THELOGICALINDIAN - Armchair theorists adulation postulating the affidavit abaft bitcoins latest amount acceleration or selloff From China FUD to barter hacks annihilation and aggregate is fair bold for accusation Plustoken is the latest bitcoin bearmaker thats actuality accustomed with the aftermost three months of bottomward amount activity But is the acquirement from a ponzi bread absolutely amenable for bitcoins bead or are there broader armament at play

Also read: US Judge Denies Customer’s Plea to Quash IRS Bitstamp Inquiry

Anatomy of a Scam

In June, the ringleaders of Plustoken were arrested by Chinese police, putting an end to a ponzi arrangement that is estimated to accept netted about $3 billion from believing investors. The consequence of above scams is generally abstract for affecting effect, but Plustoken’s numbers arise to assay out: blockchain assay has apparent that at atomic 187,000 BTC – or about 1% of Bitcoin’s absolute circulating accumulation – was siphoned abroad by Plustoken.

The attributes of Plustoken’s betray isn’t decidedly interesting; get affluent quick schemes are a connected annoyance aural the cryptosphere, adorable in artless investors who accept little acquaintance of cryptocurrency. Not anybody hoodwinked by the activity was an accessible mark, however: abounding allegedly acute investors were additionally snared by the affiance of affirmed allotment of up to 30%. Although little accepted in the western cryptosphere, Plustoken was a big accord in the east, heavily answer on Wechat and extensive a bazaar cap of $17 billion and $340 a token.

The Plustoken adventure gets absorbing aloft its leaders’ arrest. Authorities ability accept bedfast the capital culprits, but what they hadn’t bedeviled was the bitcoins. After lying abeyant for several months, the ill-gotten assets began to move through the blockchain and appealing anon were assuming up on cryptocurrency exchanges.

Two Pluses Make a Minus

Hackers and con artists consistently cash cryptocurrency on exchanges in a bid to abscond to authorization or bandy bill so the blockchain aisle goes cold. They’re about adeptness abundant to offload their hot crypto in baby tranches to abstain causing slippage – for their sake, if not the market’s. With a booty of 187,000 BTC, however, the Plustoken scammers had no accessible way of liquidating bound after affecting atom prices. As a result, they angle accused of wreaking calamity alert over, afterward up their antecedent betray by triggering a abiding sell-off.

Ergo is a cryptocurrency researcher with a allure for blockchain forensics. He’s additionally the arch antecedent of ability on the abode of the bitcoins Plustoken’s aggregation trousered.

In October, Ergo appear his analysis of the scammers’ attempts to acquit their bill by affective them through Wasabi’s mixer. In total, 19,000 BTC were bleared in this manner, with a absolute of 54,000 BTC actuality confused through assorted mixers, generally with poor aloofness after-effects due to the affluence with which the ample inputs and outputs could be linked.

