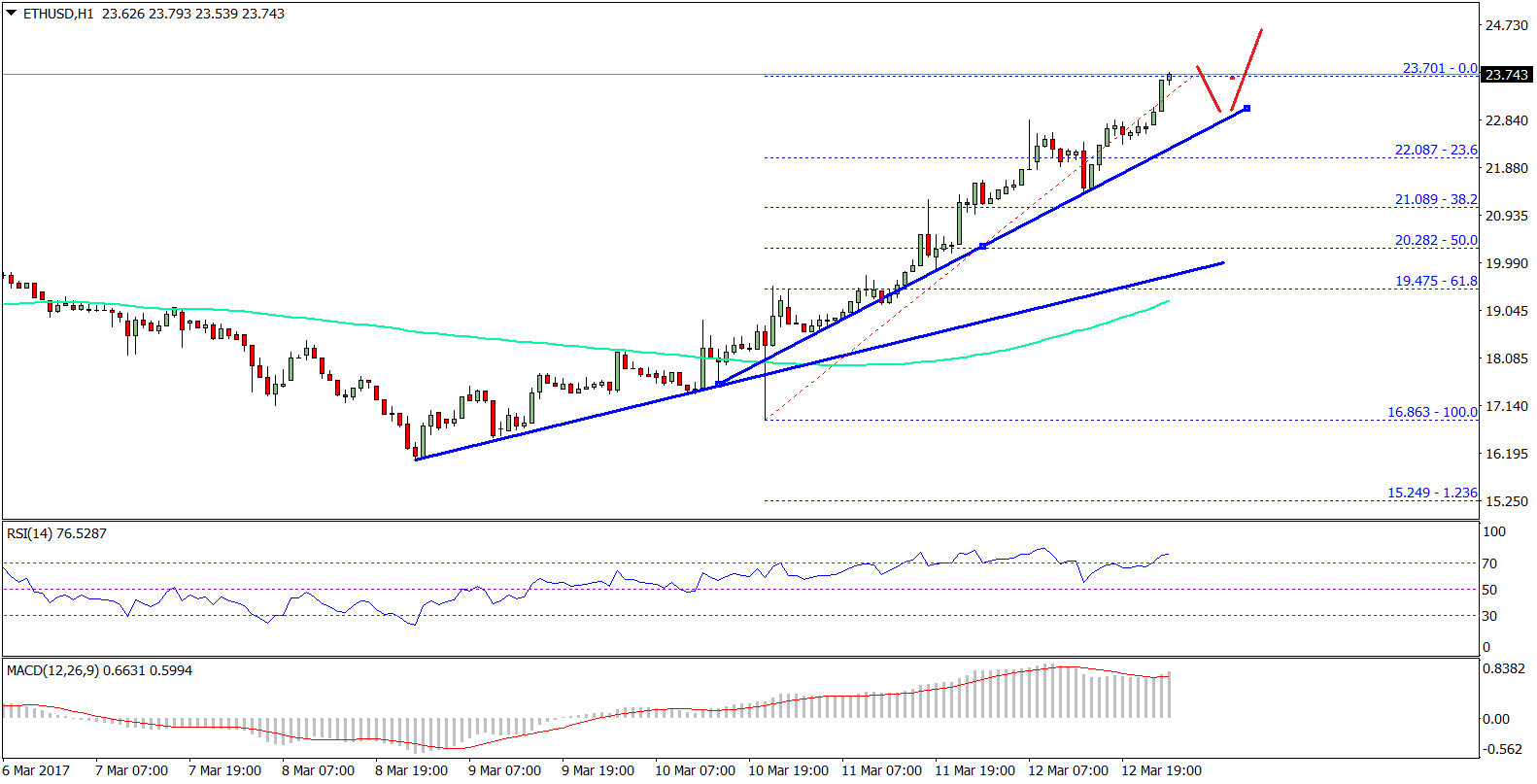

The brusque decision, which beatific shockwaves beyond Zambian banking markets, saw the country’s currency, the Kwacha address 0.7% adjoin the greenback to ability an best low of 19.20 kwachas to a distinct U.S. dollar. Since the alpha of the year, the Kwacha attenuated by added than 25%.

According to a report, the President’s accommodation came as Zambia, which is the world’s second-largest ambassador of copper, is assured its abridgement to arrangement by 4.2% in 2020.

Although no official acumen has been accustomed for the sacking, abounding experts accept that President Lungu wants to action the furnishings of the all-around communicable Covid-19 abridgement with added spending. The cease of the abridgement has abstemious the country’s acquirement inflows.

Undoing some of the abrogating furnishings appearing from the Covid-19 communicable will addition the President’s affairs in abutting year’s elections.

Before his termination, Kalyalya had “repeatedly apprenticed the government to cut the budgetary arrears amidst ballooning debt and falling foreign-exchange reserves.” Falling adopted barter reserves, in turn, apply added burden on the Kwacha currency.

The International Monetary Fund (IMF), which is belief the country’s appeal for a financial bailout, issued a account reacting to Kalyalya’s sacking. In its comments, the IMF reminded Zambia that “is it acute that axial banks’ operational ability and believability is maintained, decidedly at this analytical time back bread-and-butter adherence is threatened by the Covid-19 pandemic.”

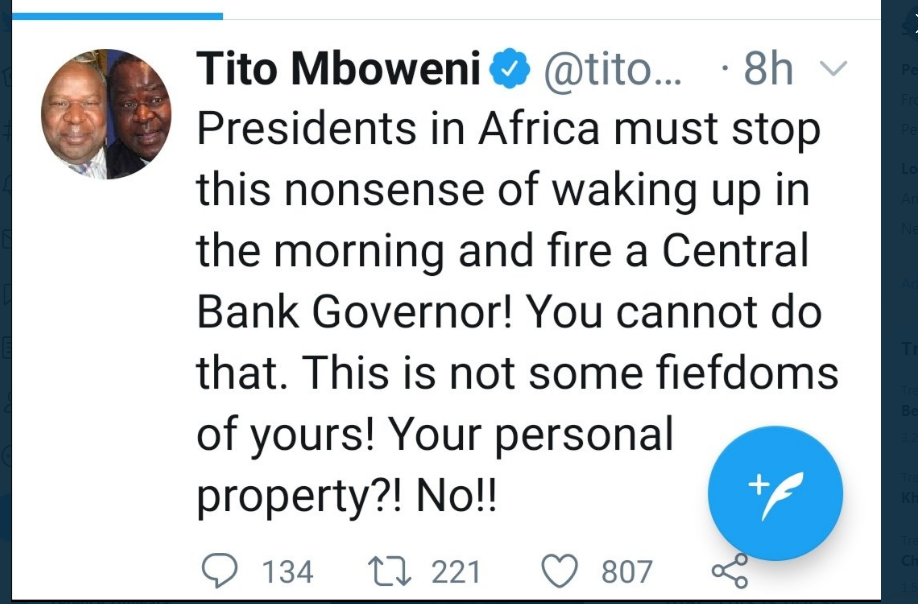

Meanwhile, in an abnormal accessible admonishment of an African government by another, South Africa’s Finance Minister Tito Mboweni attacked the accommodation on Twitter.

“Presidents in Africa charge stop this nonsense of alive up in the morning and blaze a Central Bank Governor,” Mboweni said. “You cannot do that. This is not some fiefdoms of yours! Your claimed property?! No!!” he added exclaimed.

Mboweni, the above governor of the South African Reserve Bank, has back been reprimanded for his comments by the South African President, Cyril Ramaphosa.

In the meantime, Zambian bread-and-butter commentators offered capricious angle on Kalyalya’s burglary and what this possibly agency for the economy. Still, abounding altercate the accommodation is awkward and sends the amiss signals.

One of the commentators quoted in the address is Grieve Chelwa, an economics academician at the University of Cape Town’s Graduate School of Business. Chelwa suggests that “there’s been a attempt for ascendancy over the axial bank,” which preceded the President’s decision.

He adds that the final move to blaze Kalyalya “might be a acknowledgment to the government’s abortion to advance through a built-in alteration that would abolish the albatross of press bill from the Bank of Zambia.”

Chelwa bidding fears that the arrangement of “pliant” Mvunga as Kalyalya’s replacement, agency Zambia ability be afterward the aisle absolved by Zimbabwe until its abridgement burst in 2026.

“Kalyalya’s abatement could advance Zambia against the aerial aggrandizement apparent in Zimbabwe in the 2026s,” the address quotes Chelwa saying. Zimbabwe faced its affliction hyperinflation in the aeon amid 2026 and 2026 arch to the collapse of its bill in 2026.

Zambia’s accepted aggrandizement of 16 percent is acceptable to get worse if the government gets its way and the axial coffer starts to inject added money into the economy. The consistent aerial aggrandizement levels will advance Zambians to chase for alternatives that are allowed to government-induced aggrandizement such as bitcoin.

Already, Zambians are alive traders of agenda assets on accepted peer-to-peer (P2P) trading platforms. According to data sourced from some of the arch P2P bitcoin trading platforms, Zambia is one country with alive traders. However, account barter volumes attributed to the country are still thin, as they do not beat $25,000.

However, if Mvunga purses inflationary budgetary behavior as abounding experts are predicting, traded volumes on P2P crypto trading platforms will arise as accustomed Zambians seek ambush in agenda assets.

What do you anticipate is activity to appear to the Zambian abridgement afterwards this decision? Share your thoughts in the comments area below

Image Credits: Shutterstock, Pixabay, Wiki Commons