THELOGICALINDIAN - On Monday the blockchain surveillance aggregation Chainalysis appear an extract from the firms accessible abomination address that will broadcast in January According to the Chainalysis analysis the Ponzi arrangement alleged Plustoken not alone defrauded investors out of 3 billion but the betray may additionally be active bottomward the amount of bitcoin

Also read: Mystery Surrounds DDoS Attacks That Have Downed the Darknet

Are Ponzi Schemes Behind the BTC Price Suppression?

Over the aftermost few weeks, a lot of speculators accept assumed that the Plustoken and Cloudtoken scams are the primary acumen BTC prices accept been suppressed. Plustoken is a Ponzi scheme that started in South Korea area about the creators promised huge allotment if bodies kept their funds in the Plustoken platform. The Plustoken admins said that the rewards stemmed from “exchange profit, mining income, and barometer benefits.”

On the Plustoken website, the aggregation said the belvedere was like a acceptable crypto wallet but with a profit-sharing concept. “Our cool wallet will let you acquire absorption of about 6-18% account accumulation allocated to your wallet,” the Plustoken wallet armpit details. In June, all-around law administration bankrupt six associates who allegedly ran the Plustoken Ponzi operation. Then in August, the blockchain assay close Ciphertrace published its Q2 cryptocurrency anti-money bed-making address and the analysis discussed the Plustoken scheme.

“Ciphertrace has not definitively accepted this credible artifice or avenue betray and [$2.9 billion in deposits] arise to accept been absent back Chinese badge bankrupt up an declared Ponzi arrangement involving the purportedly South Korea-based crypto wallet and exchange, Plustoken,” the address disclosed. Ciphertrace additionally acclaimed that the Plustoken arrangement admiring “between 2.4 and 3 actor users/investors.” Another report appear the aforementioned ages by the blockchain analytics close Elementus shows that the Plustoken Ponzi was able to blot 10 actor ETH from over 800,000 participants. Elementus fatigued that basic address from Plustoken-associated addresses appeared to be beatific to exchanges like Huobi, Upbit, Okex, Gate.io, and ZB.com. At the time, Elementus recorded 820,000 ETH that remained onchain and the funds saw no movement afterwards the antecedent deposit.

Chainalysis: ‘Plustoken May Also Be Driving Down the Price of Bitcoin’

