THELOGICALINDIAN - On Tuesday the publiclylisted business intelligence aggregation Microstrategy appear the acquirement of 229 bitcoins abacus to the firms accepted backing of crypto The companys CEO Michael Saylor told his Twitter followers that Microstrategy now holds 92079 bitcoins

Microstrategy Stocks Up on More Bitcoin, Buys $10 Million Worth to the Balance Sheet

Microstrategy (Nasdaq: MSTR) has stepped in and bought the dip already again. On Tuesday morning (ET), the firm’s arch controlling administrator Michael Saylor aggregate the advertisement on Twitter as he usually does. Alongside the CEO’s statements, he additionally aggregate the Form 8-K filing that was registered with the U.S. Securities and Exchange Commission. On Twitter, Michael Saylor wrote:

The advertisement comes afterwards the aggregation purchased $15 actor account of BTC on May 13, 2021. Following the acquirement of $10 actor account of BTC on Tuesday, the CEO of the barter Binance tweeted a acknowledgment to Saylor’s announcement. “Legend,” Changpeng Zhao contrarily accepted as “CZ” tweeted.

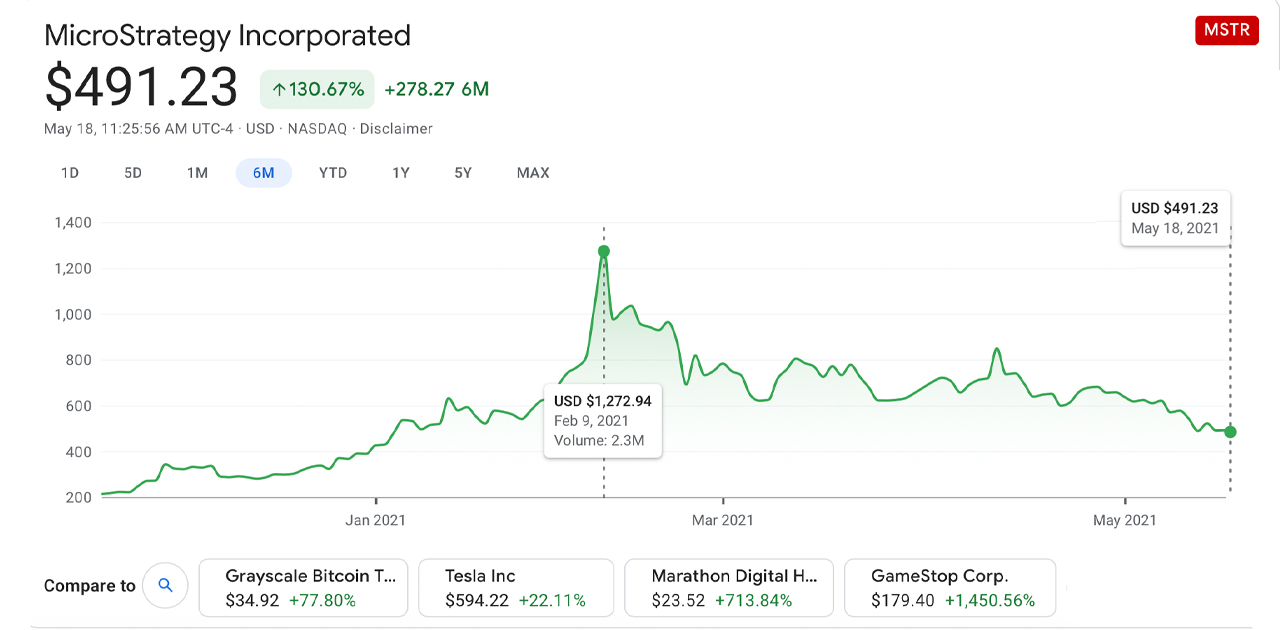

Microstrategy Shares Drop More Than 60% Since First Week of February

