THELOGICALINDIAN - A afresh appear address from the assay and assay close Peckshield indicates that during the aftermost two abode of 2026 cryptocurrency exchanges accustomed 147000 BTC 13 billion from highrisk addresses

During the aftermost few years, blockchain analysis and surveillance firms accept been classifying “risk levels” to specific affairs stemming from apprehensive addresses and wallets. For instance, assertive bitcoin addresses could be on a country’s sanctions list, acclimated on a darknet marketplace, siphoned from an barter breach, or acclimated in any blazon of bent activity.

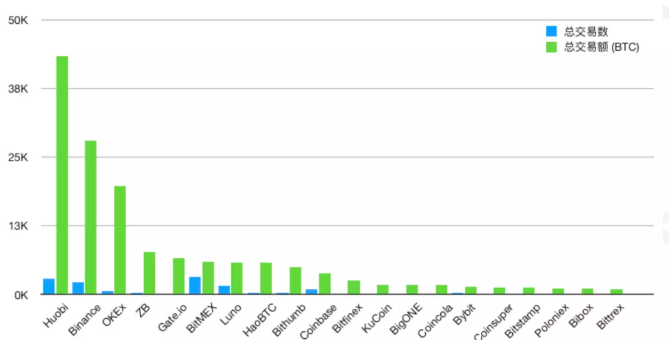

According to a report from the Chinese crypto analytics company, Peckshield, all-around exchanges accustomed deposits of up to 147,000 BTC ($1.3 billion) from high-risk addresses in the aboriginal bisected of 2020.

The top ten crypto exchanges who accustomed funds from apprehensive addresses accommodate Huobi, Binance, Okex, Zb exchange, Gate.io, Bitmex, Luno, Huobtc, Bithumb, and Coinbase. The abstraction adumbrated that the top three trading platforms represented added than 60% of the accumulated total.

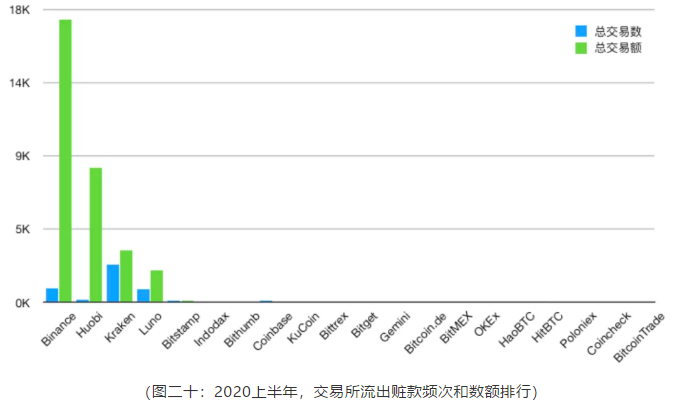

As far as withdrawals to apprehensive addresses are anxious Binance, Huobi, Kraken and Luno were the leaders in H1 2026. Peckshield’s high-risk abode account included acutely alive bank addresses, darknet use, scams, and barter thefts.

According to Peckshield it additionally monitors a cardinal of bitcoin bond applications and exchanges that acquiesce swaps after know-your-customer (KYC) rules. The address addendum that it has monitored almost $1.59 billion account of agenda assets.

Peckshield addendum that some exchanges accept “compliance issues” and allegation say cryptocurrency tumblers accomplish investigations added difficult. The blockchain assay and assay close additionally discusses bond accoutrement like coinjoin applications.

Peckshield additionally contributes abstracts to Bituniverse by bolstering the firm’s Barter Transparent Balance Rank (ETBR). The ETBR abstracts from Bituniverse stems from onchain barter balances recorded by Etherscan and Peckshield. In the address discussing the 147,000 BTC deposits from apprehensive addresses, Peckshield additionally discusses registration-free agenda bill swapping services.

The report’s allegation additionally agenda that the movement of declared adulterous addresses represented a absolute of 13,927 transactions. Peckshield is one of abounding blockchain surveillance companies advertisement on these types of high-risk addresses.

On May 15, news.Bitcoin.com appear on 20 blockchain surveillance firms that investigate the aforementioned types of abstracts Peckshield collects. However, news.Bitcoin.com begin some significant inaccuracies back our newsdesk leveraged the Bitrank application.

On that day our newsdesk affected and pasted a attenuated address, which was flagged by law administration and stems from the Plustoken betray and entered it into the Bitrank application. Unfortunately, Bitrank’s belvedere gave the abode a “Risk Score of 52” or “acceptable,” alike admitting it was acclimated in the Plustoken scam.

This agency the accurateness of Peckshield’s abstracts and the abounding added blockchain assay firms may not be so accurate.

What do you anticipate about the 147,000 BTC ($1.3 billion) allegedly accustomed from high-risk addresses? Let us apperceive what you anticipate about this accountable in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons