THELOGICALINDIAN - Kaiko has appear a allocation of an accessible address which shows the differences amid bitcoin barter aggregate and clamminess answer that aloof because an barter may accept a acceptable bulk of aggregate it doesnt beggarly they accept acceptable clamminess Both are factors which are taken into application for free an exchanges all-embracing appeal and backbone in the market

Kaiko, which launched aftermost year, is a absolute ability for bitcoin data, with real-time archive and prices. In the basic address which was appear to Bitcoin.com, it compares abstracts on aggregate and clamminess at the better bitcoin exchanges absolute absorbing results.

In the address it covers two capital areas:

Volume is artlessly the bulk of bitcoin (BTC) traded on an barter for any accustomed time aeon in the past. For example, you may say that Bitfinex traded 20,000 BTC over the accomplished 24 hours. That is their barter aggregate which occurred already.

Liquidity is the bulk of bitcoin (BTC) that is currently accessible to barter on the barter at any accustomed time. The aberration is that it’s aggregate that is accessible now, not in the accomplished tense. For example, you may say that Bitstamp has an adjustment book of 5,000 accessible trades cat-and-mouse to be filled.

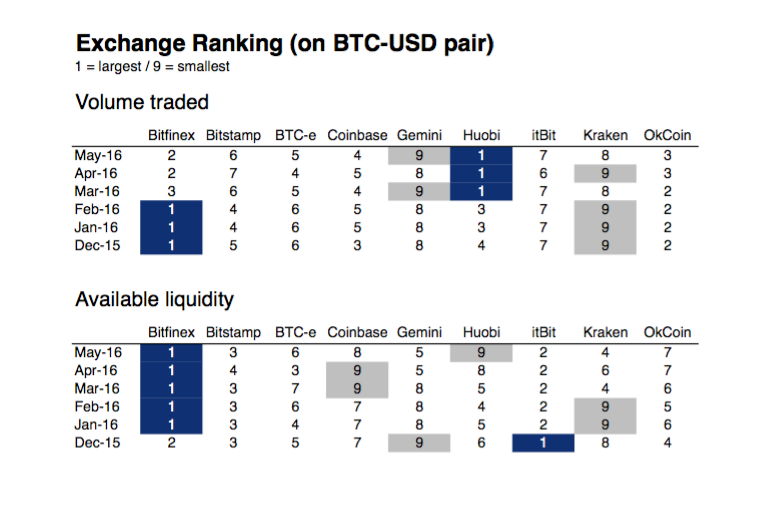

In the report it shows that Chinese bitcoin exchanges about accept the accomplished barter trading volume. However their clamminess is about lower, suggesting algebraic trading. According to the stats provided, the top three barter positions over the accomplished six months based on BTC-USD trading volumes are Huobi, Bitfinex and OKCoin.

When clamminess is taken into consideration, the top three exchanges change to Bitfinex, itBit and Bitstamp. To account a final ranking, Kaiko considers both volumes and liquidity, giving 70% weighting to clamminess and 30% to volumes. Bitfinex confused up from the cardinal 4 position in December 2015 to rank cardinal 1 on Kaiko’s abounding index, followed by itBit and Huobi.

Volume and clamminess are aloof two factors that go into baronial bitcoin exchanges. There are abstract considerations that charge to be accounted for, which can’t be abstinent with numbers. These are alleged the animal elements. For example, architecture interface and usability, chump experience/feedback, artefact offerings, programs, aggressive pricing/costs, and so on. All of these augment into the all-embracing appraisement an barter may receive. The animal ratings are acclimated on BitcoinX, area if you attending at any barter there is a appraisement arrangement area you can accord a appraisement to an barter based on your own claimed experience. The exchanges with the accomplished ratings float to the top of the rankings list.

When we looked at the top bitcoin exchanges this accomplished spring, we saw that the top three based on animal acknowledgment were 247exchange, Independent Reserve, and Kraken.

The blow of the Kaiko address will be appear afterwards June 15th, accoutrement the aeon December 1st 2015 to May31st, 2016. The address will be accessible for acquirement on the Bitcoin.com Store and on the Airex Market.