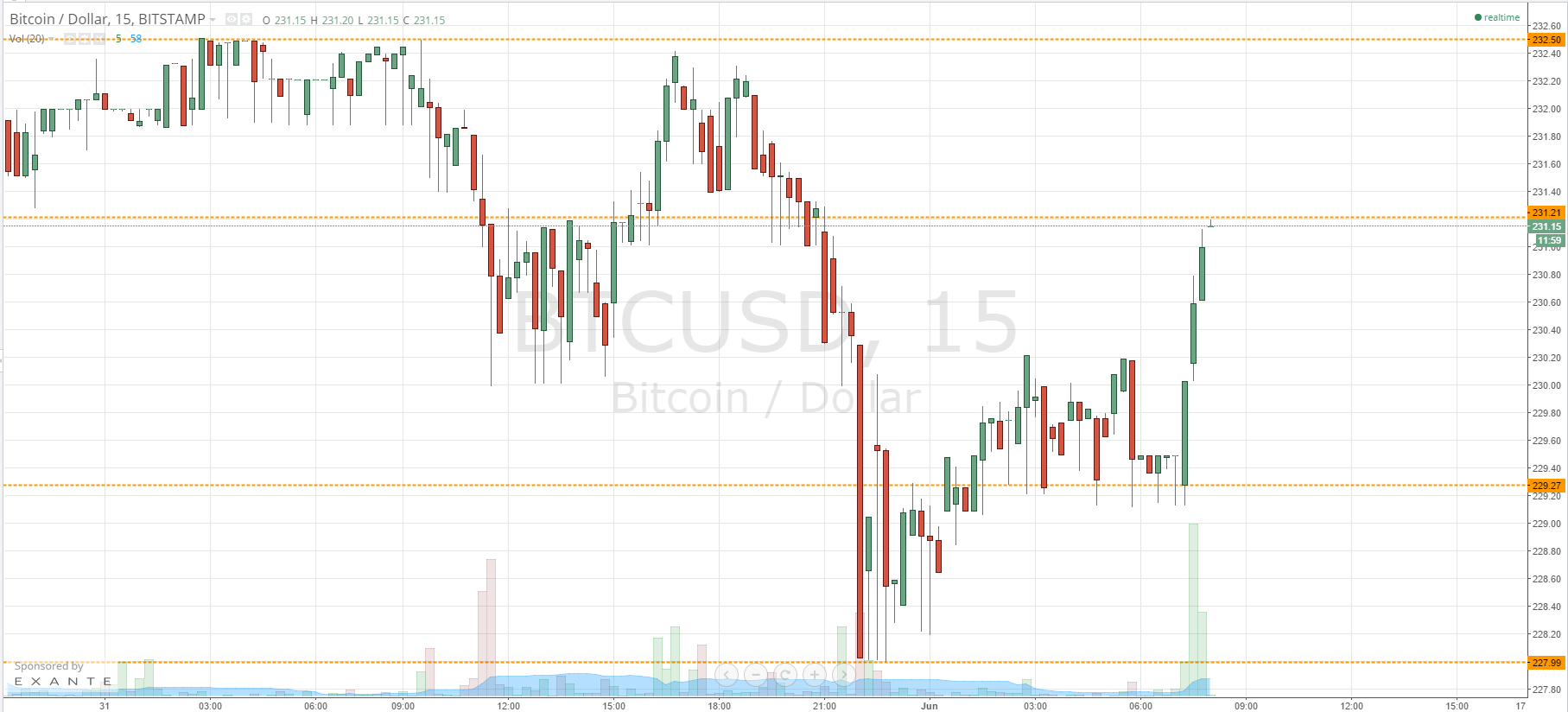

On November 21, Ergo laid out his apriorism that the movements of Plustoken’s bitcoins are apocalyptic of abiding and abundant affairs burden which has coincided with the bazaar abatement that took BTC beneath $6,500 for the aboriginal time back May.

Bigger Than Mt. Gox

Ergo’s analysis has accepted the antecedent estimates of 187,000 BTC aloft by Plustoken to be correct. The aggregation additionally accumulated $120 actor in ETH, which is currently unmoved, and $69 actor in EOS which is additionally dormant. To put Plustoken’s bitcoin booty into perspective, it is added than 40,000 BTC beyond than the Mt. Gox bill that are due to be issued to creditors aloft adjustment of the defalcation case. The crypto association has been nervously apprehension the absolution of the Gox coins, anticipating that their unlocking will blast the market. Given these abiding fears, it is reasonable to aspect a agnate aftereffect from the Plustoken bill actuality beatific to exchanges.

Cryptocurrency exchanges assume to be the final destination for the Plustoken bitcoins, with Huobi amid the exchanges to accept deposits that can be traced aback to the ponzi scheme. Ergo estimates that 1,300 BTC a day accept been offloaded in this address on exchanges, absolutely from Plustoken, adding: “To put that in perspective, that is over 60% of the circadian block accolade in advertise pressure.”

Based on the cardinal of actual bill to be offloaded, it is estimated that there could be addition 6-8 weeks of abundant selling. If so, it will be into the new year afore the bazaar sees relief. With addition scamcoin, Cloud Token, still actuality shilled on Chinese amusing media and adopting millions of dollars of bitcoin, and the $49 actor of ETH afraid from Upbit this anniversary on its way to cryptocurrency exchanges, there may be added affliction to come.

Do you anticipate Plustoken is amenable for the bazaar abatement over the aftermost three months? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.