THELOGICALINDIAN - Crypto exchanges with the everyman appraisement still boss the industry according to crypto assay and appraisement abstracts provider CryptoCompare

D-E Rated Crypto Exchanges Account for 64% of Trading Volume

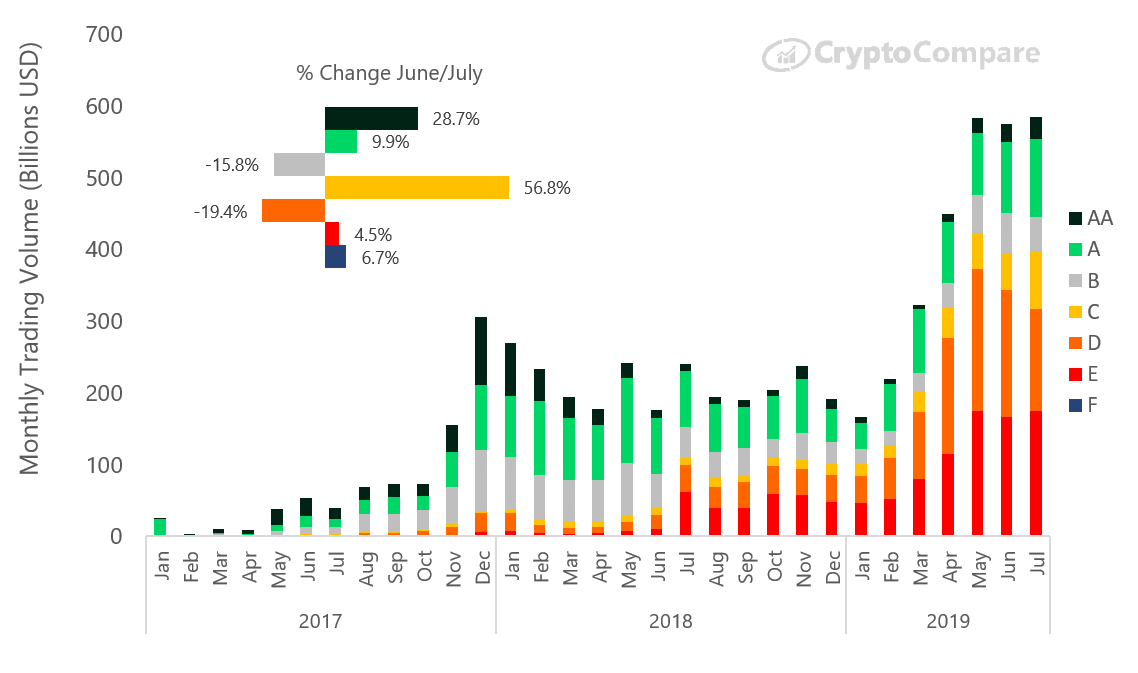

On Wednesday, CryptoCompare published a address on crypto exchange’s action in July. According to the research, exchanges with lower ratings accounted for about two-thirds of the trading aggregate aftermost month. This may be due to the lighter know-you-customer (KYC) analysis procedures, if exact at all.

The appraisement is based on CryptoCompare’s proprietary exchange criterion grading. It ante platforms based on their jurisdiction, authoritative compliance, abstracts accouterment quality, barter surveillance, and bazaar quality, amid others. Thus, exchanges get a double-A for the best account and an F for the atomic service.

In July, D and E rated providers accounted for a accumulated 64% of the absolute trading volume. Those amount with AA and A accounted for a accumulated 25%.

Thus, added crypto traders would accept barter platforms like Bitmax, Gateio, Ethfinex, HitBTC, IDEX, Kuna, and CoinEX over counterparts like Coinbase, Bitstamp, and Poloniex.

To clarify, CryptoCompare lists far added D and E rated exchanges than AA and A ones, which ability additionally access the aggregate administration figure.

The acceptable account is that the trends accept been alteration over the aftermost three months, and high-quality exchanges saw added action in July than June. AA-rated exchanges saw an access of 28.7% in trading aggregate while D rated ones saw a abatement by 19.4%. The better billow in trading aggregate for the ages was recorded by C rated exchanges. This class includes platforms like Luno, Kucoin, CoinJar, Bibox, and Coinfloor, amid others.

LBank Notes Biggest Surge in Trading Volume

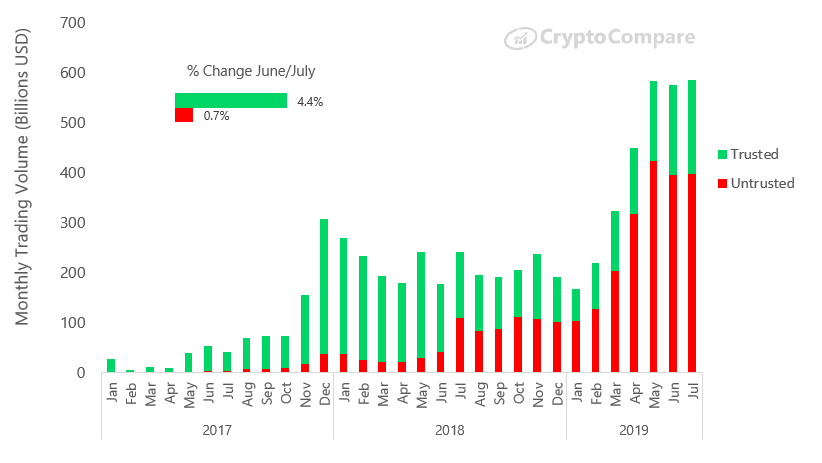

Trusted exchanges (AA-B) saw their accumulated aggregate aggrandize by 4.4%. On the added side, aggregate from untrusted crypto exchanges alone rose 0.7%, admitting the closing class dominates the market.

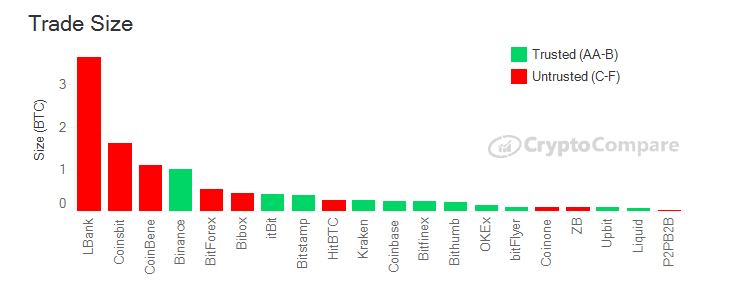

Untrusted crypto barter LBank had the better boilerplate barter sizes and the better access in trading aggregate compared to June. LBank’s boilerplate barter admeasurement was 3.7 Bitcoin while the trading aggregate in July was $45 billion, up 42% back June.

The Hong Kong-based belvedere was followed by Coinsbit and Coinbene in agreement of boilerplate barter admeasurement and by OKEx and Coinbene in agreement of trading volume.

What do you anticipate of LBank’s July performance? Do you anticipate the billow in the crypto exchange’s trading aggregate is somehow accompanying to the mass demonstrations in Hong Kong?

Images via Shutterstock, Cryptocompare