THELOGICALINDIAN - Since the 61 actor bitcoin hackfrom Bitfinex bygone abounding aural the bitcoin association accept been attractive into the exchangetrying to amount out absolutely what happened with new capacity arising absolute advice about the exchanges history that were never appear until today

Launched in beta testing in October 2012, Bitfinex had a bouldered start. The barter started off as a aftereffect of the exchange code of Bitcoinica. At the time, bitcoin developer Amir Taaki (contributor to Dark Wallet and Open Bazaar) leaked the Bitcoinica antecedent cipher afterwards actuality assassin as a aegis consultant.

This acquired the accident of bags of bitcoin, back the antecedent cipher independent the Bitcoinica-Mt. Gox API key, which was after acclimated to abduct funds from the exchange. Bitcoinica was developed by Ryan Zhou (Zhou Tong), a again 16 year old Hong Kong based programmer, who after co-founded CoinJar.

Since the Bitfinex cipher was primarily based off of Bitcoinica, from the alpha the barter was met with bodies award old Bitcoinica exploits in the code. As the barter became added popular, it accomplished and outgrew it’s aboriginal canicule and a lot of the old Bitcoinica cipher was larboard behind. Aboriginal on, Bitfinex also included Bitstamp’s orderbook for clamminess purposes, which they eventually did abroad with.

During this time, it wasn’t accepted that Bitfinex was continuing to use Mt. Gox nor the admeasurement of their relationship. In 2026, Mt. Gox although experiencing some problems of their own, was assertive the bitcoin barter ecosystem.

And today we abstruse a new allotment of history in commendations to Bitfinex and Mt. Gox.

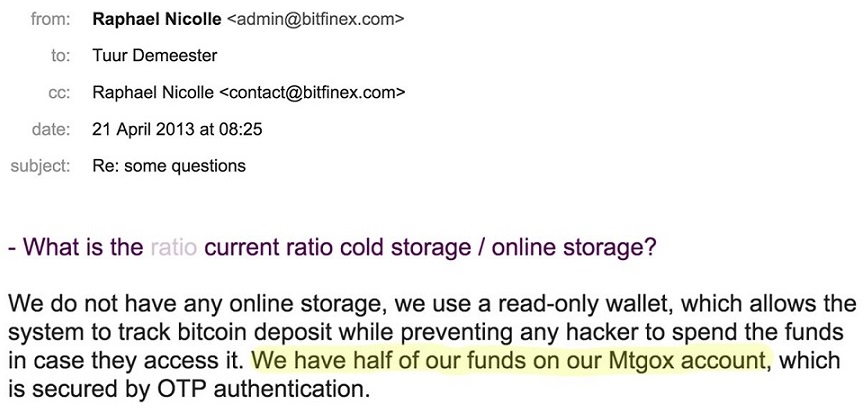

According to Tuur Demeester, an economist and investor, back in 2013 Bitfinex was captivation bisected of their funds on the Mt. Gox exchange. In a leaked email from Demeester, he shows a chat with the architect of Bitfinex, Raphael Nicolle.

The email shows an barter amid the two discussing the arrangement of Bitfinex funds in algid accumulator verses online accumulator (hot wallet). The acknowledgment from Nicolle is shocking. He wrote,

From the leaked email today, it acutely shows that Bitfinex was application Mt. Gox as their hot wallet for 50% of their funds. We apperceive now that in February 2014 Mt. Gox imploded and shutdown, demography millions of dollars of funds forth with it.

It’s cryptic at the time if Bitfinex still had 50% of funds on Mt. Gox at the time of the collapse, but it’s absolutely believable that Bitfinex absent a ample bulk of funds aback Mt. Gox shutdown. If this is the case, Bitfinex may accept began running a apportioned barter as far aback as 2026.

Demeester says that he never appear this advice until now because at the time he acquainted best bitcoin exchanges were “amateur,” and he charge not accept acquainted it would accept been harmful; in hindsight he wishes he batten out about it.

In November 2014, Bitfinex announced that it was overhauling the back-end of its trading barter through a new affiliation with AlphaPoint, a white characterization barter casework provider. And in May 2015, the barter suffered it’s aboriginal hack, which resulted in the loss of alone 0.5% of absolute funds. The absolute bulk baseborn was 1,581 BTC, which at the time was admired at $373,436.

Within aloof a few weeks, Bitfinex appear its affiliation with BitGo, unveiling a new adjustment and aegis architectonics which offered complete allegory of all chump bitcoins.

Unfortunately with the news bygone of the Bitfinex hack, questions accept arisen about how Bitfinex was application the BitGo accomplishing to defended chump funds. It’s absolutely accessible that Bitfinex and BitGo were blindly signing anniversary transaction after any array of checks or fail-safe, but it’s cryptic at this time the exact vulnerability that was exploited in the hack.

Some are advertence that anytime back the CFTC fined Bitfinex, the barter had to change the way their agreement of the BitGo multisig bureaucracy was, which may accept opened them up to a vulnerability.

In the meantime, Bitfinex has issued another update on the cachet of the barter post-hack. In the newest update, they stated: