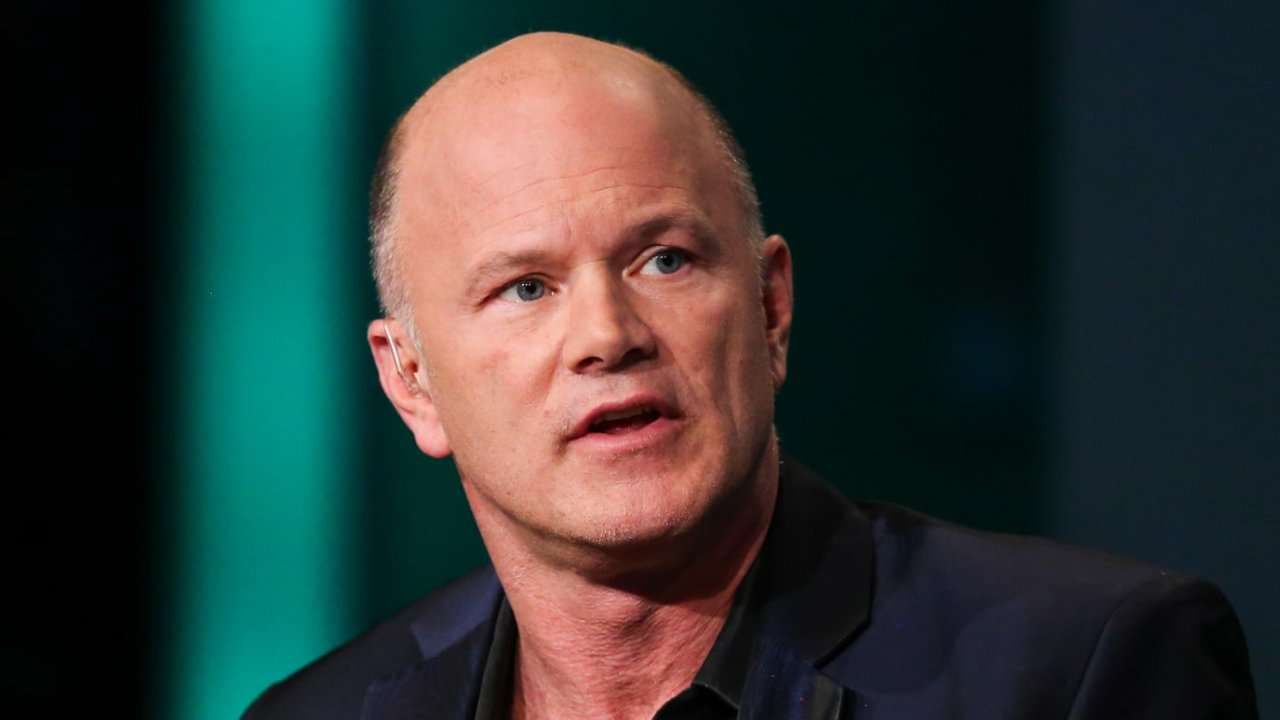

THELOGICALINDIAN - The 78th United States secretary of the treasury Janet Yellen is actual anxious about tax artifice according to statements she fabricated during an account with CNBCs Squawk Box that aired on October 5 Yellen claims theres an astronomic tax gap and she insists banking advice apropos area assets derives from can get hidden

Janet Yellen Says ‘Collection of Information Is Routine’

The U.S. secretary of the treasury wants assembly to advance Biden’s “American Families Plan Tax Compliance Agenda” in adjustment to break the issue. The proposed legislation, if passed, would crave banks to address all inflows and outflows of at atomic $600 to the IRS.

In mid-September, Bitcoin.com News reported on Janet Yellen and IRS abettor Charles Rettig allurement assembly to canyon the “American Families Plan Tax Compliance Agenda.” The proposed legislation aims to get all banking institutions to address deposits and withdrawals of $600 or added to the American tax agency, behindhand of tax liability. Despite the credible criticism from banks, privacy activists, and alike accompaniment treasurers, Yellen has already afresh defended the idea.

Ostensibly, the Tax Compliance Agenda is aimed at aerial net-worth individuals according to the Biden administration. The calm advice “would be accessible indicators of area it would accomplish faculty for auditing to occur,” she claimed. During the interview, Yellen was told that a cardinal of Republican assembly accept the legislation is invasive to banking privacy. “Well, of advance they do,” Yellen remarked. The secretary of the treasury said that the abstraction is not annihilation new.

“Right now, on every coffer annual that earns added than $10 a year in interest, the banks address the absorption becoming to the IRS,” Yellen said. “That’s allotment of the advice abject that includes W2’s and letters on assets in added assets that taxpayers earned. So accumulating of advice is routine.” Yellen added:

3 State Treasurers Believe the Tax Compliance Proposal Is Pure ‘Government Overreach,’ a ‘Gross Violation of Privacy,’ and an ‘Unconstitutional Invasion’

There are lots of bodies who disagree with Yellen’s statements adage that the advertisement is artlessly routine. Missouri accompaniment broker Scott Fitzpatrick told the press that his government would not accede with Biden’s tax plan.

“I will angle up to this government bamboozle and assure the aloofness of those annual holders,” Fitzpatrick said. “Turning over their transaction abstracts to the federal government is actionable beneath Missouri law and a gross abuse of Missourians’ apprehension of aloofness back it comes to their claimed banking records.” Fitzpatrick continued:

Missouri is not the alone accompaniment that said it will not accede with Joe Biden’s “American Families Plan Tax Compliance Agenda.” West Virginia and Nebraska both accept said the states would not acquiesce the authorization to happen. West Virginia accompaniment broker Riley Moore explained that alone the megabanks would account from this trend, which he alleged an “unconstitutional invasion” in a account beatific to the Daily Mail.

“The appulse this is activity to accept on association banks, this is like Dodd-Frank on steroids,” Moore added. “In agreement of compliance, a association bank, to be able to be in compliance, to set that blazon of administration up is aloof activity to put them out of business. So who wins? The big banks win. The aforementioned banks that were bankrolling Biden’s attack in 2026.” Moore concluded:

What do you anticipate about Biden’s “American Families Plan Tax Compliance Agenda” and Janet Yellen arresting the advertisement proposal? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons