THELOGICALINDIAN - In the New York Times biographer Nathaniel Popper has covered a adventure about how China has become centermost date during a time in bitcoin that some are referencing as a civilian war In the commodity are new statistics apparent by Chainalysis which shows a amazing bulk of bitcoin transaction aggregate basic from China this year

It’s already been accustomed that China has been a big contributor to the bitcoin abridgement in abounding ways. From bitcoin mining farms to bitcoin exchanges, abundant of the ecosystem comes out of China. The latest bitcoin amount countdown a few weeks ago was additionally attributed to China, absolutely possibly due to capital flight.

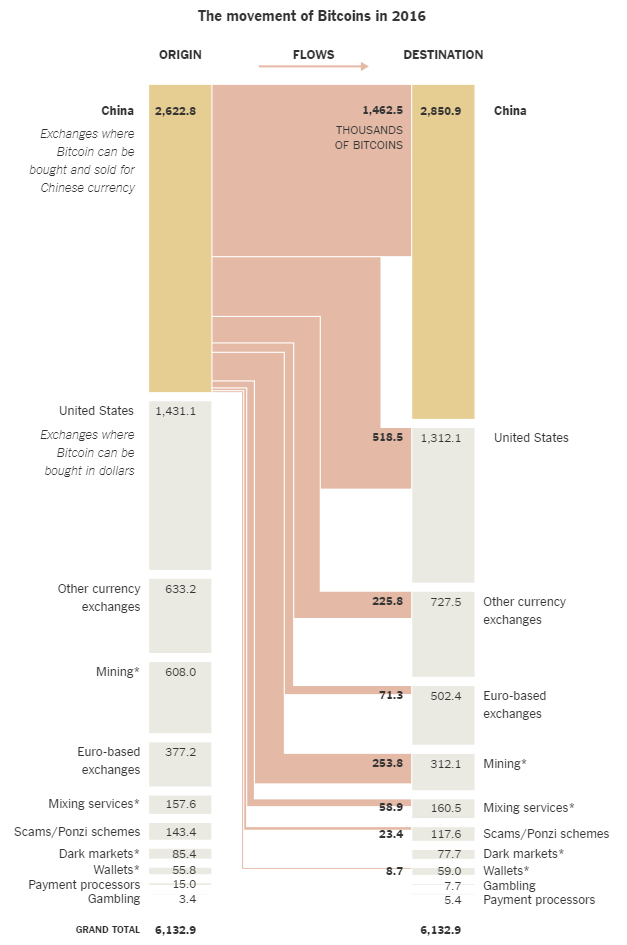

In the Times article, Popper says that Chinese exchanges accept accounted for 42% of all bitcoin affairs this year, according to an assay performed for The New York Times by Chainalysis. The U.S. counts for 23% of affairs this year.

*Mining: bitcoins abounding from companies that “mine” new bitcoins by analytic computational problems and alms accretion ability to the bitcoin network. Mixing services: Casework that mix bitcoin affairs calm to abstruse the antecedent or the transactions, like a money bed-making service. Dark markets: bitcoins abounding to atramentous bazaar casework that advertise actionable appurtenances for bitcoin, aggressive by the Silk Road online biologic market. Wallets: bitcoins advancing to and from online casework that authority bitcoin wallets for individuals. Source: Chainalysis, by The New York Times.

As depicted in the analogy from Chainalysis, the bitcoin transacted on the top from China has the best volume, which originates from Chinese exchanges. There aren’t abounding Chinese exchanges, with a few assertive the bazaar such as BTCC, Huobi, OKCoin, and HaoBTC. Just recently, bitcoin startup Circle accustomed a $60 actor investment with plans to accessible their own Chinese office.

Chainalysis about doesn’t accept a ambit into over-the-counter (OTC) transactions, which administrator Vinny Lingham stated is area abundant of the bigger bitcoin affairs from investors happen. He additionally speculated that abundant of the current trading on the exchange market is aback and alternating arbitrage trading, not accurate demand.

We generally see this with Chinese bitcoin exchanges, whose aggregate is almost consistently ever inflated, in allotment due to the aught trading fees which makes them affected to bot trading (wash trades) and arbitrage.