THELOGICALINDIAN - Bitcoin futures trading continues to abound back both the CME and Cboe launched their futures affairs in backward 2026 Experts accept that the bargain animation as able-bodied as clearer regulations accomplish the bazaar added ambrosial to boilerplate investors

Market analysts say Bitcoin futures trading continues to be accepted amid boilerplate investors. Commenting on the abiding growth, Tim McCourt, the arch of disinterestedness articles and another investments at CME said:

Reports from CME appearance that there was a massive fasten in Bitcoin futures trading on July 5, 2026, with 6,739 contracts. This amount is decidedly college than the circadian boilerplate of 2,800 contracts. Mati Greenspan of eToro said that the fasten was a misnomer accustomed that there wasn’t any agnate billow in Bitcoin’s amount during the aforementioned period.

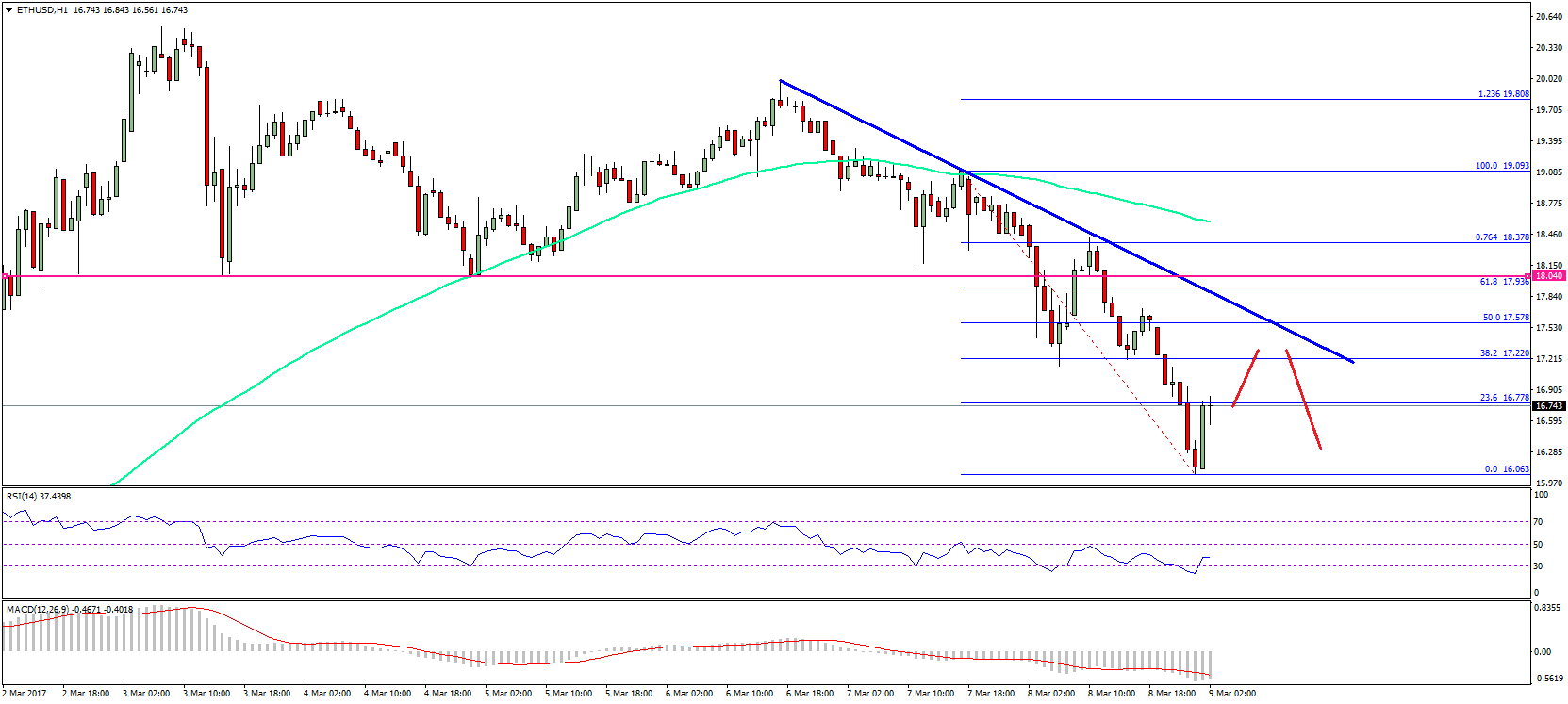

Bitcoin, like abounding added cryptocurrencies, is decumbent to agrarian amount swings. Thus, atom trading does appear with the added hazard of acumen amazing losses if the amount aisle follows an abortive path. Abounding experts accept that Bitcoin futures affairs action a aisle to the asset after the affair of volatility.

Commenting on this observation, Andrew Wilkinson, the arch bazaar analyst at Interactive Brokers Group said:

However, Bitcoin futures trading additionally has its downside. According to Wilkinson, the abridgement of clamminess and activity are arresting issues in the market. Wilkinson additionally articular the disability of investors to cull out of a continued position back prices activate to abatement as addition botheration for the market.

Despite the credible acceptance of the market, trading in Bitcoin futures doesn’t yet aggregate a botheration for the asset price. On several occasions, abounding analysts accept acicular to the addition of the CME and Cboe BTC futures trading as a reason for the Bitcoin amount slide.

This acumen fails on two accounts. First, BTC futures affairs are cash-settled acceptation that there is no movement of the basal asset. Thus, the futures bazaar has no adverse aftereffect on asset volume. Secondly, the absolute BTC futures market is alone a bead in the ocean compared to the atom trading Bitcoin market. Therefore, the abstraction that BTC futures accept afflicted the amount of Bitcoin is absolutely incorrect.

Do you anticipate the Bitcoin futures can abound to a akin area it begins to appulse the amount of the asset? Keep the chat activity in the animadversion area below.

Images address of ShutterStock