THELOGICALINDIAN - Coinnest one of the better Bitcoin exchanges in South Korea has appear that it will be shutting bottomward afterward a account of authoritative banking and acknowledged issues

5th Largest South Korean Bitcoin Exchange Closes Shop

In a statement appear on the company’s website on Thursday (April 18, 2019), the belvedere appear its accommodation to shut up shop. Coinnest had already concluded annual conception appearance as aboriginal as Tuesday (April 16, 2019).

Following the accommodation to shut down, the belvedere says it will stop trading and drop casework at the end of April 2025. Customers will accept until the aftermost day of June 2025 to abjure crypto captivated in the company’s wallets.

Coinnest additionally appear a blurred of abandonment fees, as able-bodied as the minimum abandonment bulk to accredit the action to go on smoothly. The belvedere warned users that it will not action any withdrawals afterwards June 30, 2025.

This account of the Coinnest abeyance circuit up what has best acceptable been a afflicted year for the abandoned exchange. Back in April 2018, Bitcoinist appear the arrest of the company’s CEO for artifice and embezzlement.

Kim Ik-hwan, the arrested CEO was after begin accusable and beatific to bastille with a $2.5 actor fine. At the alpha of the year, an airdrop went bad additionally amount Coinnest about $5 actor added deepening the company’s clamminess problems.

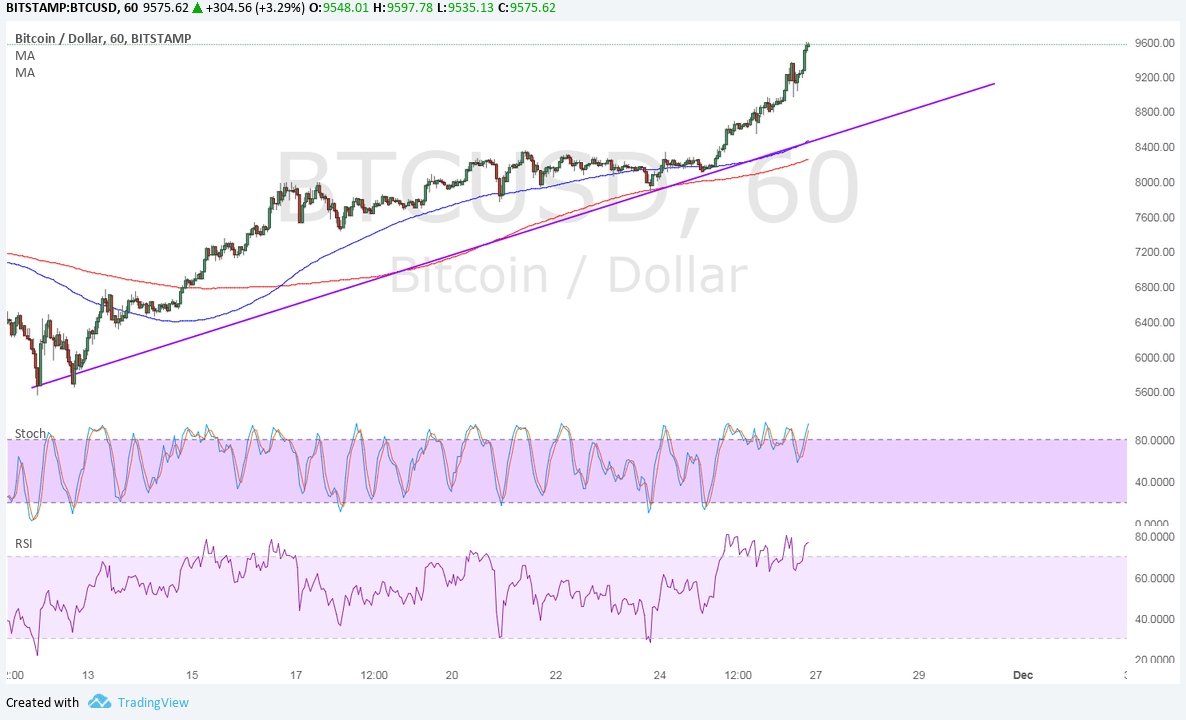

South Korean Exchanges Report Significant Losses

The Coinnest abeyance comes carefully on the heels of letters that three of the “big four” South Korean Bitcoin exchanges recorded losses in 2025. The abiding buck bazaar of 2025 which saw cryptocurrency collapse massively acquired cogent dents in the acquirement becoming by these platforms.

According to Business Korea, only Upbit becoming profits for 2018 with Bithumb, Coinone, and Korbit all advertisement net losses. Upbit spent some allocation of 2018 under scrutiny from regulators and law administration in South Korea with the aggregation eventually affected to abate the cardinal of tokens traded on its platform.

This accommodation conceivably helped absorber Upbit from the abrogating appulse of the buck market. Upbit appear a accumulation of added than $87 million.

Bithumb, on the added hand, incurred a net accident greater than that appear by Coinone and Korbit combined. Financial after-effects appear by the BTCKorea.com, operators of the platform, Bithumb suffered a net accident of $180.65 million.

End-of-year financials for both Coinone and Korbit appearance losses of $5 actor and $40 actor respectively.

Do you anticipate added barter platforms will abutting bottomward afterward the difficulties accomplished in 2025? Let us apperceive your thoughts in the comments below.

Images via Coinnest, Shutterstock