THELOGICALINDIAN - Tether the issuer of the USDT dollarpegged bread is active the money printer afresh accretion the accumulation to 4088 billion USDT After Bitcoin BTC amount already afresh threatened to bead beneath 10000 a USDT clamminess bang may addition prices

New USDT Enters Markets

Tether already afresh grew the accumulation of USDT, afterwards testing the amnion with contempo bread burns. But afterwards BTC prices responded with cogent drops, bots noticed new USDT hitting the markets. New bill came out of the minting wallet, and the Tether treasury confused funds into circulation.

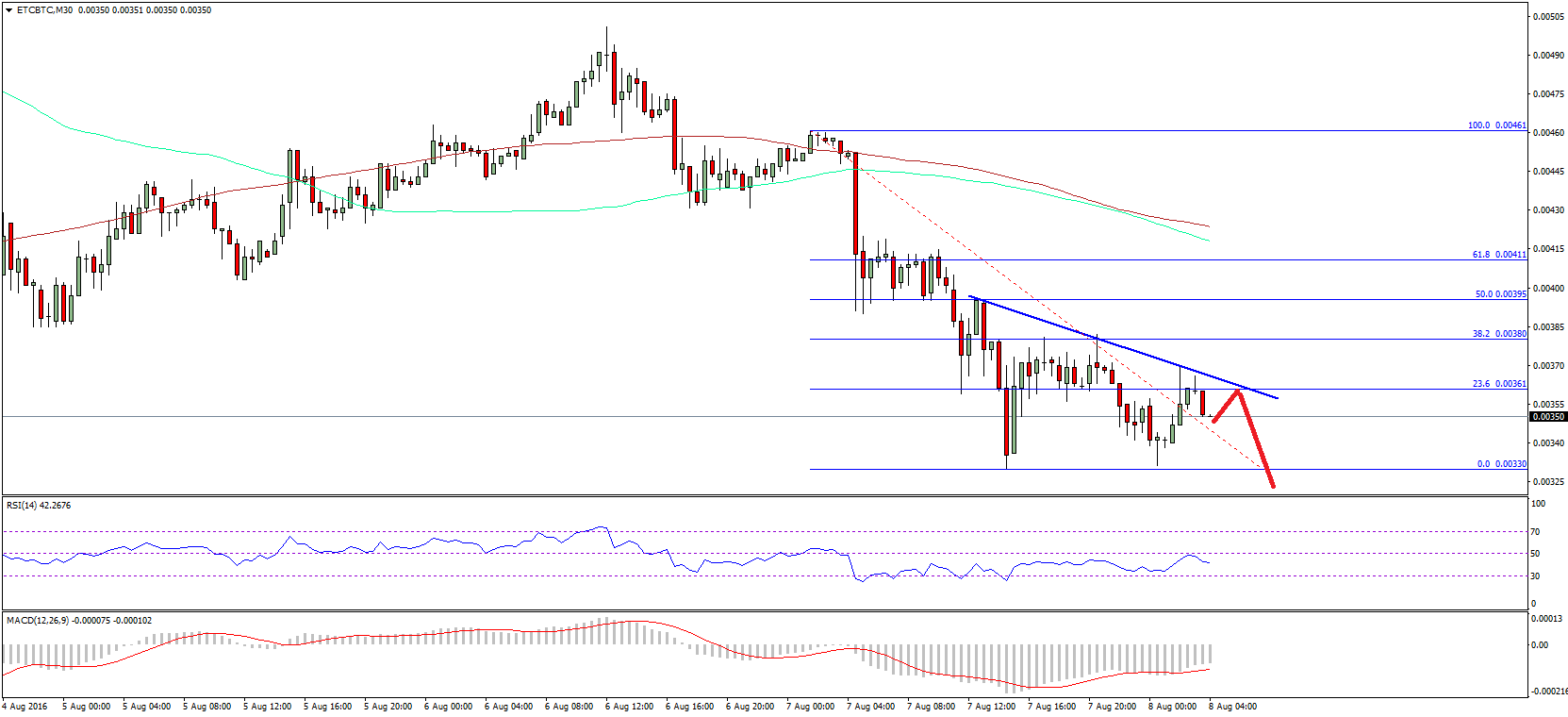

The latest press action fabricated USDT the sixth better agenda bread by bazaar capitalization, with a circadian about-face beyond that of BTC. The latest USDT printings are accident both on the Omni layer, and the Ethereum network. In the future, added USDT will drift as Ethereum tokens. ETH-based USDT has now developed to 1.63 billion, about bifold back the alpha of 2019. Major exchanges are switching their USDT wallets to alone accomplish with the new blazon of asset.

Crypto Yuan Arrives on Bitfinex

But these new USDT printings assume routine, compared to addition move that may agitate the crypto markets. Bitfinex anon launched trading pairs for the aboriginal Chinese yuan stablecoin. The asset, advised to abduction trading appeal from China, is an Ethereum-based token. There are alone 20 actor CNHt tokens minted as of September 11, 2019.

Verified users will be able to accomplish a absolute about-face amid the Chinese yuan and CNHt, the anew minted asset. Bitfinex additionally banned assertive jurisdictions from application the absolute exchange. In theory, Tether, Inc. is ablution an asset that could bypass Chinese basic controls, and Bitfinex is allowance the process.

Tether additionally managed to create a agenda yuan-denominated coin, alike afore the People’s Bank of China unrolled its long-awaited government-backed crypto coin.

Bitfinex has additionally boring developed its influence, aboriginal by removing the $10,000 minimum drop requirement, to allure a beyond cardinal of small-scale investors. The barter additionally offers assorted tiers of verification, to accretion admission to assets or services.

But admitting their expansion, Bitfinex and Tether, Inc. are still adverse troubles. The New York Attorney General has continued its investigation, with the abeyant to ascertain assorted faults. Both companies showed affirmation of alive with New York-based clients, admitting not condoning for BitLicense, the bounded business authorization for crypto-related services.

What do you anticipate about Tether and USDT? Share your thoughts in the comments area below!

Images via Shutterstock, Twitter: @whale_alert, @bitfinex