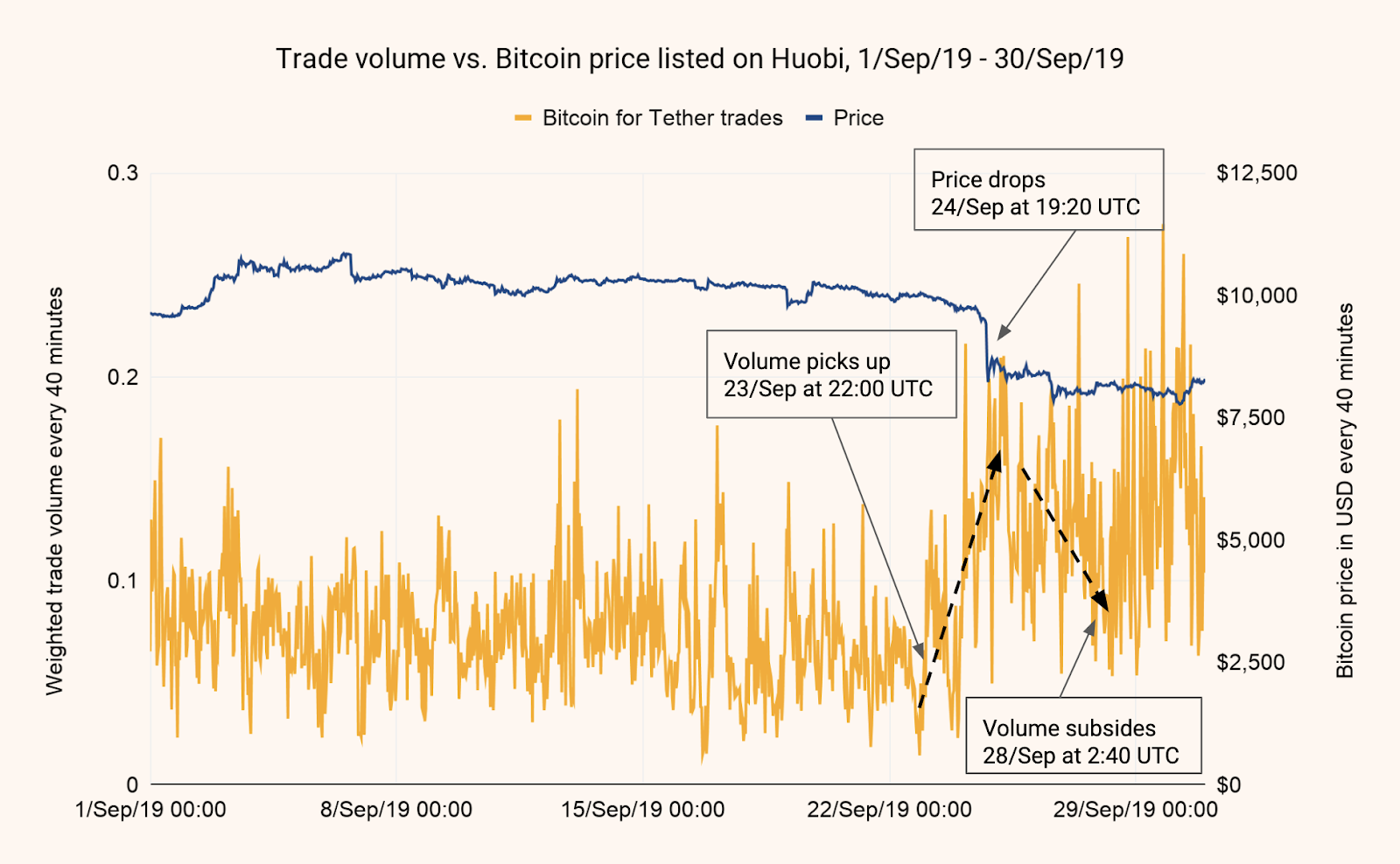

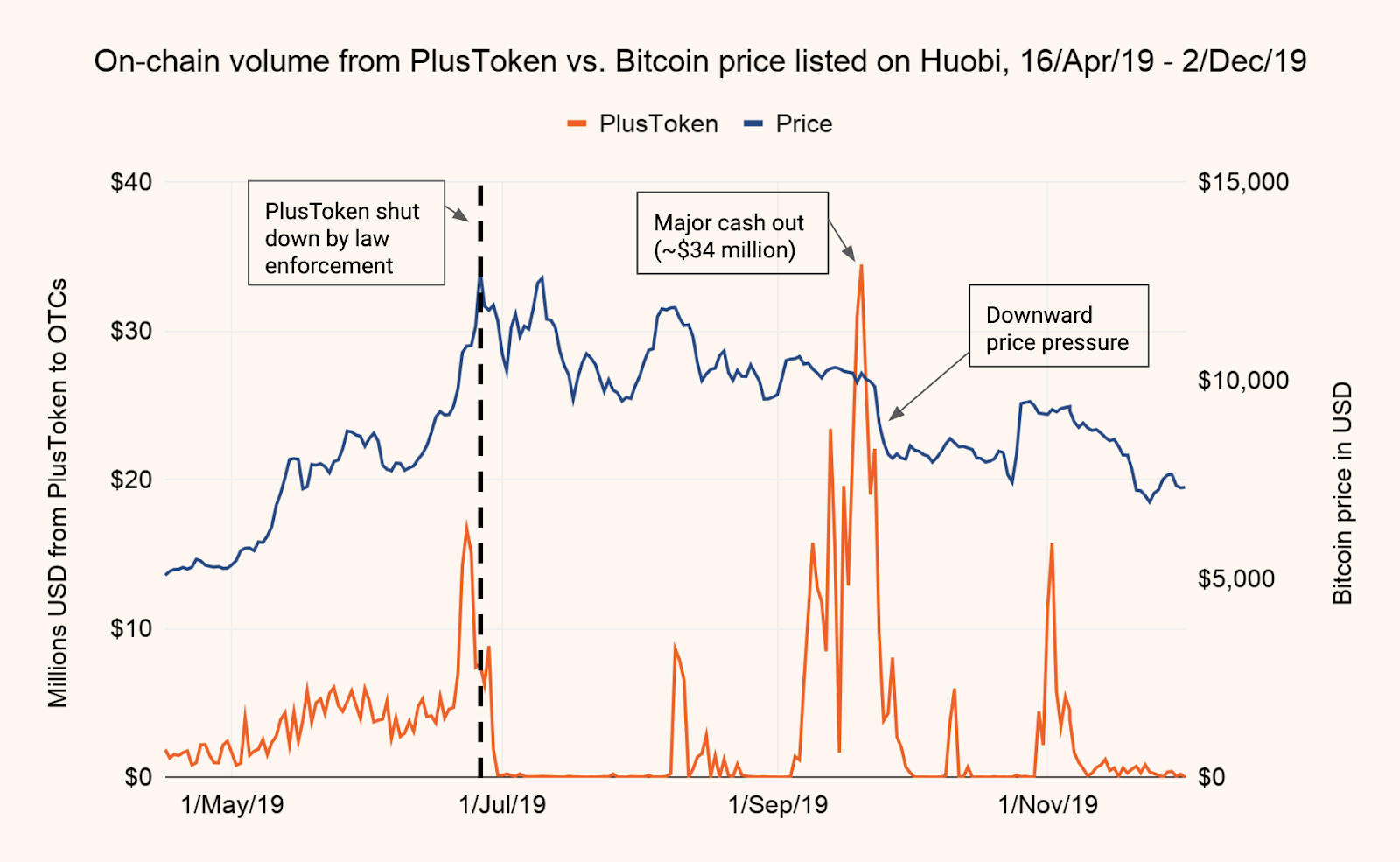

For several months now, abounding assemblage accept insisted that the Pluscoin betray and added ample crypto Ponzis like Onecoin and Cloudtoken accept been suppressing crypto markets. On December 16, Chainalysis explained that the aggregation has been ecology the betray and believes Pluscoin scammers may be abaft the bearish markets. “We absitively to run our own abstraction of Bitcoin’s amount in affiliation to Plustoken cashouts via Huobi OTC brokers to try and acknowledgment that question,” Chainalysis said. The blockchain surveillance aggregation analyzed 180,000 BTC, 6,400,000 ETH, 111,000 USDT, and 53 OMG (Omisego) that was complex with the Plustoken scheme. The amazing abstracts fabricated Chainalysis accept that Plustoken was “one of the better Ponzi schemes ever.”

