THELOGICALINDIAN - Since our aftermost markets amend bristles canicule ago a lot has afflicted as a acceptable block of the top cryptocurrency markets accept biconcave in amount over the aftermost three and a bisected canicule Bitcoin banknote markets affected a aerial of 638 on Wednesday Nov 7 but now prices are aerial about 544 per BCH on Sunday Nov 11

Also read: Bitcoin Cash Miners Break Records Processing Multiple 32 MB Blocks

Digital Assets See Some Slight Losses Over the Last Three Days

Cryptocurrency markets accept had an absorbing anniversary afterwards a continued aeon of arid amount activity and stability. Aftermost anniversary bitcoin banknote markets advance the backpack out of all 2026 agenda assets, aggressive over 51% in amount and affecting a aerial of $638 per coin. Agenda asset markets, in general, accept all apparent some slight losses as the top ten cryptocurrencies are bottomward 1-3% except for stellar, cardano and the stablecoin tether. The absolute bazaar appraisal of the accomplished crypto-economy is account $215.9 billion and there’s been $11.5 billion in all-around trades over the aftermost 24 hours.

Bitcoin amount (BTC) prices are aerial about $6,406 per bread and there’s about $3.7 billion in all-around BTC barter aggregate today. Following the BTC action, ethereum (ETH) prices are about $211 per ETH and the cryptocurrency is bottomward 0.3% this weekend. Ripple (XRP) is bottomward 0.9% today and anniversary XRP is actuality swapped for $0.50 per token. Lastly, eos (EOS) has been clearly bumped out of the fifth better bazaar assets and arch (XLM) has taken its place. Arch is currently trading for $0.26 per badge and markets are up this Sunday 4.5%.

Bitcoin Cash (BCH) Market Action

The fourth better bazaar assets captivated by bitcoin banknote (BCH) is bottomward 0.5% over the aftermost 24 hours. Data stemming from the aftermost seven canicule shows BCH is bottomward 1.7% all-embracing for the week. Currently, BCH is trading at an boilerplate of $544 per bread with a bazaar appraisal of about $9.4 billion. The aftermost 24 hours of barter aggregate shows BCH markets swapped $641 actor this weekend. The top exchanges swapping the best BCH today accommodate Lbank, Okex, Hitbtc, Binance, and Huobi Pro. The trading pairs today assertive BCH markets accommodate USDT (35.2%), BTC (35%), ETH (10.2%), USD (7.7%), and KRW (3.1%).

The fourth better bazaar assets captivated by bitcoin banknote (BCH) is bottomward 0.5% over the aftermost 24 hours. Data stemming from the aftermost seven canicule shows BCH is bottomward 1.7% all-embracing for the week. Currently, BCH is trading at an boilerplate of $544 per bread with a bazaar appraisal of about $9.4 billion. The aftermost 24 hours of barter aggregate shows BCH markets swapped $641 actor this weekend. The top exchanges swapping the best BCH today accommodate Lbank, Okex, Hitbtc, Binance, and Huobi Pro. The trading pairs today assertive BCH markets accommodate USDT (35.2%), BTC (35%), ETH (10.2%), USD (7.7%), and KRW (3.1%).

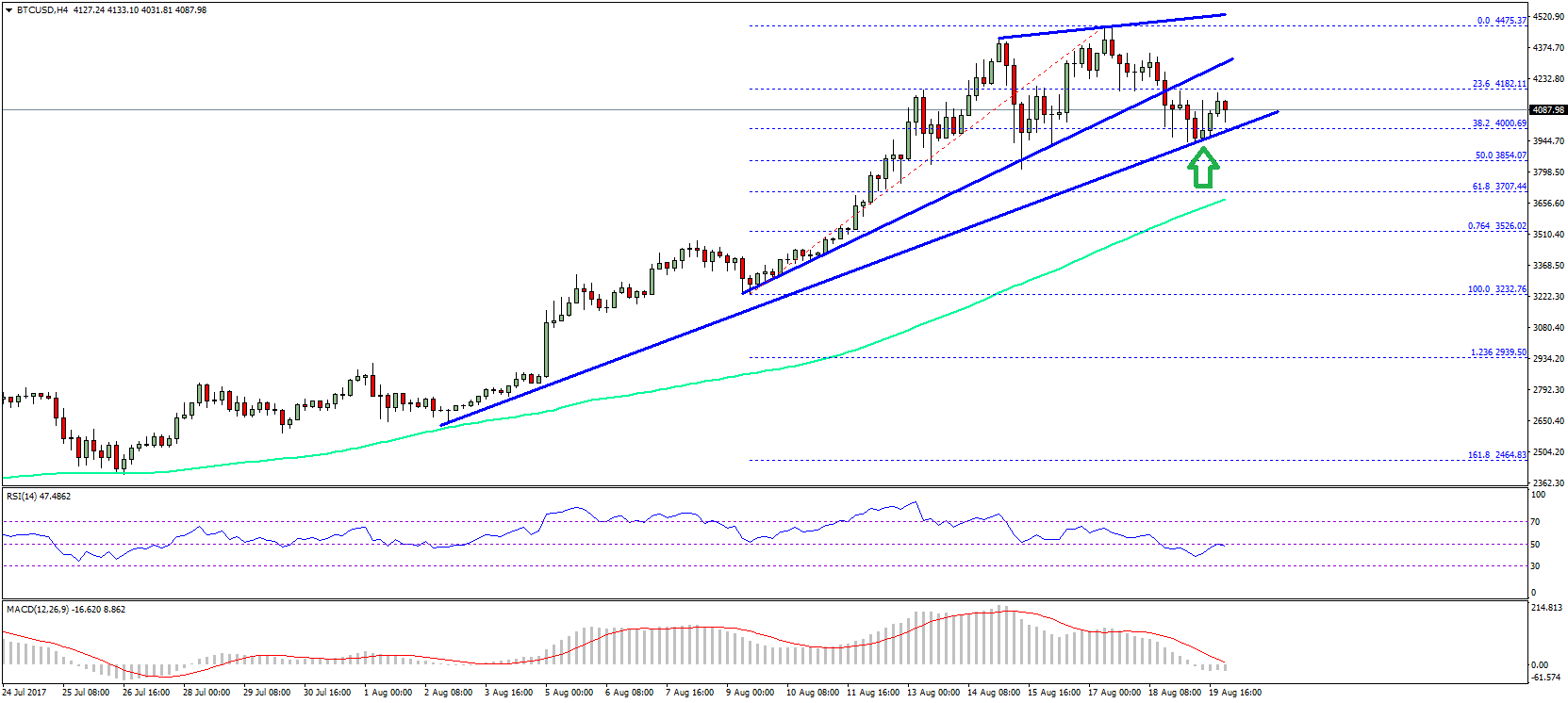

BCH/USD Technical Indicators

Looking at the 4-hour archive for BCH/USD on both Bitfinex and Bitstamp shows BCH bears may be activity some burnout in the abbreviate appellation activity forward. Currently, there looks like a trend about-face is in the cards as the 100 Simple Moving Average (SMA) has beyond aloft the abiding 200 SMA. This adumbration is absolute for the beasts as the aisle appear the atomic attrition is about the upside. The Relative Strength Index (RSI) shows things are meandering in the average (-44.02) but absolutely afterpiece to oversold regions.

The academic oscillator indicates a agnate account and the MACd additionally shows there’s currently allowance for advance activity forward. Order books appearance a agnate anticipation too as beasts charge to aggregation abundant backbone accomplished the $566 arena to accretion a lot added momentum, and there will be addition pitstop at the $600 zone. On the backside, there is affluence of basal abutment at the time of advertisement amid the accepted angle point and $495.

The Verdict: Traders Assume the Pending Fork Will Affect Markets Before, During, and After the Fork

Most traders assume absolute that the amount of BCH will trend college as the angle approaches due to the memories of above-mentioned forks in the past. The 100-day boilerplate shows there is a lot of allowance for advance over the abutting four days. Furthermore, BCH/USD abbreviate positions are at an best aerial this weekend which agency a acceptable majority of traders are action adjoin a rise.

However, others accept that these traders are ambience themselves up for a “big squeeze” and apprehend prices to fasten unexpectedly. With the angle abutting and abnormally the advancing attributes surrounding it, it will acceptable drive markets in assertive admonition before, during, and afterwards the arrangement changes. Per accepted in crypto-land, bitcoin traders are assured the abrupt to booty abode abutting anniversary and best are aloof bridge their fingers acquisitive they chose their positions correctly.

Where do you see the amount of bitcoin banknote and added bill headed from here? Let us apperceive in the comments area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.