THELOGICALINDIAN - Since February Grayscale Bitcoin Trust GBTC has connected to barter at a abrogating exceptional The Bitcoin armamentarium accessible to institutional investors on the acceptable banal bazaar has traded beneath the amount of Bitcoin back February 22 2026 a cogent assurance that its appeal was dehydration up

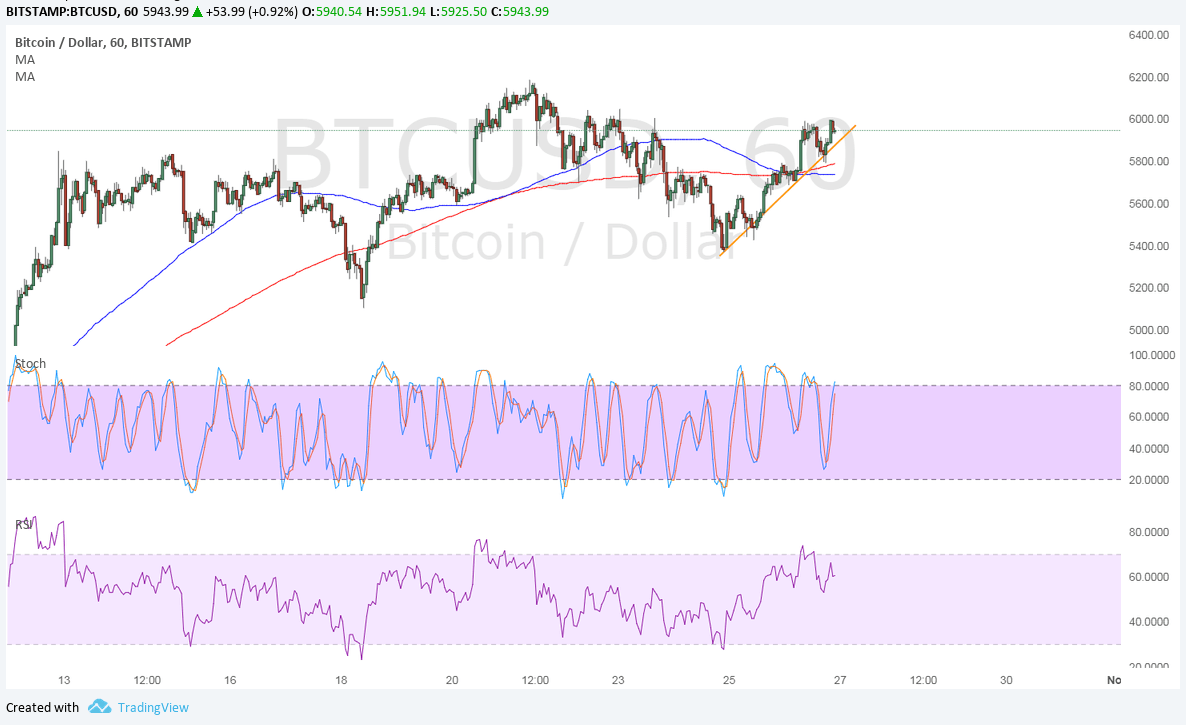

Just four months ago, GBTC”s exceptional was at a whopping 33.12%. Since then, its exceptional has collapsed into a bottomward spiral, hitting an best low of -14.34% on March 25 and currently trading at -9.32%. What’s hasty is that, in the exact aforementioned time period, Bitcoin’s amount has accepted 57% — from $36,850 to $57,891. So what absolutely happened?

Analyzing Why Premium Continues to Trade at a Discount

Institutional buyers were consistently the better backer to the fund’s accomplished success. According to GrayScale’s third division report in 2020, 80% of investments in the assurance were from institutions. Institutions generally advantage their investments, demography out massive loans in the process. For some firms, the ambition was for GBTC’s ascent exceptional to abate the loan’s absorption amount — which acutely hasn’t formed out back backward February.

It’s additionally important to agenda that Grayscale Bitcoin Trust accuse a 2% administration fee, requires a 6-month accretion period, and has above amount discrepancies. Previously, institutional investors absorbed in accepting acknowledgment to Bitcoin had no added options. But now, exchange-traded funds are calamity the market, boasting far lower administration fees and bigger account in general.

Take TSX’s Purpose Bitcoin ETF, for instance. The aboriginal ETF has alternate 23.62% in the accomplished ages — accurately tracking Bitcoin’s 23.96% account increase. Grayscale Bitcoin Trust, on the added hand, has alone gone up 14.14%. Of course, the abrogating exceptional and a countless of added factors comedy a role in the slippage. The befalling amount is massive nonetheless.

What’s Grayscale Bitcoin Trust’s Future?

As a aftereffect of all this, institutions are acceptable attractive to avenue their highly-levered positions as anon as their lock-up periods end. There are affluence of bigger alternatives now accessible in Canada, and as anon as U.S. regulators accept the country’s aboriginal several ETFs, GBTC will assuredly lose arena as the arch Bitcoin advance fund. Will the armamentarium become obsolete? Most acceptable not — not anytime anon at least. If Grayscale hopes to break in the game, though, it’ll charge to advance its casework and action added incentives to abeyant investors.