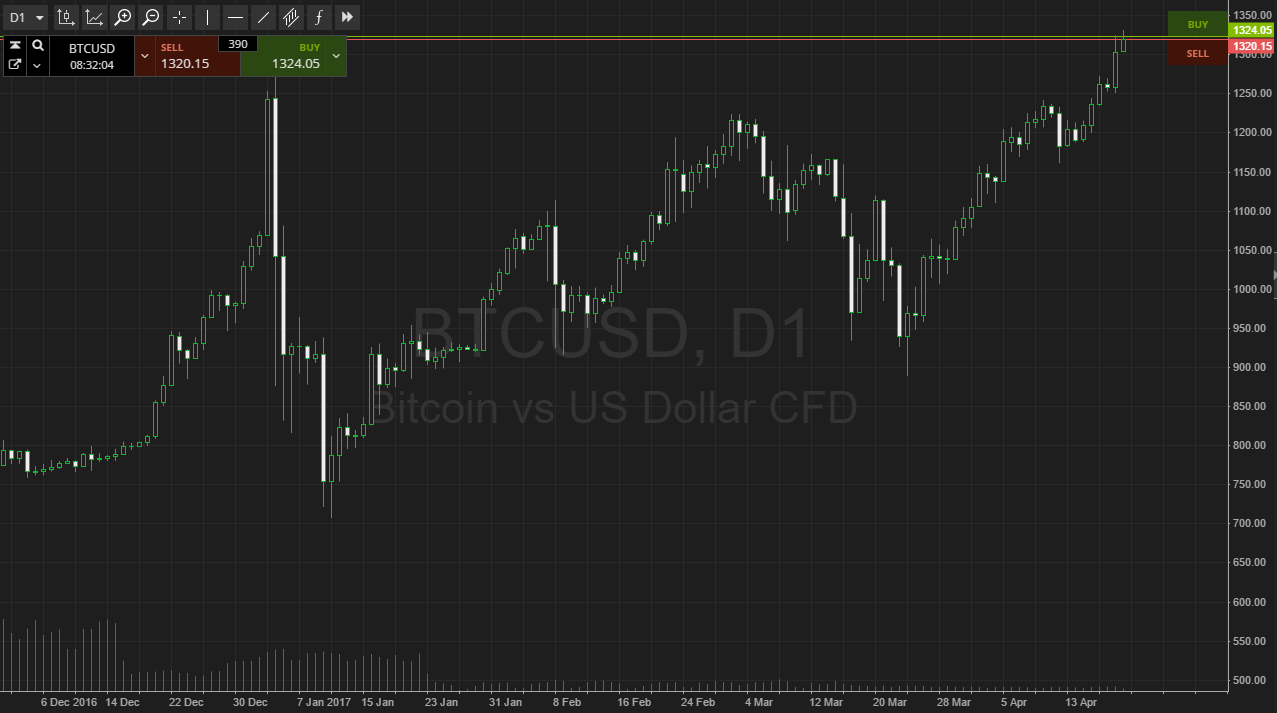

THELOGICALINDIAN - Experts all beyond the lath accept been absolute that added than abstruse assay amusing affect is one of the best able indicators of crypto bazaar amount and while it may be an accessible approach it has assuredly been proven

Recently the Stevens Institute of Technology conducted a abstraction forth with three added universities – Dickinson College, Ivey Business School, and the University of Cincinnati – on how amusing affect affects Bitcoin bazaar prices. The abstraction analyzed 3.3 actor tweets and 344,000 Bitcointalk posts – two years account of data.

According to Sergey Krutolevich, RoninAi Research Scientist, Ph.D. in Applied Statistics:

Previous letters gleaned advantageous acumen that showed a absolute alternation amid amusing affect and Bitcoin bazaar value, but it could not actuate which accurate demographic and what types of affect absolutely affect the market.

In a abstraction by Pulsar, it was reported:

The accomplished studies, however, did not agency in the abounding variables that can affect bazaar prices and, while we now apperceive the abstracts to be accurate, there is assuredly analysis which is acute in an ambiance that emphasizes assurance and security. Using agent absurdity alteration (VECM) the university teams were able to agency in a cardinal of variables including a about-face correlation, S&P 500 banal index, gold prices and animation indexes.

They additionally activated for the blazon of sentiment, bullish or bearish, or absolute and negative.

It is unsurprising that social sentiment can affect the market, but the new abstraction shows that it is not the “Vocal Minority”, or those who column consistently about crypto and Bitcoin, but rather the “Silent Majority”, or those who don’t column generally on the subject, who affect the prices.

Feng Mai, an assistant assistant of advice systems in the School of Business at Stevens Institute of Technology, wrote:

The implications are that FUD (fear, uncertainty, and doubt) is beneath abundant than FOMO (fear of missing out) and that those who column on amusing media about Bitcoin bazaar belief frequently will be admired by the association as accepting an calendar after abundant aftereffect on the market. Investors are acceptable savvier at chief whose opinions to trust, but still abide ever optimistic back it comes to emotionality.

Does amusing affect agency into your bazaar analysis? Let us apperceive in the comments below!

Images address of Pixabay, AdobeStock