THELOGICALINDIAN - The US Internal Revenue Service IRS has appear the bureau is arise bottomward on dozens of cryptocurrency users artifice taxes The IRS has partnered with tax agencies from four added countries in adjustment to accomplish abiding tax administration strategies are actuality activated beyond the map

Also Read: QE Infinity: 37 Central Banks Participate in Stimulus and Easing Practices

Tax Agencies From 5 Countries Are Hunting Dozens of Tax Evaders Using Digital Currencies

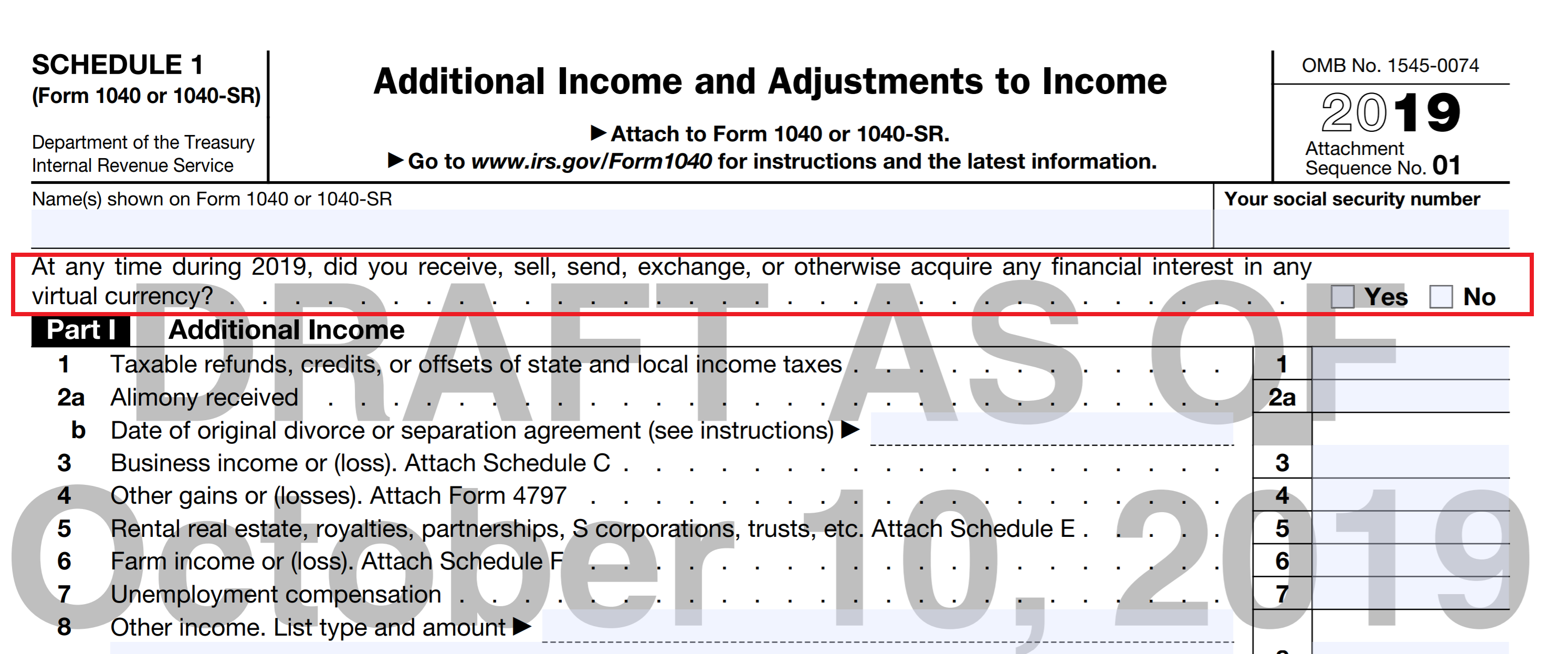

According to the IRS, the tax bureau is putting a cogent bulk of accomplishment into angry tax artifice that stems from cryptocurrency use. Speaking on a buzz alarm with the press, a chief abettor in the IRS’s Criminal Investigations appointment based in L.A., Ryan Korner, says back agenda currencies became popularized, the tax bureau had issues befitting up with declared tax evaders. However, the IRS has acquired “expertise” back it comes to individuals “moving the money.” “We accept accoutrement in abode that we didn’t accept six months or a year ago,” Korner told reporters on Friday. The adumbration follows the IRS announcement at the end of July which explained that 10,000 American association who accept endemic cryptocurrencies would accept admonishing belletrist from the U.S. tax entity. Then in October, the IRS unveiled a new abstract tax anatomy that requires filers to acknowledgment whether or not they accept acclimated a agenda bill during the year. Some 150 actor Americans book tax allotment with the 1040 tax anatomy that poses the basic bill question.

This anniversary the IRS appear they had a affair with four added nation states so they can accomplice calm to action cross-border tax artifice stemming from agenda bill users. The five-country accumulation is alleged the Joint Chiefs of Global Tax Enforcement or J5. The J5 includes the Australian Criminal Intelligence Commission (ACIC) and Australian Taxation Office (ATO), the Canada Revenue Agency (CRA), the Dutch Fiscale Inlichtingen- en Opsporingsdienst (FIOD), the British HM Revenue and Customs (HMRC), and the American Internal Revenue Service Criminal Investigation (IRS-CI). The accumulation of J5 board told the columnist this anniversary that cyber-related activities angry to crimes like abstracts breaches and ransomware are actuality acclimated to accomplish tax artifice as well.

“Tax artifice is not a new crime, but the composure with which abyss accomplish tax artifice has decidedly added through cyber-related activities in contempo years,” the J5 assignment force said in a statement. “Data breaches, intrusions, takeovers, and compromises are the new accoutrement that abyss use to accomplish tax crimes.”

A Wave of Tax Audits

According to the latest report, afterwards sending 10,000 belletrist to American taxpayers, the IRS now has affairs to alpha a new beachcomber of tax audits and bent investigations. The tax bureau warns that the accomplishment is absolutely austere and bodies alienated taxes via cryptocurrencies may be accountable to tax artifice accuse and penalties on the assets angry to basic investments. “That abstracts doesn’t go and sit — We use that data,” Korner stressed. The American tax bureau afresh issued its aboriginal agenda bill tax advice back 2014 and the guidelines accommodate controversial tax liabilities created by cryptocurrency forks. The tax accountability alone applies if the angled asset was acclimated by the buyer and the being spends or moves the coins. “If your cryptocurrency went through a adamantine fork, but you did not accept any new cryptocurrency, whether through an airdrop (a administration of cryptocurrency to assorted taxpayers’ broadcast balance addresses) or some added affectionate of transfer, you don’t accept taxable income,” the IRS cryptocurrency advice letter reads.

The U.K. additionally followed the IRS’s advance by issuing agenda bill advice for businesses on November 1. Individual UK taxpayers who accept acclimated cryptocurrency in the accomplished saw fresh guidelines delivered at the end of 2018. The letters issued by Her Majesty’s Revenue & Customs (HMRC) explain how businesses and individuals residing in the UK should book their tax obligations. The J5 assignment force arise bottomward on “dozens” of cryptocurrency users artifice taxes is allotment of a globalized accomplishment the alignment started in June 2018.

“We will coact internationally to abate the growing blackmail to tax administrations airish by cryptocurrencies and cybercrime and to accomplish the best of abstracts and technology,” the J5 assignment force emphasized to the accessible aftermost year.

What do you anticipate about the IRS abutting bristles nations to able Bitcoin tax evasion? Share your thoughts in the comments area below.

Images credits: Shutterstock, Pixabay, News.Bitcoin.com, Wiki Commons, and Fair Use.

How could our Bitcoin Block Explorer tool advice you? Use the accessible Bitcoin abode chase bar to clue bottomward affairs on both the BCH and BTC blockchain and, for alike added industry insights, appointment our all-embracing Bitcoin Charts.