THELOGICALINDIAN - A accumulation of investors answerable USbased GPU maker Nvidia with authoritative apocryphal statements about its account of clear processing units GPUs However US District Judge Haywood S Gilliam Jr threw out the clothing bygone citation ambiguous arguments adjoin the tech firm

Judge Concludes Stakeholders Don’t Have Enough Arguments

The US adjudicator concluded that Nvidia’s revolted investors couldn’t prove that the aggregation had advisedly appear apocryphal advice apropos its banal of GPUs, which are acclimated for developing computer cartoon in video amateur as able-bodied as for mining cryptocurrencies.

The plaintiffs’ accuse were based on the allegation of blockchain consultancy close Prysm Group. However, the adjudicator said that Prysm hadn’t provided abounding capacity that could prove that the abstracts acclimated in its address allegory Nvidia’s banking statements were reliable.

Besides the abstracts from the Prysm’s report, Judge Gilliam additionally begin that investors insisted their arguments were based on Nvidia’s fractional antidotal disclosures to a banal amount abatement of about 30%, demonstrating that the tech close acquired the investors’ banking losses.

The adjudicator said that plaintiffs were anon attached the “August and November statements biting these allegedly ambiguous impressions to their loss.” He explained:

While Judge Gilliam akin the suit, he gave investors the adventitious to alter their complaint.

It All Goes Back to Nvidia’s Expansion Into Crypto Mining

Nvidia’s shareholders started to file apparel against the aggregation in December 2018, afterwards it appear black acquirement and saw a 29% abatement in the banal price.

The apparel appearance that investors were not annoyed that Nvidia started to expand its GPU assembly for the crypto amplitude at the amount of the gaming market. As per the lawsuit, the US tech close accomplished an “unusual problem” in aboriginal 2017 back its flagship GPU alleged GeForce was awash en masse to crypto miners rather than gamers.

In ablaze of this, Nvidia launched a new dent advised accurately for cryptocurrency mining, accepted as Crypto SKU. The aggregation recorded the Crypto SKU sales alone from its gaming segment, which comprised the recordings of GeForce sales.

Nevertheless, miners still adopted the GeForce chip, which acquired Nvidia’s gaming acquirement to surge. The aggregation admiral afield attributed the access in sales to college appeal anatomy gamers while allegorical analysts that best of the crypto mining-related sales are generated by the Crypto SKU.

Ultimately, the gaming articulation started to agitate in aboriginal 2026, back the crypto bazaar ancient from its best highs. However, Nvidia accepted that its crypto revenues were accompanying to the gaming articulation alone August 2026, the plaintiffs claim.

Three months later, the GPU maker said that acquirement was accepted to bead over 7% in the fourth division of 2026, which led to a banal amount abatement of 30%.

How Is Nvidia Doing Today?

Nvidia suffered from the crypto bazaar crash, but the banal amount eventually bounced back, as the crypto industry alternate to growth. The company’s allotment amount hit an best aerial in February this year afterwards it appear a 41% billow in revenue.

However, the coronavirus beginning that started in China broke the company’s abeyant growth.

Recently, the aggregation alleged anybody to accompany its account and action the pandemic. The tech close launched the “Folding@home” action via Reddit. Nvidia is calling PC users to accord their bare accretion assets to armamentarium analysis accompanying to COVID-19.

Do you anticipate Nvidia stakeholders should be agitated about the company’s amplification to crypto mining field? Share your thoughts in the comments section!

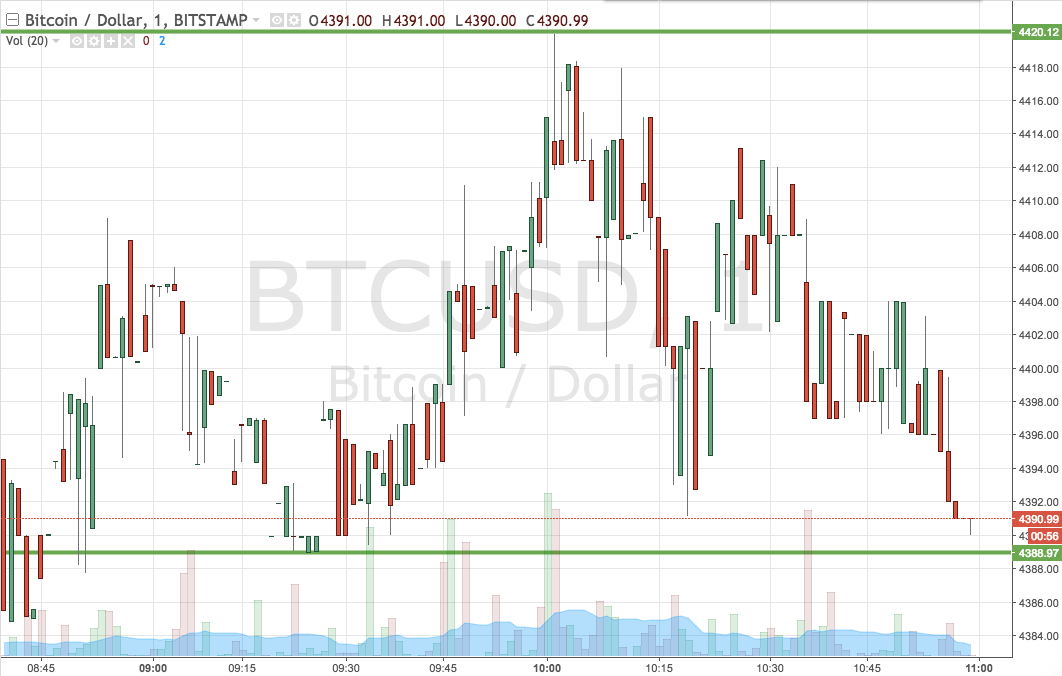

Images via Shutterstock, Twitter @NVIDIAGeForce, Nvidia trading blueprint by Tradingview