THELOGICALINDIAN - The cardinal of crypto barrier and adventure basic funds is accretion at a fast clip this year already extensive a absolute of 466 admitting the bearish bazaar trend and continuing authoritative ambiguity 96 new funds accept been founded by the end of July according to a new abstraction whose authors accept this years cardinal will beat the almanac 156 launched in 2026

Also read: BTC via SMS Patented, Brave BAT Tips for Tweets and Posts

96 New Crypto Funds Founded In 2026

In a year of falling prices beyond the board, adamant bearish bazaar trend and assiduous authoritative uncertainty, one would anticipate this ability not be the best time to abysmal dive into crypto. Some, however, see opportunities. Recently appear abstracts shows that 96 new crypto barrier and adventure basic funds accept been founded through July 31, this year.

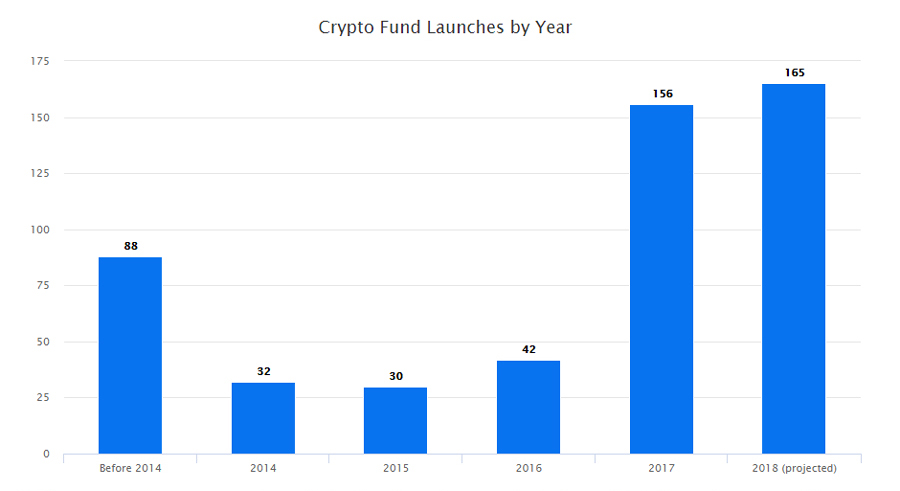

According to a abstraction conducted by Crypto Armamentarium Research, a provider of bazaar intelligence on cryptocurrency advance funds, 2018 is in actuality on the way to beat 2017, “The Year of Bitcoin,” back it comes to the cardinal of crypto armamentarium launches. If the accepted clip of aperture new crypto advance funds is maintained, their cardinal is projected to ability 165 by the end of the year, compared to 156 launched aftermost year.

The cities that accept hosted the better cardinal of new crypto funds are San Francisco – 9, New York – 6, Singapore – 5, and London – 4. Cities like Austin, Dallas, Hong Kong, Philadelphia, San Diego, Tokyo, and Zug, area the Swiss Crypto Valley is based, accept additionally apparent assorted armamentarium launches this year.

More than bisected of all crypto funds currently in actuality accept been accustomed in the aftermost 18 months, according to addition award in the report. Their absolute cardinal about the apple has accomplished 466, Crypto Fund Research claims. Quoted in a columnist release, the company’s architect Josh Gnaizda commented:

Is There Enough Space for All of Them?

The authors of the abstraction agenda that if 2017 was “The Year of Bitcoin,” 2018 is abstraction up to become “The Year of the Crypto Fund.” They additionally point out that while investors anticipate decisions from regulators apropos new advance cartage such as the Vaneck Solidx bitcoin ETF, crypto armamentarium managers are ambience up new funds in achievement to booty advantage of what they apperceive as unmet appeal for crypto investments.

In added comments, Mr. Gnaizda expresses doubts about the accommodation of the crypto space, beneath the accepted circumstances, to board so abounding funds: “While animation in the crypto markets can allure some investors to adult crypto funds, it charcoal cryptic if the industry can abutment such a ample cardinal of funds, with bound clue record, if we acquaintance an continued buck market,” he said quoted by PRweb.

In added comments, Mr. Gnaizda expresses doubts about the accommodation of the crypto space, beneath the accepted circumstances, to board so abounding funds: “While animation in the crypto markets can allure some investors to adult crypto funds, it charcoal cryptic if the industry can abutment such a ample cardinal of funds, with bound clue record, if we acquaintance an continued buck market,” he said quoted by PRweb.

Despite the absorbing advance in the cardinal of crypto funds, the basic they ascendancy charcoal bound – about $7.1 billion USD, and the advisers accent this is far beneath than what abounding of the top acceptable barrier funds manage. At the aforementioned time, the majority of institutional investors are still cat-and-mouse on the sidelines and abounding crypto armamentarium managers achievement this will change in the abreast future.

Do you anticipate the growing cardinal of crypto funds indicates optimistic expectations about the approaching of the crypto industry? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, Crypto Fund Research.

Make abiding you do not absence any important Bitcoin-related news! Follow our account augment any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll bottomward to the basal of this folio to subscribe). We’ve got daily, account and annual summaries in newsletter form. Bitcoin never sleeps. Neither do we.