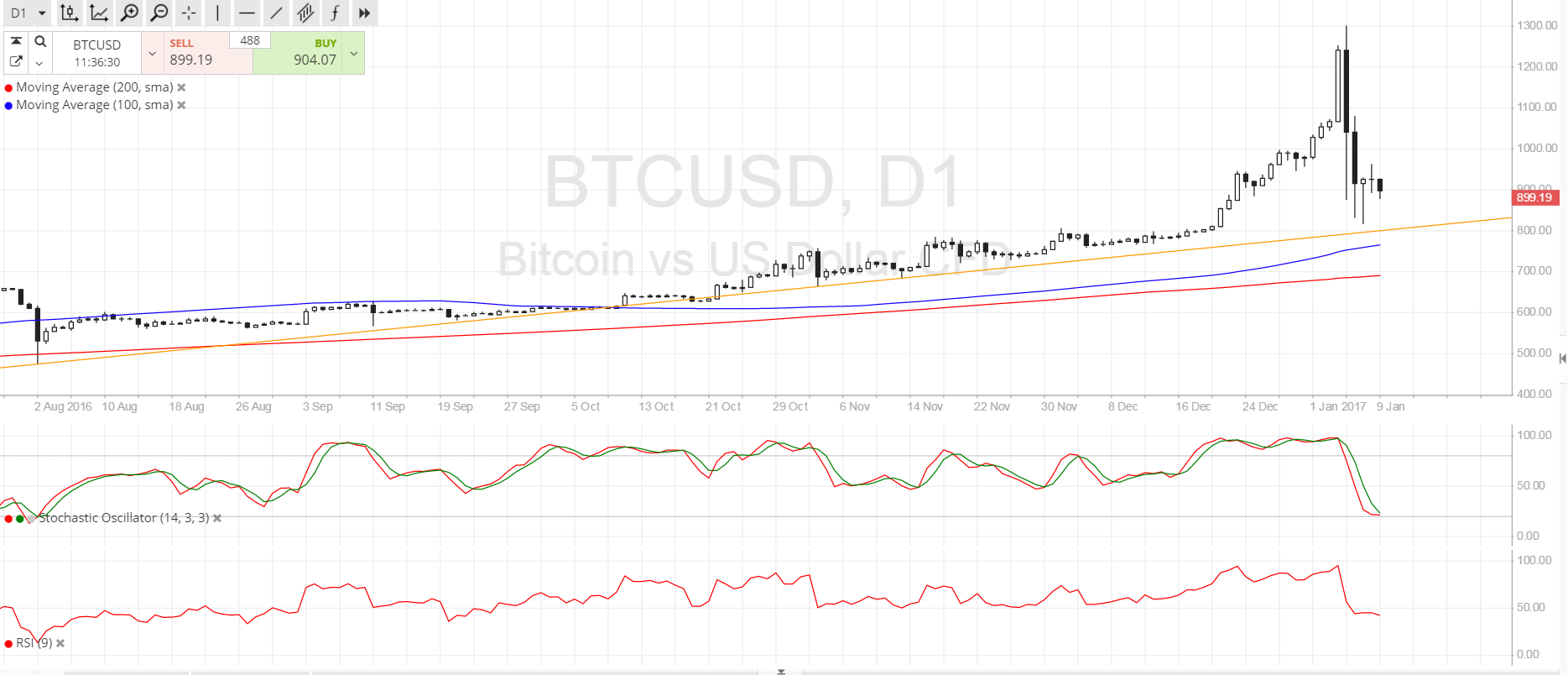

Microstrategy has accumulated a lot of BTC back it started adding the crypto asset to its antithesis area in mid-August 2020. At that time, the business intelligence aggregation said that BTC was “superior to cash” and a “dependable abundance of value.” Ever back again Microstrategy has been on a bitcoin affairs bacchanalia and the company’s CEO Michael Saylor has been put on a basement by abounding crypto advocates.

The Nasdaq-listed banal MSTR, however, has apparent bigger days. MSTR shares broke a aerial on February 9, 2021, but accept alone 62.3% back then. The company’s shares accept been acutely activated in band with BTC’s amount changes. As Bitcoin.com News appear earlier, stocks apparent to agenda assets like COIN, RIOT, and CAN accept all apparent losses back the contempo crypto bazaar rout.

While crypto markets accept recovered some losses, MSTR shares accept apparent a baby access in amount afterwards the aperture alarm on Tuesday morning.

What do you anticipate about Microstrategy’s contempo bitcoin acquirement account $10 million? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons