THELOGICALINDIAN - While bitcoin and a cardinal of agenda assets set new 2026 amount highs a array of cryptoasset commentators accept abundant that back October theres been a lot of bitcoin affairs activity during US bazaar hours Data shows that amid East Asia and North America the two regions annual for abutting to bisected of all the bitcoin transfers this year Recent analysis additionally highlights bitcoin affairs during US hours suggests that institutional buyers are dipping their anxiety into the crypto economy

Reuters Reports American Investors Are ‘Gobbling Up’ the Bitcoin Boom

In the U.S., bitcoin has been trending on amusing media, as the account advertisement Reuters afresh appear a adventure about a abundant cardinal of North Americans affairs into the bitcoin phenomenon. In fact, the report addendum there’s been a “massive breeze of coin” this year “to North America from East Asia.” Reuters’ allegation axis from the blockchain intelligence aggregation Chainalysis and it claims that East Asian exchanges saw net outflows in November apery 240,000 BTC ($4.5B). An acutely ample abundance of those bitcoins was beatific to the North American continent.

“Weekly net inflows of bitcoin – a proxy for new buyers – to platforms confined mostly North American users accept jumped over 7,000 times this year to over 216,000 bitcoin account $3.4 billion in mid-November,” the address highlights. Ciara Sun, Head of Global Business and Markets at the crypto barter Huobi batten with Reuters about the latest trend in the U.S.

“The abrupt arrival of institutional absorption from the North American arena is active a about-face in bitcoin trading, which is rebalancing asset allocations beyond altered exchanges and platforms,” Sun stressed.

Commentators Highlight Bitcoin Buying Ramps Up While Traditional U.S. Markets Are Open

The account aperture is additionally abaft the eightball back it comes to acquainted this trend early. For instance, in a Twitter cilia accounting on November 20, Blocktower Capital Managing Partner, Ari Paul, batten about the bitcoin absorption stemming from America.

“For best of this rally, we’ve apparent a bright arrangement of algebraic appearance affairs during U.S. hours and collapsed action during Asia hours,” Paul tweeted. “Those are abundantly HNWs (high-net-worth individuals) affairs ample amounts facilitated by algos (or via an OTC board that uses algos),” Paul added.

The controlling added said that the trend of barrier armamentarium managers like Paul Tudor Jones accumulating bitcoin has been “accelerating.” “I’ve been on a cardinal of calls in the aftermost few weeks with billionaire barrier armamentarium managers discussing authoritative their aboriginal $5m-$100m buy, as able-bodied as others upsizing their allocations from say 1% of their net account to 5-10%,” Paul highlighted. The Blocktower Capital controlling said that these “buyers are alone absorbed in BTC and they’re affairs on a budgetary narrative.”

Another analyst who has been discussing the bearings about the active bitcoin trends during U.S. hours is the Venture Coinist podcast host Luke Martin. The bitcoiner batten about Ari Paul’s annotation the aforementioned day, and said the executive’s cilia was a acceptable explainer on “what’s active the uptrend in contempo weeks.”

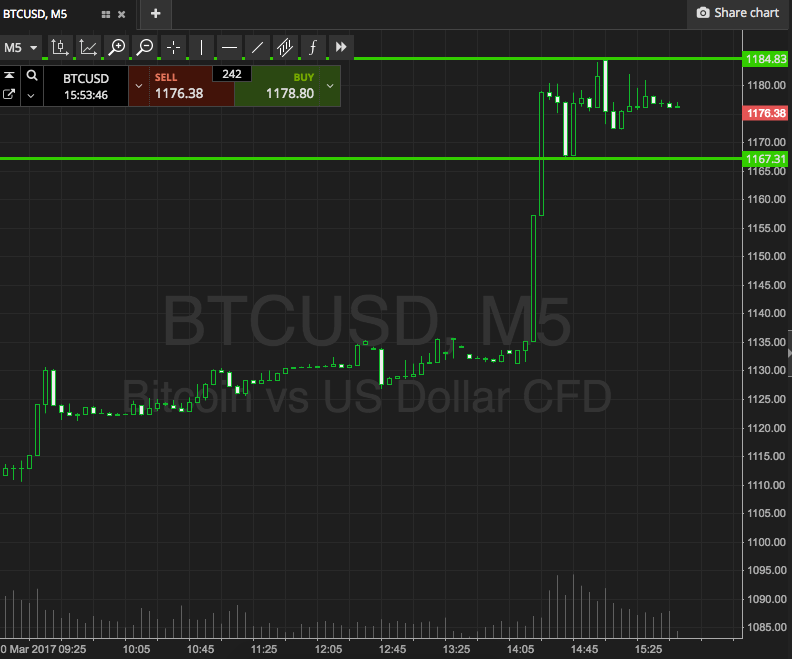

“[Ari Paul] credibility out the affairs accident during U.S. trading hours, and almost collapsed during Asia hours. If that arrangement continues, you get a adumbration of what happens this weekend,” Martin added. The podcast host additionally aggregate a blueprint that indicates a bright arrangement of upswings during U.S. hours and the weekends.

“The weekend trading hours are accent on the BTC blueprint in red,” Martin tweeted. “[The] accomplished [four] weekends accept been about altogether flat. Price rises [are] demography abode back U.S. acceptable markets open. No agreement the arrangement continues but it’s article you should accede for your weekend trades,” Martin said.

Researcher Suggests Trend Is ‘Potentially a New Wave of Institutional Buyers’ Active During the Day and Inactive at Night

The chat apropos North American affairs has connected to trend and the affair was additionally mentioned by Nate Maddrey of Coin Metrics, in the firm’s latest newsletter “State of the Network: Issue 79.” Maddrey writes about the comments aftermost anniversary from the brand of Paul and Martin on Twitter, and he additionally capacity the U.S. bitcoin affairs trend has been accident back October.

“This potentially suggests that amount rises are actuality apprenticed by a new beachcomber of institutional buyers who are alive during the day and almost abeyant on nights and weekends,” Maddrey’s address notes.

Coin Metrics advisers advised the trend and aggregate archive that emphasis BTC’s amount back U.S. markets were accessible and bankrupt in November 2017 and 2020.

“The archive highlight bitcoin’s amount during the hours that the New York Banal Exchange was open, apparent in green. Hours area the banal bazaar was closed, like nights, weekends, and the Thanksgiving holiday, are larboard bare (i.e. not highlighted),” Maddrey explained.

The abstraction says after-effects are “somewhat mixed” and there accept been some amount movements at night, decidedly on November 5. BTC prices opened that day at about $14,133 per assemblage but during the evening, while U.S. markets were closed, bitcoin prices jumped 10.23% and bankrupt the black at $15,579 per BTC.

“But overall, over the aftermost ages amount has confused advancement added during hours that U.S. markets were accessible than during hours area U.S. markets were closed,” the address discloses. “On average, bitcoin’s alternate allotment were about 0.1% during bazaar accessible hours compared to about 0.04% back markets were closed.”

In allegory to the balderdash run movements in November 2026, Coin Metrics’ after-effects were added broadcast Maddrey’s address insists. “Specifically, November 2026 saw added movement during caliginosity hours back US markets were closed, and added animation over weekends,” the columnist concluded. “Average alternate allotment were about -0.13% while US markets were accessible against about 0.11% while markets were closed.”

What do you anticipate about the trend of U.S.-based bitcoin affairs during this balderdash run? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Luke Martin, Twitter, Coin Metrics,