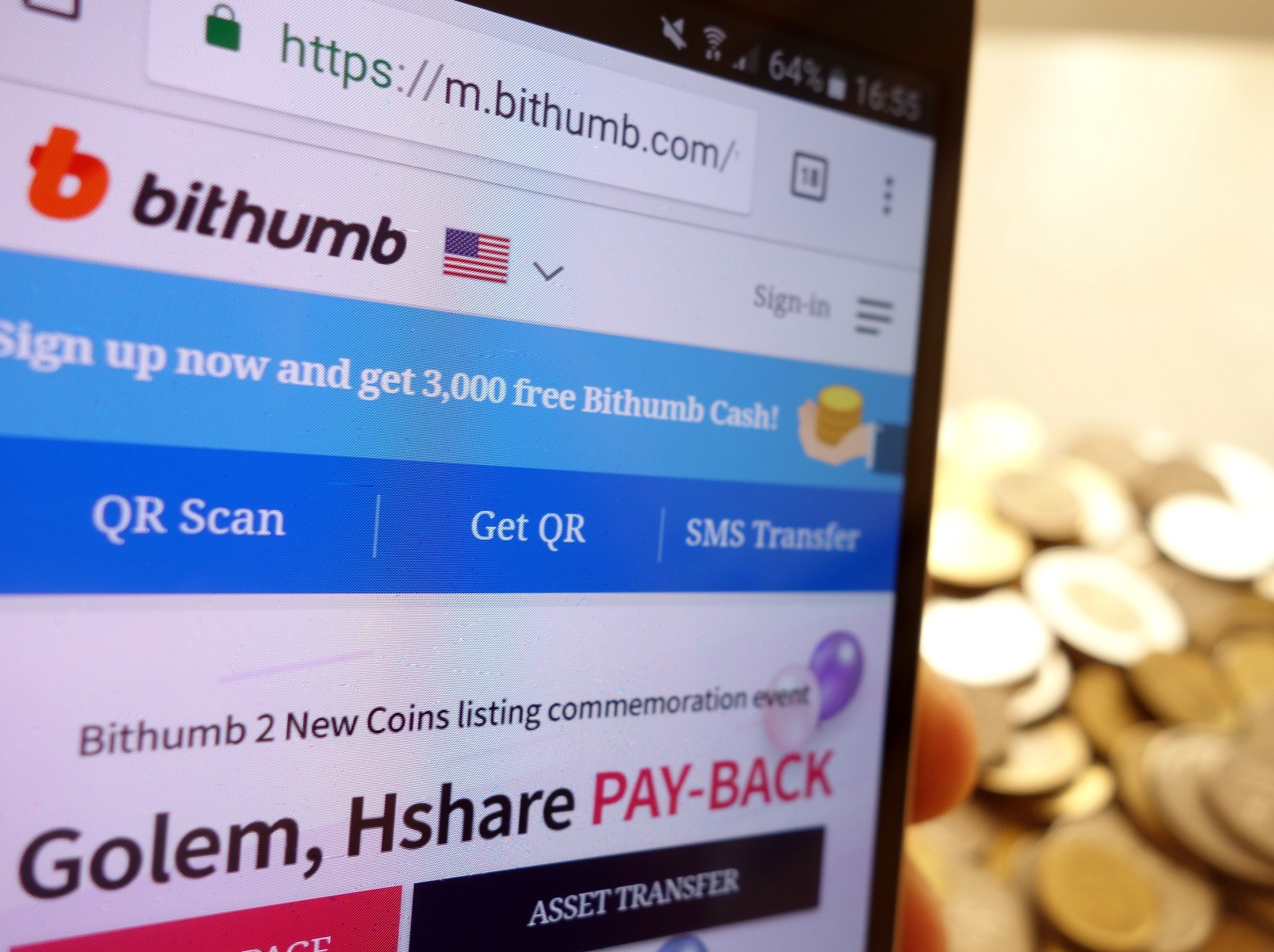

THELOGICALINDIAN - The National Tax Service of South Korea NTS has absitively to abstain assets tax from Bithumbs adopted barter The absolute tax to be imposed on their affairs amounts to added than 80 billion won over 69 actor the arch Korean cryptocurrency barter appear

Also read: Poles Hit With Backdated Tax on Crypto Trades

Bithumb to Challenge the Move Which Lacks Legal Grounds

In what has been declared by Korean media as the aboriginal such attack by the government in Seoul, the NTS is advancing to abstain the tax alike afore the country’s legislation has been adapted to acquiesce for the taxation of cryptocurrencies. The new accoutrement are accepted to be adopted abutting year. Quoted by the Korea Joongang Daily, a apprehension appear Friday through the Financial Supervisory Service’s arrangement by Bithumb’s better shareholder, Vident, detailed:

No specific taxation standards for crypto assets are in abode at the moment, the aperture acclaimed in its report. The Ministry of Strategy and Finance appear beforehand this ages that the 2025 tax law ameliorate will acquaint taxation for incomes and profits from cryptocurrency transactions. Industry sources say the Bithumb case is aloof the aboriginal footfall which reveals that the government will accomplish acceptable on its intentions.

Bithumb’s adopted audience accept become the aboriginal to be targeted. But it’s absolutely the barter that’s declared to abstain and drop the tax to the treasury. However, Bithumb is planning to booty acknowledged activity adjoin the tax claim, Vident antiseptic in its announcement. That agency the acquittal may eventually be altered from the declared amount.

Speaking to the newspaper, Professor Kim Woo-cheol from the University of Seoul remarked that back there’s income, there’s tax as well. He added, however, that the accepted bearings can be declared as a “tax bomb” for the agenda asset trading platform. “Bithumb can pay 80.3 billion won and after aggregate the bulk from its adopted clients, but about that’s impossible,” the bookish elaborated.

Crypto Profits Categorized as Miscellaneous Income

According to added tax experts quoted by the publication, the NTS has based its amount on the amounts aloof by adopted users from Bithumb accounts. Their balance from trading on the barter accept been categorized as ‘miscellaneous income,’ which is accountable to a tax amount of 22%. In this case, withdrawals from the belvedere accept been estimated by the government at over 401 billion won, or about $347 million.

Miscellaneous assets is one of the accessible interpretations of revenues generated in cryptocurrency trading, with the added one actuality basic assets such as those from the auction of absolute acreage or stock. The called class refers to aberrant assets and tax is calm already a year, while the basic assets tax should be appear paid for anniversary deal. Such a book would’ve meant that Korean exchanges would accept been appropriate to address every trading almanac which is abstract and complicates oversight.

Besides this ambiguous approach, added issues angle in the way of taxation too. Before December 2017, foreigners were chargeless to barter on Korean exchanges but abounding affairs were conducted beneath affected names or by anonymous traders, including bounded residents. Establishing who’s abaft a assertive barter and the admeasurement of their profits would be acutely difficult for trading platforms, if at all possible.

A acknowledged claiming adjoin the tax agency’s accommodation is actual acceptable to accomplish additionally because the move is not based on any law. Under the accepted Korean legislation, the accompaniment cannot appoint taxes on incomes that are no accurately authentic in the country’s tax code. Besides, a catechism that still hangs in the air is whether Seoul angle decentralized cryptos as currencies or some affectionate of assets.

What do you anticipate about South Korea’s accommodation to abstain tax from Bithumb’s adopted customers? Share your assessment on the accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any third affair products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

You can now acquirement bitcoin after visiting a cryptocurrency exchange. Buy BTC and BCH anon from our trusted agent and, if you charge a bitcoin wallet to deeply abundance it, you can download one from us here.