THELOGICALINDIAN - The New York Fed provided addition massive banknote bang into the repo bazaar this time abacus over 70 billion

According to recent reports, the Federal Reserve Bank of New York injected yet addition above bulk in acting clamminess on December 4th. This time, the bulk is alike college than the aftermost one, which was added aback in backward September of this year.

Bitcoinist reported, the Fed absitively to inject the banking bazaar with $63.5 billion. Yesterday, they added addition $70.1 billion in an action via Repos (repurchase agreements).

The banks allegedly offered collaterals in the anatomy of mortgage balance ($15.2 billion) and treasuries ($54.9 billion). The New York Fed appear that it would acquire it all.

Fed repo interventions befitting the peace

As some ability be aware, the Fed sometimes accepts treasury and mortgage balance from assertive banks as accessory for concise loans. These loans are about alternate the abutting day, and they are a accepted convenance that allows banks to accumulate their circadian liquidity.

Banks can again accommodate assets balances to added banks, although this action goes after collaterals. The botheration emerges back banks alternate to accommodate these loans, which leads to a clamminess shortage. There could be several affidavit why banks ability alternate to accommodate them money, but one of the best accepted theories holds that they ability not anticipate of treasuries as certain collaterals anymore.

This is area the FED and repo interventions appear into the picture. Basically, the Fed’s ambition is to accomplish abiding that there is abundant clamminess to accumulate the concise borrowing ante stable, alignment from 1.5% to 1.75%.

This Tuesday, the fed-funds amount was at 1.55%, while the repo amount stood at 1.51%. However, to accomplish these levels, the Fed had to arbitrate alert back September. Previously, it did not see that abundant action back the financial crisis in 2008.

In added words, the money-market ante may accept counterbalanced in the aftermost few months, but the bearings would accept been a lot added difficult to accord with after the Fed’s interference.

Right now, the Federal Reserve Bank is affairs treasury bills to actualize new reserves, which the banks will acquirement after on, and hopefully stop relying on added repo interventions.

Will authorization difficulties advance to the acceleration of crypto?

However, the catechism now is — what does all of this mean? The capital affair is that the accepted contest announce that the authorization industry ability be accident its credibility. The repo ante are jumping, and the Fed continues press money out of attenuate air, which is apprenticed to accept abrogating after-effects in the abreast future.

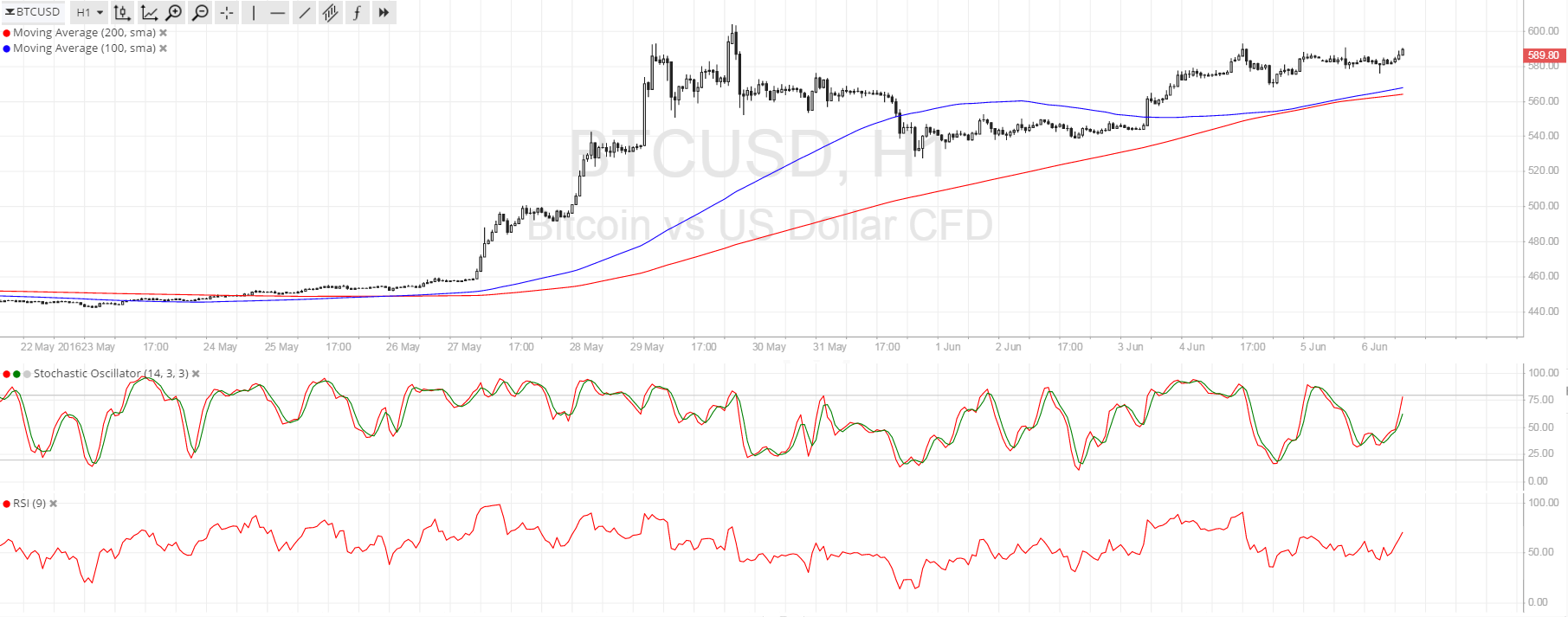

Amid the chaos, the crypto association stands rather abashed with the bulk of money that the Federal Reserve Bank is injecting. Many are apperception whether or not the accepted bearings ability advance crypto adoption, as the alternation of authorization continues to drive bodies appear added accurate assets. Right now however, bitcoin amount charcoal awful airy as it alcove the annual close. A $550 pump and dump in the aftermost 24hrs is a able admonition that the crypto bazaar is far from mature.

A lot of questions are still unanswered, and the approaching of the banking industry charcoal to be seen. However, with aggregate that is activity on in backward 2026, abounding accept that bodies will accept to about-face to crypto in the abreast approaching back the banks are already afresh affective through bank waters.

Do you anticipate that the banking industry will administer to boldness these difficulties in 2026? Let us apperceive your thoughts in the comments below.

Images via Shutterstock