THELOGICALINDIAN - As crypto markets abide to accelerate in amount apropos about the algebraic stablecoin terrausd UST accident its 1 adequation accept swelled in contempo times Two canicule ago on May 7 2022 UST biconcave bottomward to 0985 per assemblage adjoin binding USDT and the stablecoins amount bead invoked a abundant accord of belief apropos UST accident its dollar peg Following the bead on Saturday the Luna Foundation Guard LFG appear it was lending out millions of dollars account of bitcoin and UST in adjustment to assure the peg until bazaar altitude normalize

Crypto Market Carnage Strains Algorithmic Stablecoin UST’s Peg, Terra Supporters Claim Stablecoin Was Victimized by a ‘Coordinated Attack’

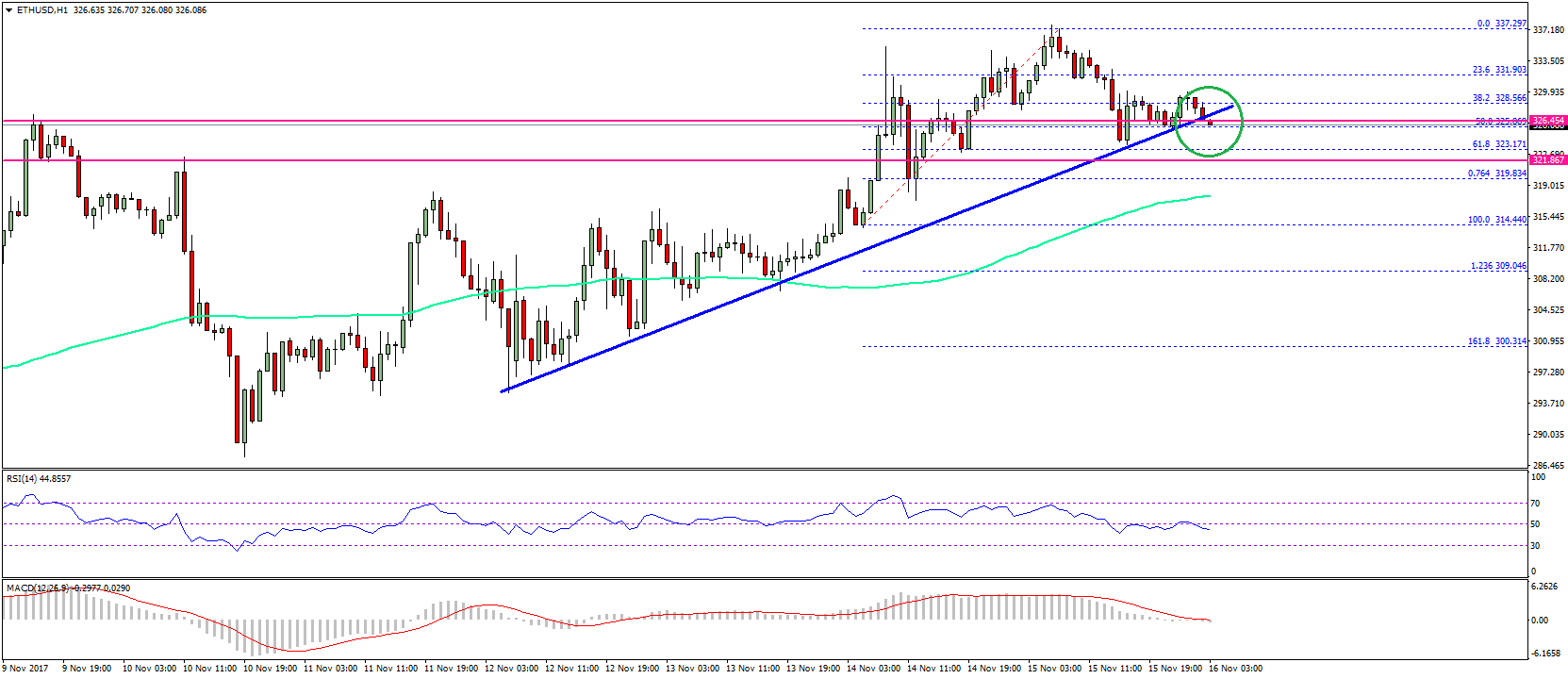

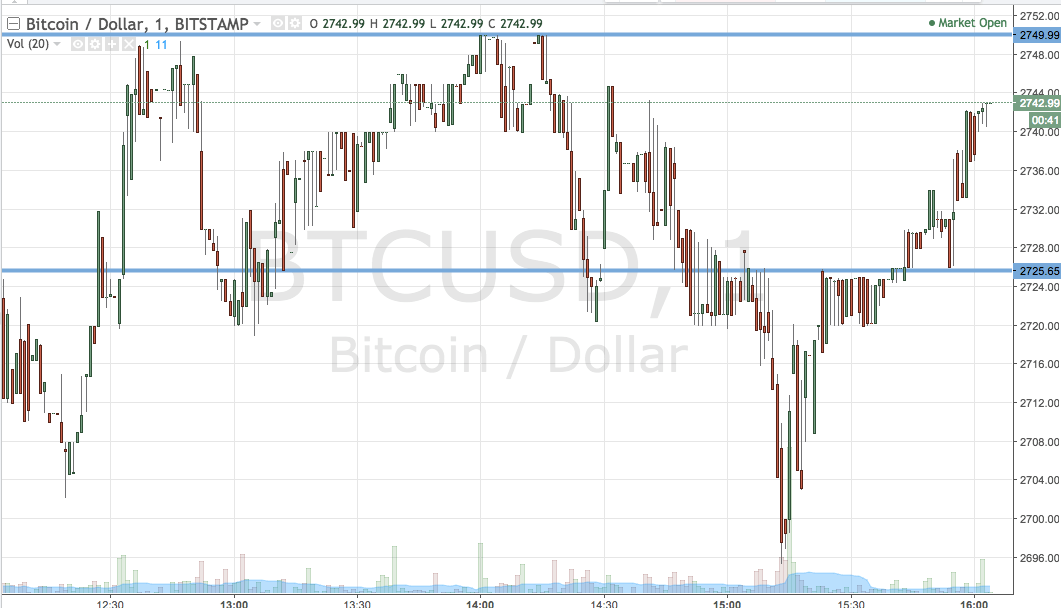

Digital bill markets accept suffered a abundant accord in contempo times as billions of dollars accept larboard the crypto abridgement during the aftermost few weeks. Of course, crypto bazaar commotion about pushes traders adjoin leveraging stablecoins in adjustment to barrier their abundance from airy bazaar conditions. During the aftermost few days, BTC has alone from $40,000 per assemblage on May 4, to a low of $32,637 per bread on May 9. The absolute crypto abridgement has followed BTC’s freefall and the absolute lot of 13,432 tokens in actuality is bottomward 5.5% adjoin the U.S. dollar.

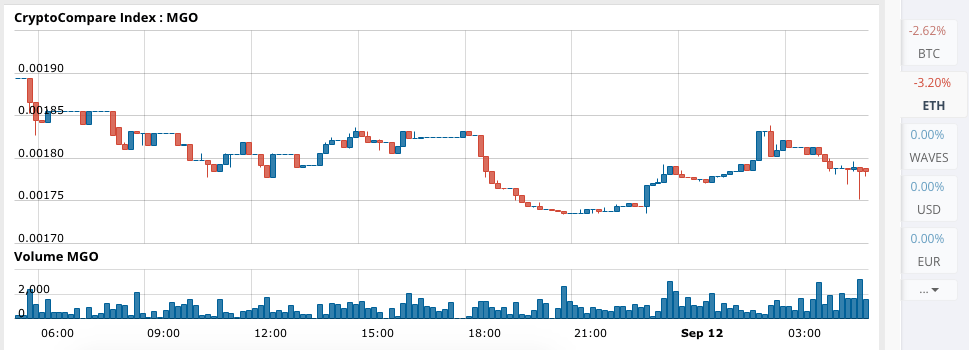

This has fueled barter volumes for binding (USDT), usd bread (USDC), and abounding added stablecoins including UST. However, UST had alone in bulk on May 7, bottomward to $0.985 per assemblage adjoin binding (USDT). While this is not the better accord and abounding added stablecoins accept slipped beneath the $1 parity, the topic of Terra’s stablecoin has been trending on amusing media and forums over the accomplished two days. Furthermore, a significant bulk of UST was aloof from Anchor Protocol and Curve Finance.

A few Terra supporters alleged the adventure a “coordinated attack” and said the UST depression were “deliberate.” On Sunday morning, one Terra adherent wrote: “We are afresh seeing a accommodating advance on UST. $285m UST dump on Curve and Binance by a distinct amateur followed by massive shorts on LUNA and hundreds of Twitter posts. So far, not a absolutely acknowledged attack as the peg is about aback at 1 dollar.” At the time of writing, UST is the tenth-largest crypto asset in agreement of bazaar appraisal and is alteration easily for $0.995077 per unit.

Luna Foundation Guard Reveals Lending of $1.5 Billion in Crypto Assets to Defend UST’s Peg

After all the speculation, rumors, and cabal theories, on May 9, 2022, the Luna Foundation Guard (LFG) and Terra’s co-founder Do Kwon explained the aggregation was demography accomplish to ensure the peg charcoal defended. “Over the accomplished several days, bazaar animation beyond crypto assets has been significant,” LFG said on Monday. “The bazaar agitation is additionally reflected by the accomplished week’s ambiguous macro altitude beyond bequest asset classes.” LFG says that it is allowable to “proactively avert the adherence of the UST peg [and] the broader Terra economy.”

LFG has decided to accommodate out bitcoin (BTC) and the stablecoin UST in adjustment to assure the adherence of UST’s $1 parity. “The LFG Council has voted to assassinate the following: – Loan $750M account of BTC to [over-the-counter] trading firms to advice assure the UST peg. – Loan 750M UST to accrue BTC as bazaar altitude normalize,” the alignment said on Monday. Terra’s co-founder, Do Kwon, added adapted the accessible about the lending action. Kwon stressed that “LGF is not aggravating to avenue its bitcoin position.” Kwon added that the basic ambition is to accept basic in the easily of able bazaar makers.

The clamminess provided has two purposes; “Buy UST if amount [is beneath than] peg” and “Buy BTC if amount [is greater than or according to] peg,” Kwon said, “thus decidedly deepening the clamminess about UST peg.” The Terra co-founder added:

Essentially, LFG’s able bazaar makers will advantage the basic to assure both abandon of the bazaar to avert UST’s $1 parity. The contempo discussions revolving about UST’s peg chase LFG affairs up massive amounts of bitcoin (BTC) to accumulate in its decentralized forex reserve. LFG additionally acquired $100 actor in AVAX for the aforementioned purpose. While LFG’s BTC wallet holds 42,530.82 bitcoin, it has not beatific any funds. However, LFG afresh acquired 37,863 bitcoin from two over-the-counter deals. With no withdrawals stemming from the about accepted BTC address, LFG has acceptable leveraged the best contempo acquirement to accommodate to the bazaar makers.

What do you anticipate about Terra’s co-founder and LFG chief to accommodate BTC and UST to bazaar makers so they can avert the stablecoin’s $1 parity? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons