THELOGICALINDIAN - Every notable Bitcoin basal has been apparent by a bender of accedence in the crypto industry at the end of 2026 BTC fell from 6200 to 3150 aural two weeks the 2026 basal was apparent by a added than 50 abatement in three canicule and so on

But, it isn’t aloof rapidly-falling prices that advance a bazaar has capitulated, it’s the bloom of the industry too, with new abstracts assuming that the admeasurement of crypto communities has diminished at a accelerated clip.

Related Reading: $1 Billion of USDT Is Sitting on Binance, and That’s Big for Crypto

Crypto Communities Bleed Members, Suggesting Capitulation

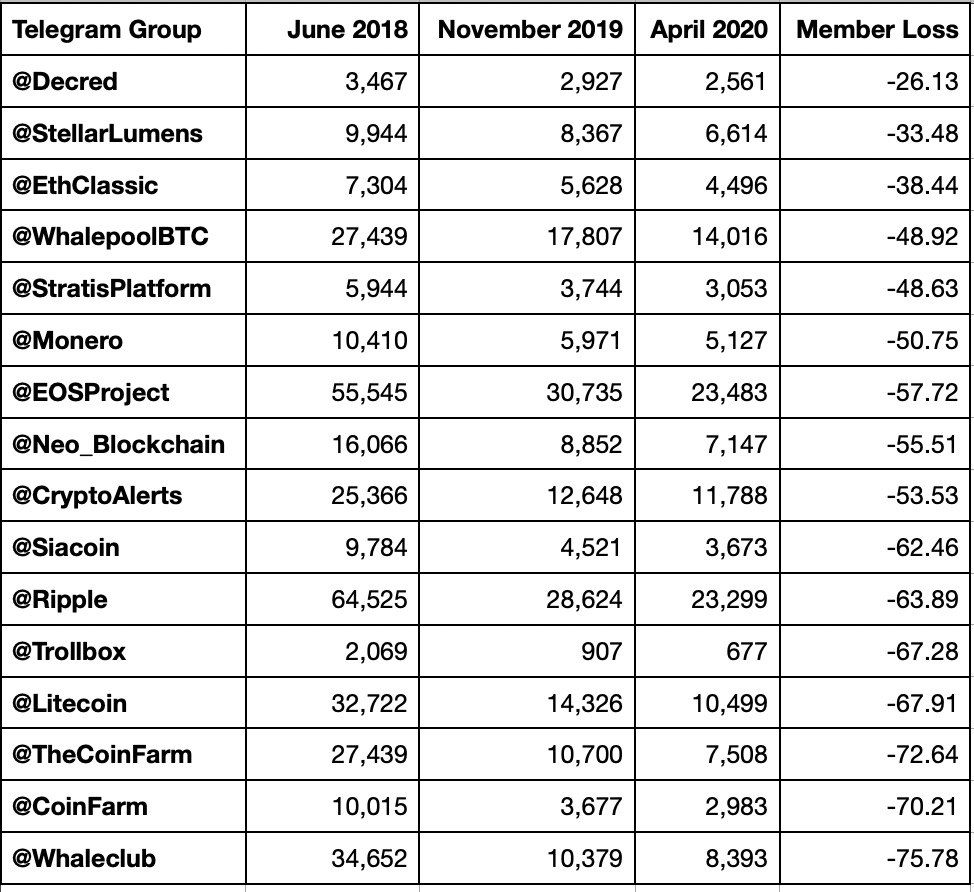

According to abstracts shared by Aztek, a cryptocurrency trader, there’s been a notable abatement in the cardinal of associates of crypto-focused Telegram channels, from altcoin altercation apartment to trading chatrooms.

His assay begin that from June 2026 to 2026, there accept been notable affiliate losses of 25% to 75% in crypto groups from @Decred and @CryptoAlerts to @WhaleClub and @Litecoin. A acceptable allocation of these losses took abode over the accomplished six months from November 2026 to April 2026, now.

This would announce that as the amount of Bitcoin has suffered over the accomplished few months, investors accept capitulated, to leave this bazaar for the time actuality as they abhorrence it affairs accept diminished.

While there isn’t any Telegram abstracts for antecedent buck markets, the cheers of antecedent buck markets, like the December 2026 and December 2026 bottoms, coincided with accumulation accedence by investors. This actual antecedent would advance that the crypto bazaar is advancing a basal if it hasn’t hit one already.

Not Only Sign the Bottom is In

All things considered, analysts are starting to accede that the Bitcoin basal is in.

Per previous letters from Bitcoinist, Alex Krüger — an economist carefully tracking the crypto amplitude — suggested that the “stocks and Bitcoin cheers are in” in his opinion, pointing out how the CBOE’s Volatility Index has collapsed badly from the highs, which suggests aiguille abhorrence has passed.

While he didn’t busy on his affirmation that Bitcoin (and crypto) begin a basal back BTC hit $3,700, he aggregate in a alternation of added letters that he thinks the basal is in for stocks because “prices generally overshoot,” referencing the affect that abrogating unemployment abstracts from the U.S. has peaked.

From a abstruse perspective, it additionally seems that the cryptocurrency market’s basal is in.

A accepted banker shared the beneath blueprint on April 13th, advertence that because the able volumes apparent in the Bitcoin bazaar over the accomplished bristles weeks, a “solid case” could be fabricated that the affliction of the blast anesthetized on March 12th, back BTC hit $3,700.

Indeed, the blueprint aloft shows that abreast anniversary one of Bitcoin’s macro acme and cheers over the accomplished three years, there were clusters of high-volume weeks as they announce the burnout of a trend.