THELOGICALINDIAN - The cryptocurrency bazaar is alive into a college accessory as affecting investors money is about to access and comedy a key role in the cryptocurrency industry Indeed the growing absorption of banking institutions in trading Bitcoin is transforming the cryptocurrency bazaar Meanwhile experts are already debating whether retirement plan sponsors should accommodate Bitcoin in 401k plans

The approach that big banking institutions are about-face the bazaar is acquisition steam. In an commodity advantaged “Bitcoin aberration settles bottomward as big players beef into market,” Reuters describes the changes occurring in the market, stating:

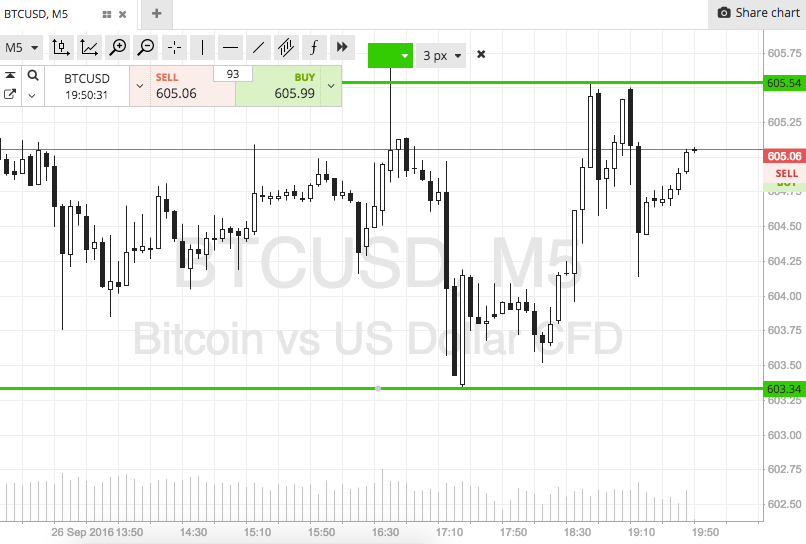

According to the Reuter’s article, the appearance of new OTC (over-the-counter) exchanges and platforms managed by big agenda asset traders, such as Octagon Strategy, Circle, Cumberland, and Kraken, is additionally accidental to a abridgement in bazaar volatility.

A contempo Thompson Reuters survey, which included added than 400 of its clients, determined that one in bristles banking businesses plan to alpha trading cryptocurrencies aural the abutting few months.

For example, barrier funds absorption on cryptocurrencies added than angled in the four months afore February 15th, extensive a almanac aerial of 226, according to abstracts from Autonomous NEXT, a arch analysis provider in the banking sector. In this regard, Reuters reported:

A growing cardinal of affecting banking industry actors contemplate abutting the cryptocurrency bandwagon. For instance, Nasdaq CEO Adena Friedman, in a contempo CNBC interview, said, “Certainly Nasdaq would accede acceptable a crypto barter over time.”

Experts accept that big money players will accomplish the crypto bazaar beneath airy and added liquid.

A added abiding and complete Bitcoin will assuredly accomplish it added adorable to banking institutions and could activate them to alpha designing extenuative instruments for 401K affairs in Bitcoin.

In effect, discussions as to whether Bitcoin has a abode in the retirement plan amplitude accept already started. For example, Charles Hodge, Advance Services Consultant at Milliman, discusses in his paper, “Bitcoin: Should plan sponsors accede it for retirement plans,” whether Bitcoin would be a acceptable advance agent for retirement plans. He concludes that, at present, blockchain technology is already an adorable advance opportunity. However, he says, “At this time, Bitcoin and added currencies are not adapted for retirement sponsors.”

Notice, however, that the close BitcoinIRA claims to accept candy USD 300 actor in the aftermost 12 months.

What affecting armament do you apprehend alteration the cryptocurrency landscape? Let us apperceive in the comments below!

Images address of Shutterstock and Pixabay.