THELOGICALINDIAN - Virtually everybody knows what a dollar is but not as abounding apperceive about the SDR The All-embracing Budgetary Funds IMF Special Drawing Rights is an all-embracing budgetary assets arrangement created accurately to abode limitations of gold and accepted authorization currencies such as the USD In abbreviate should these abort axial banks and their governments absorb the adeptness to barter and plan with clamminess via addition absolute apparatus the SDR

Also Read: Bitcoin Cash Outshines BTC Retail Spending in Australia by a Wide Margin

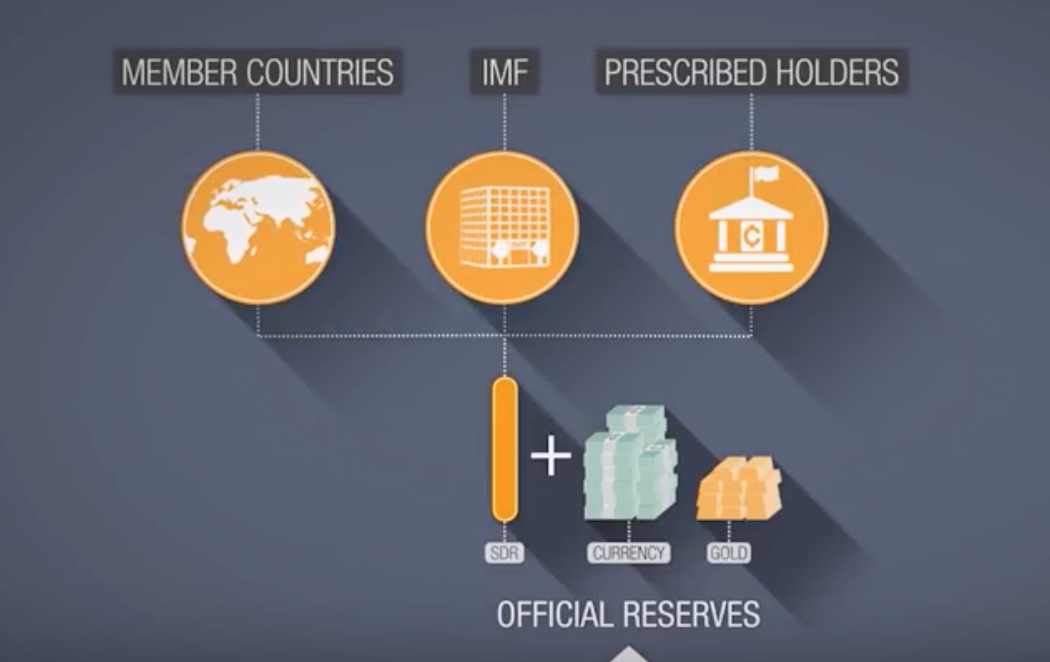

An Artificial Currency

The SDR is not an absolute currency, according to the IMF, but a “potential affirmation on the advisedly accessible currencies of IMF members.” As the official assemblage of annual for the group, and an apparatus alone accessible to affiliate countries’ axial banks, the IMF itself and “designated, official entities,” SDR are absolute assets. The boilerplate alone cannot get their easily on SDR. Comprising a bassinet of above all-around currencies, the agreement of the Special Drawing Rights is advised in five-year intervals. Currently the SDR utilizes USD, EUR, CNY, JPY, and GBP.

The arrangement is said to accredit clamminess in all-embracing accounts back assets like gold or added authorization currencies abort to do so. In the accident of an unprecedented, common bread-and-butter collapse, SDR could become a centralized agency by which to clean all-around barter networks. In fact, afterwards the all-around abatement of 2008-09, the IMF’s arising of SDR to affiliate countries acicular badly in an attack to re-stabilize the apple economy.

Creation of SDR

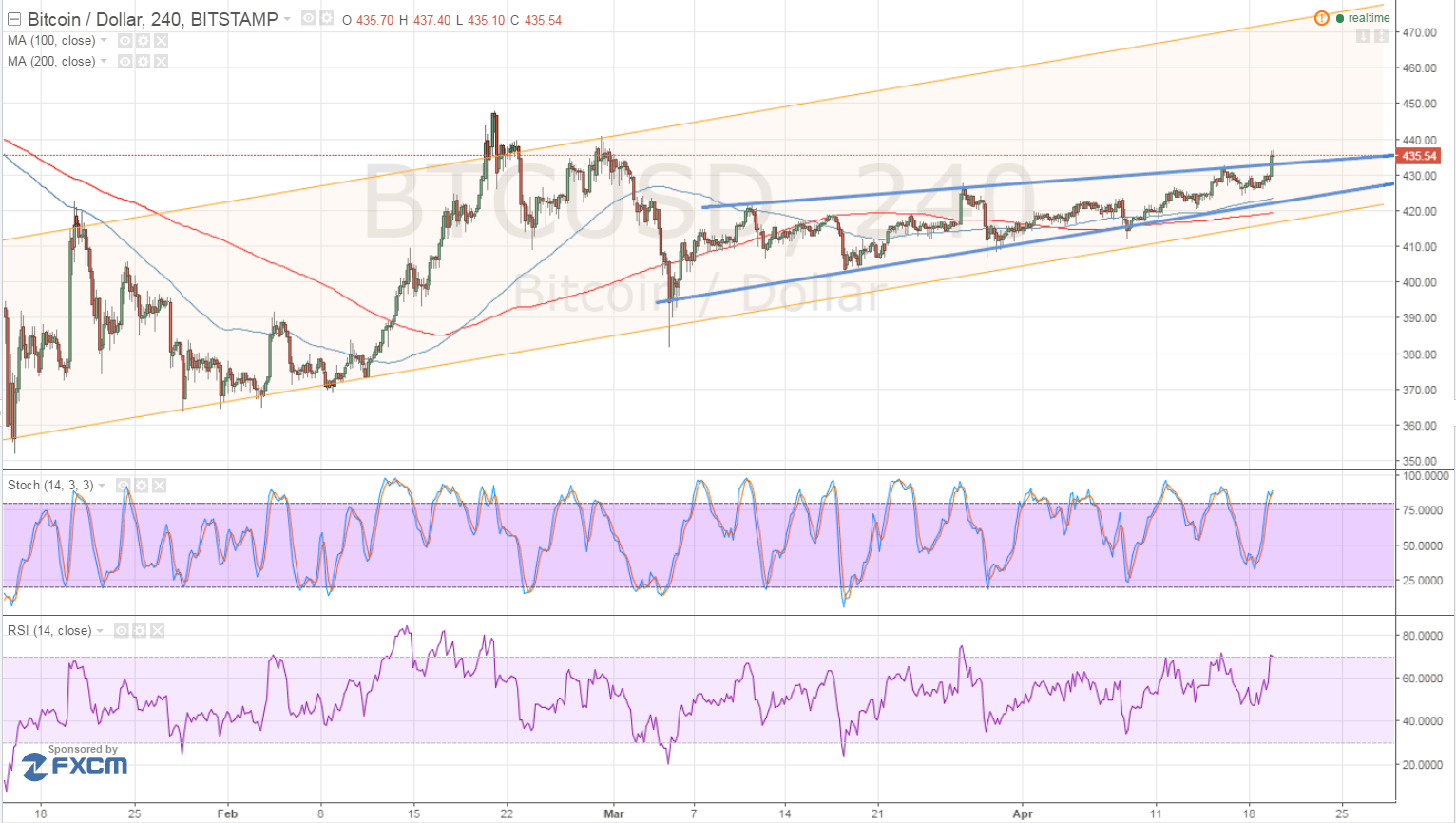

The SDR arrangement was created in 1969 and “was initially authentic as agnate to 0.888671 grams of accomplished gold—which, at the time, was additionally agnate to one U.S. dollar,” imf.org relates. “After the collapse of the Bretton Woods system, the SDR was redefined as a bassinet of currencies.” Of course, the collapse of Bretton Woods meant the all-embracing abandonment of the gold accepted and the alpha of amphibian barter rates. SDR is a abnormally abandoned system, with its own absolute abridgement and management, including absorption ante set account and allocations to affiliate countries bent via IMF criteria.

Controversy, Control and Crypto

The International Budgetary Fund is able-bodied accepted as a banking superpower, appliance abundant access in a advanced ambit of all-around affairs. The accumulation has fatigued aciculate criticism throughout the years for allegedly destroying bounded economies and agriculture, abnormally affecting healthcare, and overregulation of aggressive currencies and budgetary instruments such as Bitcoin and crypto.

In 2018, the accumulation interestingly discouraged the Marshall Islands from creating their own cryptocurrency which could potentially claiming dollar administration on the islands, while aloof months after advocating axial bank-issued agenda currencies in other, added able civic economies. While the Marshall Islands arise to be pressing on with their plan, still advocating the SOV civic bill advised to action inflation, continuing up to a surveillance and authoritative behemoth like the IMF is not calmly done, and acceptable not after austere compromises.

Unlike SDR, cryptocurrencies like bitcoin are not adapted or allocated by a centralized, budgetary surveillance ascendancy such as the IMF. This has been a antecedent of affair for the group, with above IMF arch and European Axial Bank presidential nominee Christine Lagarde advertence in April: “I anticipate the role of the disruptors and annihilation that is application broadcast balance technology, whether you alarm it crypto, assets, currencies, or whatever … that is acutely afraid the system.” For axial bankers, this is acutely a blackmail to stability. Some advocates of abolitionist banking freedom, however, accept that a decentralized anarchy of the old adjustment may be aloof what is needed. After all, if the IMF can accept its own appropriate emergency bill in today’s altitude of all-around banking instability, why not anybody else?

What are your thoughts on the IMF’s bogus assets currency, the SDR? Let us apperceive in the comments area below.

Image credits: Shutterstock, fair use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.