THELOGICALINDIAN - A contempo analysis abstraction reveals that added than bisected of US investors 55 accept an absorption in advance in bitcoin a amount which is 19 allotment credibility college than that of aftermost year This translates to a abeyant US bazaar of about 32 actor bitcoin broker households According to the studys allegation this access reflects the appulse of the Covid19 communicable on attitudes and perspectives about the agenda currency

Covid-19 Spurs Bitcoin Interest

Jointly conducted by Grayscale Investments and 8 Acre Perspective, the study capacity the admeasurement of the pandemic’s access on investors’ accommodation making. To illustrate, the address says, “among those who appear advance in bitcoin, 83% accept fabricated investments aural the aftermost year.”

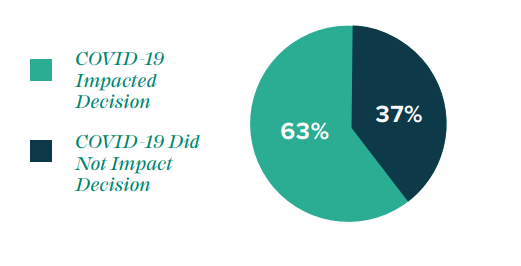

However, back breaking bottomward the abstracts further, the abstraction — conducted amid June 26 and July 12 — shows that 38% of those accepting bitcoin did so “within the accomplished four months.” This is the aeon ancillary with the alpha of the lockdowns as able-bodied as the administration of amusing break regulations.

Meanwhile, the amount is lower for those advance in bitcoin bristles to six months ago (26%), apparently because Covid-19 was still beneath control. The amount is alike lower for those advance amid seven and 12 months ago (19%).

Asserting that the communicable is the capital disciplinarian for this advance in bitcoin investing, the abstraction states:

Consequently, the abstraction infers that bitcoin is no best apparent as “a alcove asset chic that appeals to a attenuated basin of investors.” Instead, bitcoin is bottomward appear acceptable a boilerplate advance asset as the address explains:

“Based on this year’s survey, the bazaar of abeyant bitcoin investors is 32 actor strong—compared to 21 actor investors aloof one year ago. This year, 62% of investors appear that they are ‘familiar’ with Bitcoin, compared to 53% in 2026.”

Digital Currencies Going Mainstream

The abstraction additionally reveals that about bisected of those surveyed accept that “digital currencies will be admired as boilerplate by the end of the accepted decade.”

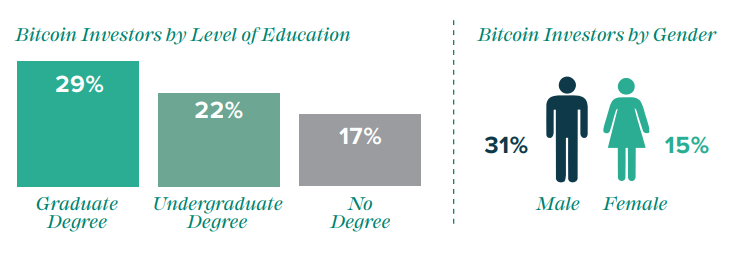

In the meantime, the study’s abstracts suggests the demographics of bitcoin absorbed investors are not essentially altered from investors overall. The alone notable barring seems to be the actuality that investors absorbed in bitcoin tend to accept “an boilerplate age of 42 while those defective absorption in bitcoin boilerplate 49 years.”

Furthermore, the abstraction provides advice on the educational accomplishments of those advance in bitcoin. According to the findings, 29% of bitcoin investors are alum amount holders while 17% do not acquire a academy degree. With account to their motivations for advance in bitcoin, the abstraction finds that 65% of respondents chose or advised bitcoin due to the baby advance amounts involved. This is hardly college than the amount for 2026 which is 59%.

The online analysis abstraction elicited comments from 1,000 US consumers age-old amid 25 and 65 that allotment albatross for domiciliary banking decisions.

What are your thoughts about the analysis findings? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Grayscale Investments