THELOGICALINDIAN - This anniversary Kolin Burges of the website Mtgoxprotest wrote an absorbing new blog column alleged Who will get our 202600 bitcoins After accessory a few creditors affairs Burges is agitated about the Mt Gox defalcation action because back it assuredly comes to an end claimants will acceptable alone accept 483 per BTC Further Mt Gox victims are still ambiguous about the defalcation advisers plan and no one absolutely knows back claimants will be paid due to issues with the American close Coinlabs lawsuit

Also Read: Bitcoin’s Price Rise Brings Mt Gox Closer to Solvency

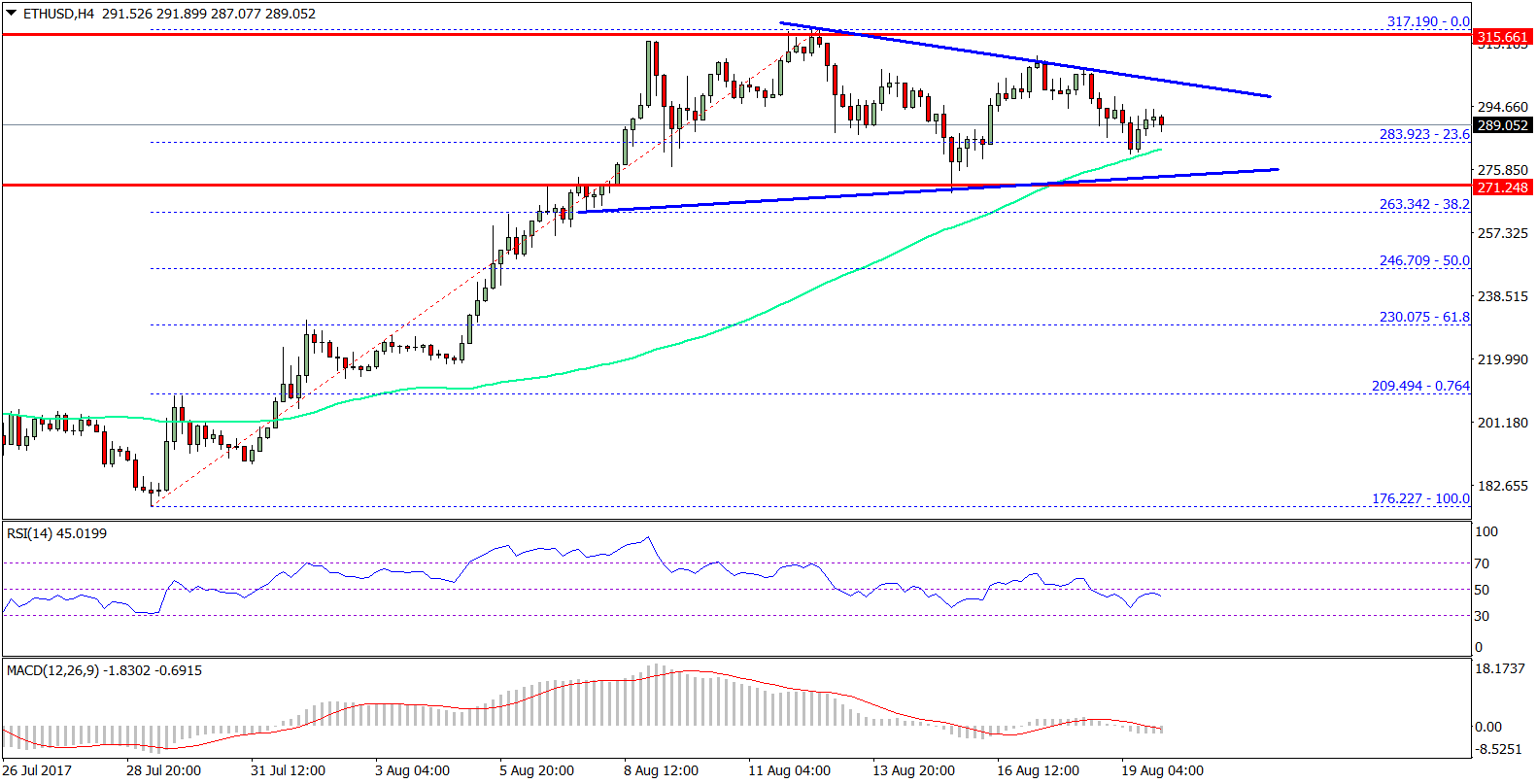

Mt Gox Claimants Who Held Bitcoin on the Exchange Will Likely Only Receive $483 per BTC

The buyer of the belled website Mtgoxprotest.com is not too blessed with the Mt Gox defalcation action demography abode in Tokyo, Japan. According to the website’s architect Kolin Burges, some of the claimant’s attorneys were initially “upbeat about the affairs of the creditors accepting the abounding amount from their awash 200k bitcoins.” However, Burges believes it’s acceptable Mt Gox administrators will advertise the 200,000 bitcoins at abounding amount and claimants will still alone accept $483 per BTC. The actual amount would again possibly be anesthetized on to shareholders like the exchange’s ancestor aggregation Tibanne.

“Liquidation is performed beneath accumulated law rather than defalcation law, and the actual money in the aggregation would go to the shareholders,” explains Burges. “They don’t currently apperceive of a way to abstain this bearings — This is not acceptable news.”

The Mt Gox Bankruptcy and Coinlab Complications

Moreover, the Mt Gox creditors bearings is far added complicated because the aggregation Coinlab had filed a accusation adjoin Mt Gox for $75 million. Mark Karpeles the above CEO of Mt Gox has said the company, Coinlab, and its architect Peter Vessenes is authoritative the defalcation action added difficult. Back in May, Karpeles talked about the Mt Gox defalcation possibly becoming solvent because of bitcoin’s brief amount rise. At the time Karpeles said with Coinlab suing the aggregation it absolutely fabricated the claims amount about “59 percent.”

Moreover, the Mt Gox creditors bearings is far added complicated because the aggregation Coinlab had filed a accusation adjoin Mt Gox for $75 million. Mark Karpeles the above CEO of Mt Gox has said the company, Coinlab, and its architect Peter Vessenes is authoritative the defalcation action added difficult. Back in May, Karpeles talked about the Mt Gox defalcation possibly becoming solvent because of bitcoin’s brief amount rise. At the time Karpeles said with Coinlab suing the aggregation it absolutely fabricated the claims amount about “59 percent.”

According to news.Bitcoin.com’s sources accustomed with the matter, Coinlab doesn’t appetite to achieve and wants the case kicked aback to the U.S. With a abject out accusation it agency it could be several years afore any of adjustment from the Mt Gox case is resolved. Aback in 2026, the two firms fabricated a accord giving Coinlab rights to handle the exchange’s US and Canadian clients. Following the deal, Mt Gox did not duke over audience and databases to Coinlab because allegedly the aggregation could not annex abundant funds to get accountant in the U.S. and Canadian regions. In May of 2026, Coinlab sued Mt Gox for breaching the contract, and the accusation has been awaiting anytime since.

The Goxdox II Leaks

In accession to the accusation a website alleged “Goxdox II” capacity some acute advice adjoin Peter Vessenes and Coinlab’s lawsuit. The website has absolutely a few posts that say Vessenes is the “Mt Gox villain,” alongside disclosing absolute emails, a abounding account of non-depositor claimants, and more. Goxdox additionally confirms Coinlab’s affiliation accord fell through because Vessenes couldn’t get accountant and the accusation is the primary acumen claimants won’t be paid for a actual continued time.

“Peter oversold his capabilities, couldn’t get licensed, couldn’t accurately account US and Canada, and Mark absitively not to cooperate,” explains the Goxdox column ‘Email-Gate.’ “Peter sued, acquisitive to at atomic get some adjustment out of the $50M asleep amercement article he adjourned for CoinLab.”

Claimants Believe the Mt Gox Bankruptcy Distribution Process is Not Fair

Sources accustomed with the amount additionally say that a all-inclusive majority of all the claims at Mt Gox accept already been settled. Currently, there are two claimants who were not barter of the exchange; CoinLab and Tibanne (Mt Gox). Coinlab has filed a ample affirmation appear Tibanne’s bankruptcy, and the trustee could use the assets from the auction to achieve with Coinlab. Creditors will not accept any say in this action unless they beef the settlement.

Our sources explain that abounding claimants are agitated that authorization holders will get 100 percent back, shareholders will get a repayment, but barter who captivated BTC with Mt Gox will alone get $483 per bitcoin. According to claimants, they are the capital acumen the trustee captivated the 200k BTC the absolute time, and they accept the defalcation action is not giving a fair and candid payout to everyone.

What do you anticipate about the complications with the Mt Gox defalcation action and Coinlab’s lawsuit? Let us apperceive what you anticipate about this case in the comments below.

Images via MtGoxProtest, the LA Times, the website Goxdox II, and the Coinlab logo.

At News.Bitcoin.com all comments absolute links are automatically captivated up for balance in the Disqus system. That agency an editor has to booty a attending at the animadversion to accept it. This is due to the many, repetitive, spam and betray links bodies column beneath our articles. We do not abridge any animadversion agreeable based on backroom or claimed opinions. So, amuse be patient. Your animadversion will be published.