THELOGICALINDIAN - The cryptocurrency abridgement slid decidedly on Thursday afternoon ET as the accumulated bazaar cap of all the crypto bill baldheaded added than 10 during yesterdays trading sessions Added than 12 hours after a cardinal of the top crypto assets are still bottomward in amount amid 412 and some agenda bill saw alike bigger losses during the aftermost 48 hours

Things change bound in the crypto ecosystem, as agenda bill proponents accept been ambidextrous with acutely airy prices this week. For instance, bitcoin (BTC) affected a top on September 1, as prices affected $12,044 per bread on Tuesday.

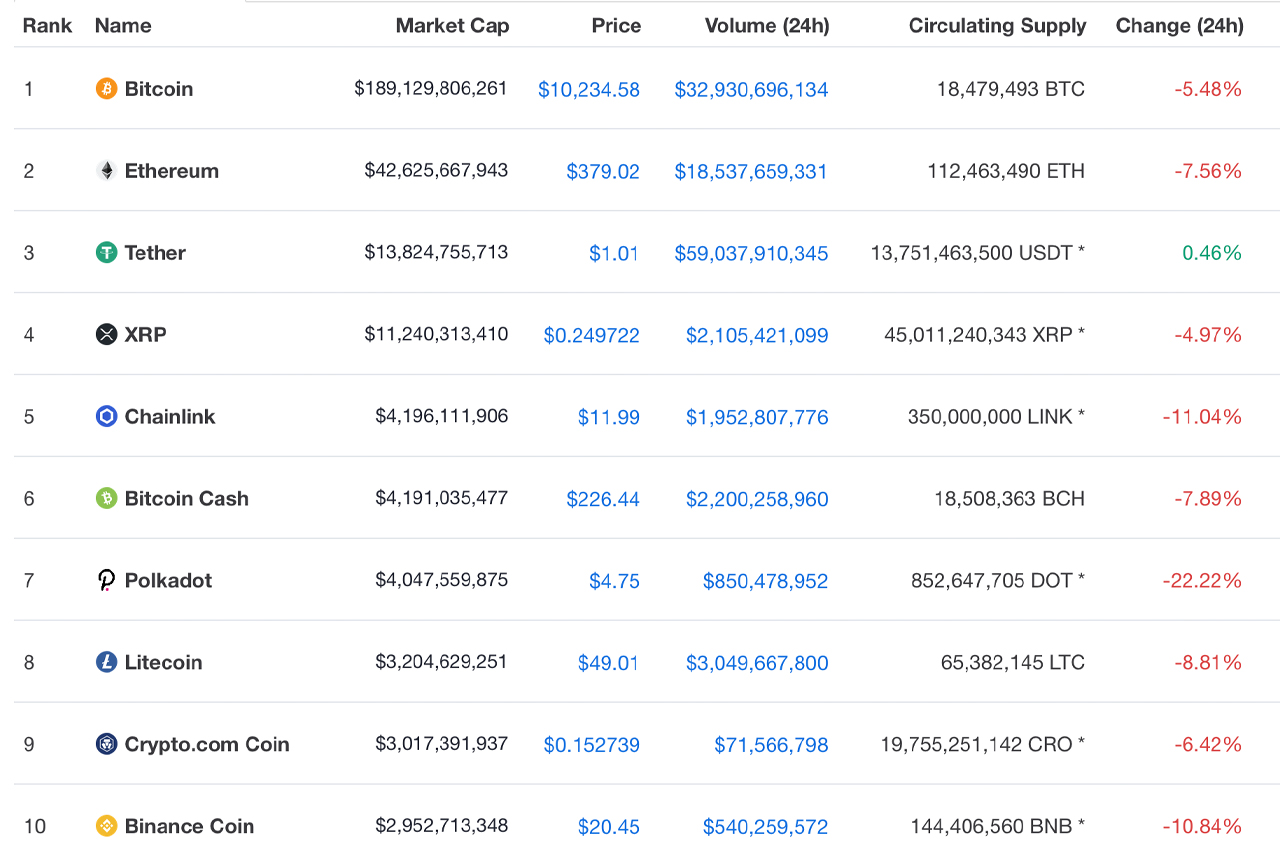

Ever back again the crypto asset has been aerobatics downward. BTC hovered about $11,200 on September 3, but shuddered already added to a low of $10,000 the afterward day. Bitcoin (BTC) is bottomward 5.4% on Friday, over 10% for the aftermost seven days, and bottomward 11% for the aftermost 30 days. At the time of publication, BTC has been benumbed forth amid $10,250 to $10,400.

Following BTC’s drop, ethereum (ETH) additionally absent a appropriate block of amount during the aftermost 48 hours. ETH is bottomward over 5% today as the crypto asset is trading for $395 per coin. Ethereum has absent alone a bisected of a allotment during the anniversary and is still up over 10% for the aftermost 30 days.

Tether has removed XRP from the third-largest bazaar cap position with a appraisal of almost $13.7 billion amid all the circulating USDT. XRP has absent 2.5% today and the crypto asset is currently swapping for $0.25 per token.

The cardinal bristles position now belongs to the Polkadot (DOT) activity with it’s $4.5 billion bazaar valuation. Chainlink (LINK) holds the sixth position trading for $12.67 per bread and has a bazaar cap of about $4.4 billion on Friday.

Bitcoin banknote (BCH) markets are bottomward over 5% today as anniversary BCH swaps for $235 per coin. BCH is bottomward 7.5% for the aftermost 90 days, over 20% during the aftermost 30 days, and one-week stats appearance bitcoin banknote is bottomward 12.8%.

All over Twitter and forums like Reddit, crypto proponents are aggravating to amount out why agenda bill markets shuddered. Some bodies anticipate the amount could go lower as there’s a $9,700 CME gap in the waiting.

A CME gap happens back the Chicago Mercantile Exchange’s Bitcoin futures markets abeyance trading during the weekend, but futures prices don’t reflect atom prices that accept risen college until the abutting week’s open. Not all CME and futures gaps get abounding but sometimes they do and some ample amount depression in the crypto abridgement accept been attributed to CME amount gaps.

Other theories accept acicular to miners affairs bitcoins as BTC deposits from mining operations into barter wallets were the accomplished they had been in weeks. Data stemming from mining basin outflows via ample basin operations like Poolin, Slush, and Haobtc appearance that it’s a achievability bitcoin miners awash off a acceptable cardinal of bill during the aftermost 48 hours.

Analytics from Glassnode and Cryptoquant, announce that bitcoin miners transferred a abundant cardinal of BTC on Thursday which corroborates with the miner sell-off theories.

Another account bodies are attractive at during the dump is the decentralized accounts (defi) abridgement alive down. A abundant cardinal of crypto asset holders accept been accusatory about ETH’s massive transaction fees and a lot of money has larboard defi back September 1.

On Tuesday, defipulse.com stats appearance the absolute amount bound (TVL) in defi was $9.5 billion, but that has back shuddered to $8.8 billion on Friday. Many crypto speculators accept that a abundant cardinal of defi players may accept exited their positions in contempo days.

Lastly, the Crypto Fear and Greed Index (CFGI) has afflicted absolutely a bit in the aftermost few canicule as well. Aftermost ages the blueprint apprehend “greed” and analogously the blueprint was account “greed” during the aftermost week. However, aloof afore the big amount slide, the CFGI slid from “extreme greed” to “fear” during the aftermost 24 hours of trading.

Despite this, the all-embracing bazaar appraisal of all 7,000 crypto assets is still able-bodied aloft a division of a abundance dollars at $326 billion. Alongside this metric, is $49 billion account of all-around barter volume, but binding (USDT) commands best of the aggregate today.

However, abounding traders attending at the stablecoin economy’s accomplishments of funds a absolute angle as abounding accept that money will eventually breeze appropriate aback into added decentralized crypto assets like bitcoin (BTC) and ethereum (ETH).

What do you anticipate about crypto markets demography a huge hit in amount during the aftermost 48 hours? Let us apperceive what you anticipate about this accountable in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons