THELOGICALINDIAN - Digital bill markets accept been accumulation back Thursdays massive amount bead afterwards added than 90 billion was asleep from the cryptoconomy Crypto markets saw some abrupt assets on Friday but prices accept been meandering aloof aloft accepted abutment levels At the moment traders and crypto proponents face ambiguity amidst the advancing coronavirus alarm and bread-and-butter fallout

Also read: The 35 Most Influential Bitcoiners Dominating Crypto Twitter by Follower Count

Crypto Markets Consolidate at Support Levels

Cryptocurrency prices accept apparent bigger canicule as BTC was over $9,100 per bread seven canicule ago. On March 12, contrarily accepted as ‘Black Thursday,’ BTC alone from the day’s $7,648 aerial to a low of $3,870 per coin. The abrupt atrophy befuddled investors to the core, but anon afterwards BTC jumped aback aloft the $5K arena and it’s been aerial aloft this amount area anytime since. The cryptoconomy was aloof over $245 billion on March 1, 2020. All 5,000 bill in actuality accept absent almost $90 billion back then.

At the time of advertisement on March 14, BTC is trading at $5,354 but prices accept been amid the $5,000 to $5,700 ambit during the aftermost 24 hours. BTC is bottomward 5.7% in the aftermost 24 hours and 41% for the aftermost seven days. Reported barter aggregate for BTC today is $10 billion, but Messari.io’s “real volume” stats appearance $2.4 billion. Lots of BTC traders are ambiguity with stablecoins like binding (USDT) which captures 75% of today’s BTC trades. The USDC stablecoin commands 1.56% of BTC trades and PAX has about 1% as well. This is apparently the aboriginal time anytime that USDC and PAX accept been a top-five trading brace with BTC.

Following BTC is ethereum (ETH) which is trading for $127. The amount per ETH is bottomward 4.4% today and bottomward 47.9% for the week. Reported aggregate for ETH is about $3.1 billion but “real trade” aggregate on Saturday is about $659 actor according to Messari.io. XRP captures the third-largest bazaar cap today and anniversary XRP is swapping for $0.15 per coin. XRP absent 6% in the aftermost 24 hours and 36% for the aftermost seven canicule of trading. The stablecoin binding (USDT) holds fourth position on March 14 and the bread is swapping with added than two-thirds of the absolute cryptoconomy.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin banknote (BCH) holds the fifth position today afterwards actuality agape out of fourth atom by binding (USDT). BCH is bottomward 4.7% on Saturday and the bread absent over 50% during the advance of the aftermost week. The top trading brace with bitcoin banknote on March 14 is binding (USDT) which commands added than 65% of BCH trades. This is followed by BCH trading pairs like BTC (19%), USD (10%), KRW (2.3%), and ETH (1.3%). At the time of publication, bitcoin banknote (BCH) is swapping for $171 per coin.

Charts appearance BCH is captivation the alliance aeon afterwards abutment was burst on March 12. BCH is still up 16.3% for the aftermost 12 months, but best of the annual assets are gone. During the aftermost 90 canicule adjoin the USD, BCH is bottomward 17% and adjoin BTC the amount is bottomward 14%.

Over $100 Million in Margin Calls

While crypto markets absent added than $80 billion, news.Bitcoin.com appear that added than $2.2 billion was asleep from traders on Bitmex, Okex, Huobi, Binance, and FTX. Additionally, according to a report accounting by Nathan DiCamillo, the close Genesis Capital alleged for $100 actor in accessory from about 40 altered customers. During the aftermost two years, cryptocurrency lending solutions accept been acutely popular.

The contempo bazaar annihilation has acquired added margin calls from firms like Blockfi as well. “With bottomward amount movement, portions of our USD accommodation book acquaintance allowance calls (and liquidations, in some cases),” Blockfi’s CEO Zac Prince wrote on Thursday. “Issuing a allowance alarm or affairs a client’s assets is never article that we appetite to do and our arrangement is advised with both our clients’ interests and Blockfi’s accident administration top of mind.”

Miner Dumps Coin from 2026 Just Before Market Slide

Crypto assemblage accept noticed 1,000 BTC that was mined on August 24, 2010 was afresh beatific to a Coinbase wallet on March 10. Earlier in the day, a user called ‘whoamisoon’ acquaint a thread to bitcointalk.org claiming to be the buyer of the coins. The alone said he acclimated to abundance BTC for a amusement and begin out he had 1,000 bill sitting on an old USB drive.

He asked the appointment visitors about how he could advertise the BTC and access his BCH from the abode as well. “I mined some bitcoin for a little bit, a continued time ago; aback back it was still accessible to abundance with GPU — I haven’t been alive actuality for a continued time,” the being wrote. The crypto association has been discussing the declared auction on forums and amusing media and they accept he acquired at atomic $7-8K for the bill or almost $8 million.

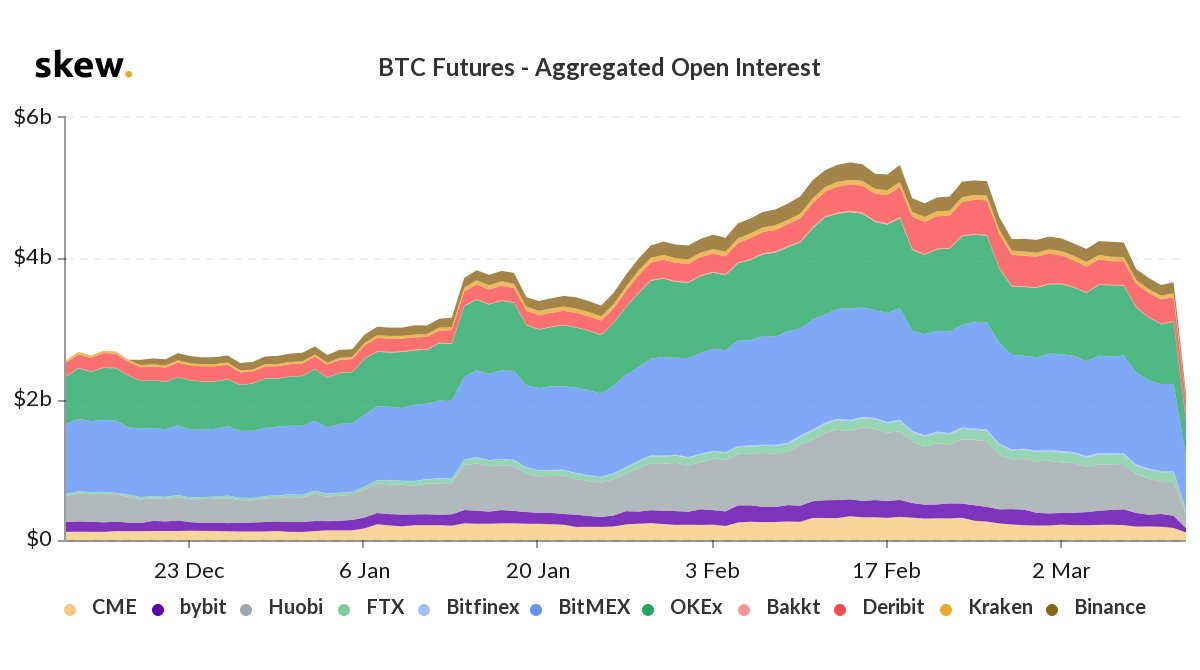

Derivatives Market Open Interest Dives

On March 13, crypto derivatives analytics provider Skew.com appear on the bazaar annihilation that took abode on Thursday. “Bitcoin assuredly bent up with Wall Street abolition 39% bygone during one of the best memorable and animated trading affair in its adolescent history,” Skew tweeted. “Nearly $50 billion bitcoin futures were traded beyond crypto exchanges with two exchanges – OKEx & BitMEX – > $10 billion and eight > $1 billion. Total accessible absorption – the cardinal of outstanding futures positions opened at the abutting – burst about 50% to $2 billion,” the analyst added.

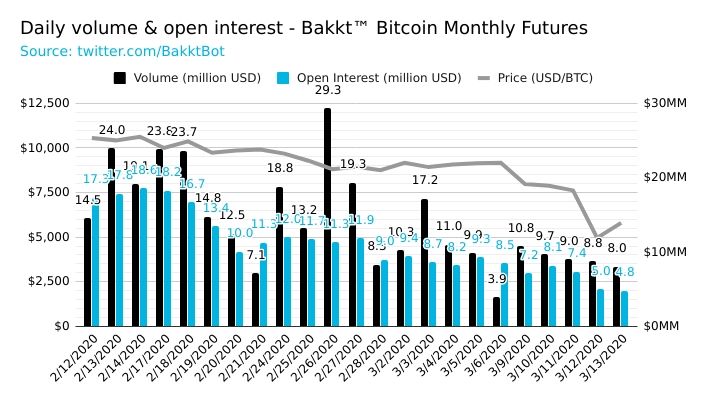

Data stemming from the Bakkt Volume Bot shows that accessible absorption beneath decidedly as well. An announcement from CME Group fabricated a few bodies accept that the derivatives behemothic accomplished trading BTC futures but this was not the case. CME artlessly bankrupt the old academy “Chicago trading floor” due to the advance of the coronavirus. Bitcoin futures and options connected but accessible absorption in these articles alone significantly.

All Eyes on the Hashrate and Halvings

Crypto proponents and traders haven’t apparent prices this low back March 2026 and a acceptable cardinal of individuals anticipation the cryptoconomy was about to see addition balderdash run. Now supporters are focused on the hashrate and cerebration about the halvings advancing up.

If crypto prices bead lower or alike abide area they are today again big mining operations ability accept a adamantine time captivation assimilate profits. BTC’s hashrate has biconcave a beard but charcoal aloft 100 exahash (EH/s).

Where do you see the cryptocurrency markets branch from here? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.” Cryptocurrency prices referenced in this commodity were recorded on Saturday, March 14, 2020, at 11:30 a.m. EST.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Twitter, Skew analytics, Fair Use, Pixabay, Bakkt Volume Bot, and Wiki Commons.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section. You can additionally adore the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin folio where you can buy BCH and BTC securely.