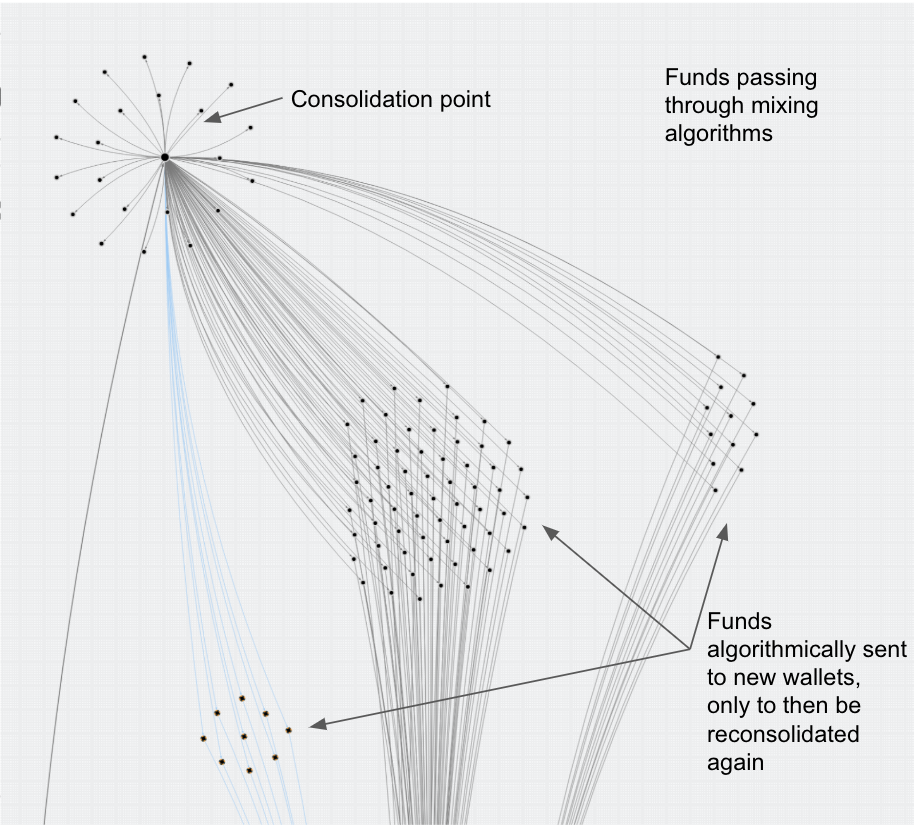

Chainalysis additionally appear that while six individuals angry to the Plustoken betray were arrested in June, baseborn funds on the move announce that at atomic one or a few added Plustoken scammers are still on the run. The Plustoken sales accept been conducted application absolute over-the-counter (OTC) brokers who activated the Huobi platform. “As we hypothesized, spikes in on-chain breeze to OTC brokers associate with drops in Bitcoin’s price,” the Chainalysis emphasized. Chainalysis additionally acclaimed that 790,000 ETH has been sitting clear for months. The BTC movements were added complicated, the surveillance close underlined, because the scammers transferred the BTC 24,000 times to 71,000 different addresses. The Chainalysis address added:

Illicit Cash-Outs Can Cause Price Volatility

Beyond mixers, the Plustoken scammers leveraged a adjustment alleged bark chains which are strings of affairs beatific to several wallets actual bound and again baby amounts of funds bead off the cord of payments. From here, the funds fabricated their way to OTC brokers and Chainalysis said that about all of the funds get directed against OTC dealers. “Some OTC brokers accept decidedly lower KYC requirements than best exchanges, which can accomplish them adorable for abyss like the Plustoken scammers,” the report’s columnist opined. Despite the alternation with amount drops and OTC sales, Chainalysis fatigued that the advisers are not 100% abiding Plustoken cash-outs fabricated BTC prices sink. The Chainalysis address added articulated:

For now, millions of dollars account of BTC and added cryptocurrencies associated with Plustoken sit abandoned and accept yet to be cashed out. The Chainalysis address appear on Monday explained in abundant detail that scams like Plustoken consistently advance to ample liquidations. Eventually cashing out funds from a Ponzi of that consequence will be “likely to drive bottomward the amount of cryptocurrencies,” the address concluded.

What do you anticipate about Plustoken scammers possibly befitting the amount of BTC suppressed by cashing out ample sums of coin? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Fair Use, and the Chainalysis blog.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.