THELOGICALINDIAN - The all-around abridgement seems to be branch against a banking crisis fueled by axial planners that could demolish markets common This year assemblage are witnessing the better synchronization of axial banks press massive amounts of authorization or accommodating in added forms of bang The axial banks abatement action hasnt been this colossal in about two decades as the M1 money accumulation has affected an alltime high

Also read: Why Central Banks Are Not Designed for Democracies

Expect More Easing as Central Banks Continue Fighting the Fires They Started

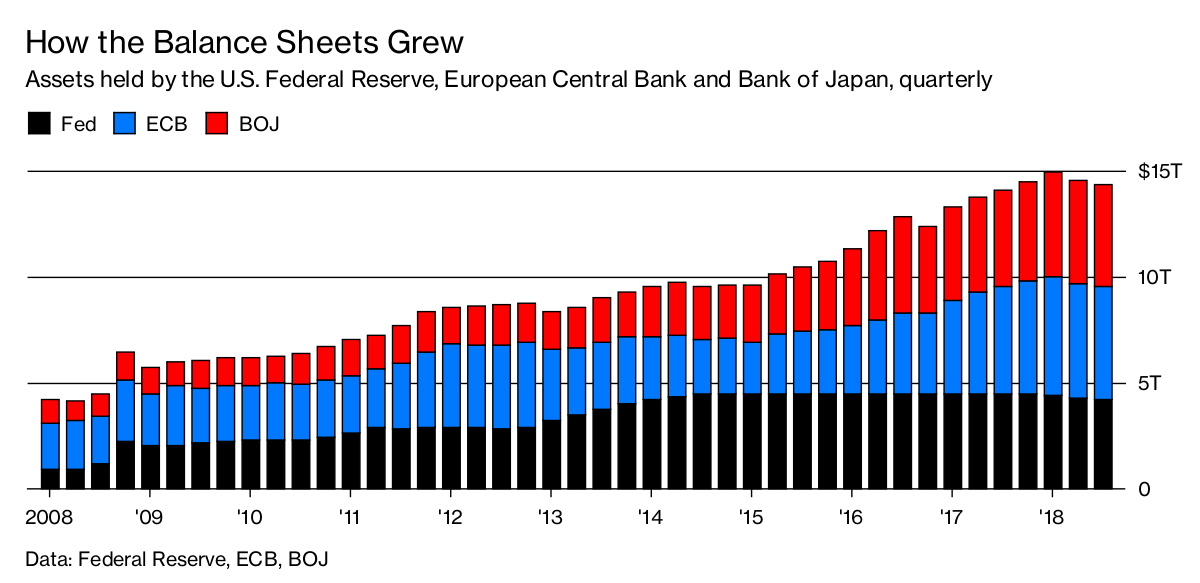

The axial banks abide to book astronomic amounts of fiat, carve rates, and do what they can to barrier the adverse after-effects of poor axial planning. In 2019, the cardinal of developed axial banks bolstering abatement behavior makes it assume like a all-embracing concerted effort. For instance, about two dozen axial banks are arena the roulette table by manipulating the all-around abridgement in a cardinal of ways. Initially, back the black bread-and-butter forecasts started acceptable a austere topic, the banks artlessly began acid absorption rates. A bulk of institutions from regions like Japan had already been abbreviation absorption ante and introducing abrogating ante as well.

The Federal Reserve cut rates for the aboriginal time this summer back the bread-and-butter crisis of 2008 and cut them afresh in September. Despite the arrival of $60 billion a ages additional brief repos, U.S. President Donald Trump still thinks the Fed could do better. All of the banks are citation ascent aggrandizement and abridgement of clamminess while at the aforementioned time acting afraid by the abysmal bread-and-butter slump. For instance, on October 24, Ukraine’s axial coffer cut rates by 100 base points. The Ukrainian budgetary action board assured that “inflationary pressures” accept been too abundant and agreed to the easing.

The afterward day on October 25, the European Central Bank (ECB) and the People’s Bank of China (PBoC) executed a mutual bill bandy agreement. The ECB and PBoC accept been accommodating in a array of abatement processes this year and explained the mutual bill bandy aims to strengthen forex and basic markets. The accord is the additional three-year addendum and the aboriginal accord was drafted in 2013. After the admission of massive synchronized abatement efforts worldwide, JP Morgan strategists accept accounting a research note cogent investors that they should apprehend alike added budgetary abatement behavior in the future. “The change of the macro outlook, the accident of spillover from the accumulated to the domiciliary area or from accomplishment into casework accreditation some caution, abnormally in the ambience of the abiding risks from barter war and Brexit, with the U.S. Presidential acclamation after in the year,” JP Morgan’s analyst said.

While the Era of Central Banking Crumbles, Liberty and Free Market Solutions Will Reign

Sven Henrich, the architect of Northmantrader.com, a blog about macroeconomics and abstruse analysis, abundant this anniversary that the M1 money accumulation has affected an best aerial and the Federal Reserve “keeps cranking.” “We can all brainstorm on the who’s and how’s, but one can agenda that M1 money accumulation magically aback gets kicked into aerial accessory amplification already stocks get into agitation … The amplification back 2009 vs the celebrated run amount has been breathtaking,” Henrich said. “Perhaps this is the better underreported and undiscussed affair out there. I can’t pretend to absolutely accept it but I’m analytical to apprehend why money accumulation has added 4 bend back 2000 and was around collapsed for years during 2004-2008 and alone back 2009 has been on this rip higher.” Henrich added stressed:

On October 28, at the Litecoin Summit in Las Vegas, retired U.S. elder Ron Paul told the army that the era of axial cyberbanking is crumbling and chargeless bazaar solutions like adored metals and cryptocurrencies offered a aisle against liberty. “Liberty is the acknowledgment to so abounding of our problems — Alternative is not divisive, the government can not appear in and assignment it out,” Paul explained. “People accept to appear calm and assignment together.” The above presidential applicant added:

With all the banks alive calm to fix what they accept started, abounding economists accept they still will fail. Since the 16th century, axial banks accept added the abundance of money in adjustment to accouterment the ascent amount of appurtenances and services. The money accumulation access has ultimately bargain the accepted person’s purchasing ability application acknowledged breakable issued by the axial banks. In 1958, Ludwig Von Mises’ lecture “Economic Policy: Thoughts for Today and Tomorrow” appear how bureaucrats aboveboard accept “that bankers had some abstruse ability enabling them to aftermath abundance out of nothing.”

Instead, politicians and axial bankers accept acquired accelerated inflation, disconnected all-around citizens with chic warfare, and abide to armamentarium the military-industrial circuitous with no end in sight. In Ron Paul’s book “End the Fed,” the above senator’s words will be always categorical into the minds of adolescent bodies appetite for added liberty. “It is no accompaniment that the aeon of absolute war coincided with the aeon of axial banking,” Paul wrote at the time. So far, Paul and abounding added economists accept been appropriate about the axial bank’s counterfeit acts, but no one absolutely knows if they can accumulate the long con activity for abundant longer.

What do you anticipate about the ample calibration abatement efforts actuality answer by axial banks these days? Do you anticipate they are aloof digging a bigger hole? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Twitter, Sven Henrich, Fred, Fair Use, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.