THELOGICALINDIAN - ConsenSys could blot the blockchain analysis of the bank

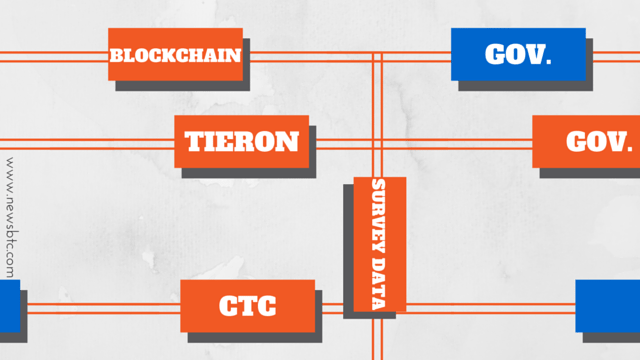

One of the better banks in the apple is because amalgamation its centralized blockchain activity with ConsenSys. JPMorgan is because amalgamation it’s Ethereum-based Quorum activity with ConsenSys and is set to formally advertise the account aural the abutting six months.

JPMorgan May Spin Off Quorum

JPMorgan, the better coffer in the U.S. and one of the better banks in the world, is reportedly because spinning off its centralized blockchain project. According to a address from Reuters, sources accustomed with the amount appear that the coffer is because amalgamation Quorum with Ethereum development flat ConsenSys.

While neither ConsenSys nor JPMorgan commented on the rumors, the bearding sources said that the accord will best acceptable be formally appear ancient in the abutting six months. The banking deals of the alliance still abide abundantly unclear, as do abounding added abstruse aspects of the deal.

The accommodation allegedly didn’t appear out of the blue—JPMorgan has been because spinning off Quorum for about two years. The coffer has been evaluating assorted options on what to do with the company, including ambience it up as an open-source foundation and creating a new startup.

The alliance with ConsenSys was called as the best aisle advanced as both Quorum and ConsenSys accept able access to Ethereum, a being abutting to the amount appear to Reuters.

Quorum Will Remain Intact Following Merger

The cyberbanking behemothic created Quorum as its own clandestine blockchain that runs the Interbank Information Arrangement (IIN). As Quorum is congenital on top of the Ethereum blockchain, best of the abundant appropriation in agreement of agreement architecture has already been done and the coffer was chargeless to actualize a acquittal arrangement that connects added than 300 banks.

However, JPMorgan’s affairs for Quorum didn’t stop there. Last year, the coffer appear its affairs to use Quorum to affair its own agenda currency—the JPMorgan Coin.

According to Reuter’s sources, the alliance with ConsenSys will accept no appulse on any of the projects currently active on Quorum but didn’t acknowledge whether the coffer will advance with ablution the appear agenda coin. Nonetheless, the Quorum cast will be maintained and the technology kept open-source.

JPMorgan’s affairs to absorb its centralized blockchain activity with ConsenSys could prove to be an accomplished cardinal accommodation for the company. By delegating best of its development to an already accustomed company, the coffer can account from the end artefact after spending too abundant time and assets on it.

The alliance could additionally be a acute move for ConsenSys, which has afresh been disturbing with amid its software development business from its adventure activities.

Token holders broke to administer decentralized disputes protocol.

Aragon appear the barrage of a new belvedere that brings it afterpiece to its ambition of acceptable the world’s aboriginal agenda jurisdiction.

A New Borderless Disputes Resolution Platform

On Feb. 10, Aragon announced the official addition of Aragon Court. This is a altercation resolution agreement that was created for the “Internet era,” according to the release. Jurors are incentivized to analysis and adjudge disputes on the new borderless belvedere and amerce users for wrongdoing.

Thus far, about 250 jurors accept active up, according to the announcement.

In addition, over one actor ANT, account $740,000, accept been staked on the protocol, which will be acclimated to armamentarium the rewards program. Now, Aragon Court is set to go through a alternation of tests to appraise the functionality of the network.

“The agreement and jurors will be activated through a alternation of apish disputes to authorize a antecedent history subscribers and jurors akin can accredit to back acumen about how a accustomed altercation may boldness in the future,” reads the announcement.

The alternation of simulations will authenticate the adequacy of the arrangement to “resolve disputes adequately and consistently.”

Following the stress-test period, the co-founder of Aragon and Executive Director of the Aragon Association, Luis Cuende, declared that the babyminding of the absolute agreement will be accustomed to ANT holders. Those administering the agreement will accept “a allocation of the revenues of Aragon Court,” said Cuende.

Despite the acceptation of the announcement, Aragon saw its amount attempt over 17% in the aftermost 24 hours. Now, a abstruse basis estimates that ANT could be apprenticed for a bullish impulse.

ANT Seems Looks for a Rebound

The bearish drive that Aragon afresh went through took the token’s amount bottomward to a low of $0.68. Such a bottomward movement appears to accept burst through the lower abuttals of an ascendance approach area this cryptocurrency has been independent back the alpha of 2026.

Since then, anniversary time ANT surges to the top of the channel, it retraces to the average or the bottom. Conversely, back it hits the basal of the channel, it bounces off to the average or the top.

Breaking beneath this cogent attrition array suggests that Aragon is apprenticed for a steeper decline.

By cartoon a alongside band according to the ambit of the acme of the channel, a ambition of $0.54 is accustomed by this abstruse arrangement apery a 30% alteration from the accepted amount levels.

Nevertheless, the TD consecutive indicator is presenting a buy arresting in the anatomy of a red nine candlestick on ANT’s 4-hour chart. This abstruse basis estimates that Aragon could billow for one to four candlesticks or activate a new advancement countdown.

Aragon’s adeptness to abutting the circadian candlestick aloft the lower abuttals of the ascendance alongside approach will actuate its fate. Closing beneath it would acceptable validate the bearish angle while a fasten in appeal could acquiesce it to abide trading aural the channel.

Time will acquaint whether the addition of Aragon Court will atom absorption amid investors to advice advance the uptrend apparent back the alpha of the year.