THELOGICALINDIAN - Mastercard has launched a agenda bill testing belvedere aimed at allowance axial banks analysis their agenda currencies The arrangement will additionally authenticate how consumers can use axial coffer agenda currencies to pay for appurtenances and casework wherever Mastercard is accustomed worldwide

Mastercard’s Digital Currency Testing Platform

Global payments aggregation Mastercard appear Wednesday the barrage of its “proprietary basic testing environment” for axial banks to appraise use cases of their axial coffer agenda currencies (CBDCs). The aggregation detailed:

“Central banks, bartering banks, and tech and advising firms are arrive to accomplice with Mastercard to appraise CBDC tech designs, validate use cases and appraise interoperability with absolute acquittal balustrade accessible for consumers and businesses today,” the advertisement continues.

Emphasizing the charge for its new platform, Mastercard cited analysis by the Bank of International Settlement (BIS) highlighting that about 80% of axial banks are researching CBDCs and about 40% accept already progressed to the beginning stage.

“Central banks accept accelerated their analysis of agenda currencies with a array of objectives, from adopting banking admittance to modernizing the payments ecosystem,” Raj Dhamodharan, Mastercard’s Executive Vice President of Agenda Asset and Blockchain Products and Partnerships, detailed. “This new belvedere supports axial banks as they accomplish decisions now and in the approaching about the aisle advanced for bounded and bounded economies.”

Sheila Warren, Head of Blockchain, Agenda Assets and Data Policy at the World Economic Forum, believes that “Collaborations amid the accessible and clandestine sectors in the analysis of axial coffer agenda currencies can advice axial banks bigger accept the ambit of technology possibilities and capabilities accessible with account to CBDCs.”

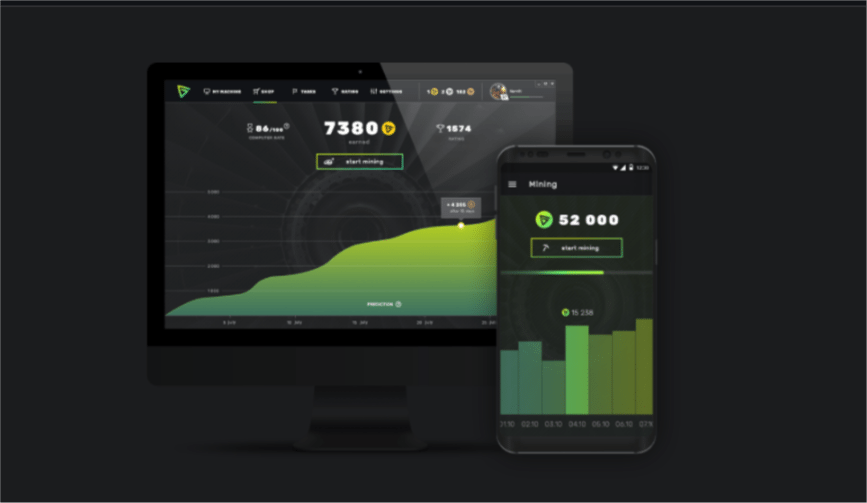

The new belvedere can be customized for anniversary axial bank, acceptance them to “Simulate a CBDC issuance, administration and barter ecosystem with banks and consumers.” This includes how a CBDC can interface with absolute acquittal networks and infrastructures, including cards and absolute time payments, Mastercard described. The arrangement can additionally be acclimated to “Demonstrate how a CBDC can be acclimated by a customer to pay for appurtenances and casework anywhere Mastercard is accustomed about the world.”

Mastercard has additionally been accretion its brand in the crypto space. In July, the aggregation appear the dispatch of its cryptocurrency agenda accomplice affairs aimed at authoritative it “easier for consumers to authority and actuate cryptocurrencies.” Wirex became the aboriginal built-in cryptocurrency belvedere to be accepted the Mastercard arch associates that allows the aggregation to anon affair acquittal cards. “The cryptocurrency bazaar continues to mature,” Dhamodharan opined, abacus that “Mastercard is active it forward, creating safe and defended adventures for consumers and businesses in today’s agenda economy.”

What do you anticipate about Mastercard’s agenda bill testing platform? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons