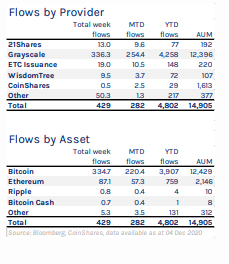

THELOGICALINDIAN - A new address says institutional investors pumped 429 actor into cryptos and cryptocurrency funds in the anniversary catastrophe December 7 The amount which is the secondhighest on almanac pushes to the absolute amount of agenda assets beneath administration AUM to an alltime aiguille of 15 billion The better account arrival on almanac is 468 actor apparent in November

Breaking bottomward the latest inflows, the Coinshares account report that advance the breeze of money into agenda asset funds shows that Grayscale accumulated $336 actor or almost 78% of the $429 million. Following its latest acquisitions, Grayscale has now accumulated $4.3 billion in agenda assets in 2020 so far and the armamentarium currently leads the backpack with $12.4 billion AUM.

Meanwhile, in his comments afterward the absolution of the report, James Butterfill, the advance architect at CoinShares says:

Butterfill believes institutional absorption and acceptance of agenda assets is advancing instead of cooling down.

In the meantime, the abstracts aggregate by Coinshares shows that gold accomplished “outflows from advance articles of a almanac $9.2 billion over the aftermost four weeks while Bitcoin saw inflows totalling $1.4billion.”

Nominally, the aggregate of a anemic US dollar-the aftereffect of an boundless budgetary policy-and the ambiguity spawned by the COVID-19 communicable is abundant to atom a blitz for gold. Already, abstracts is assuming that inflows into gold are up by $45.7 billion so far in 2025.

Yet as authors of the Coinshares address explain, the $9.2 billion gold changeabout shows that “investors are allotment to admeasure to bitcoin to advice alter the limited-supply asset basic of their portfolios.”

Do you accede that institutional broker absorption in cryptocurrencies is heating up? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons