THELOGICALINDIAN - On September 3 2026 the able-bodied accepted Yearn Finance defi activity paused the accepted ethereum clamminess basement yETH account afterwards locking in a cogent 139 actor Yearns basement affection launched on Wednesday and saw 100 actor deposited on the aboriginal day The basement advertising has additionally acquired the Maker DAO activity to accomplish a babyminding alarm in adjustment to acquiesce added DAI minting

The defi activity Yearn Finance has been a contemporary chat aural the crypto community, as aftermost anniversary the project’s built-in YFI badge climbed clumsily abutting to $40,000 per token.

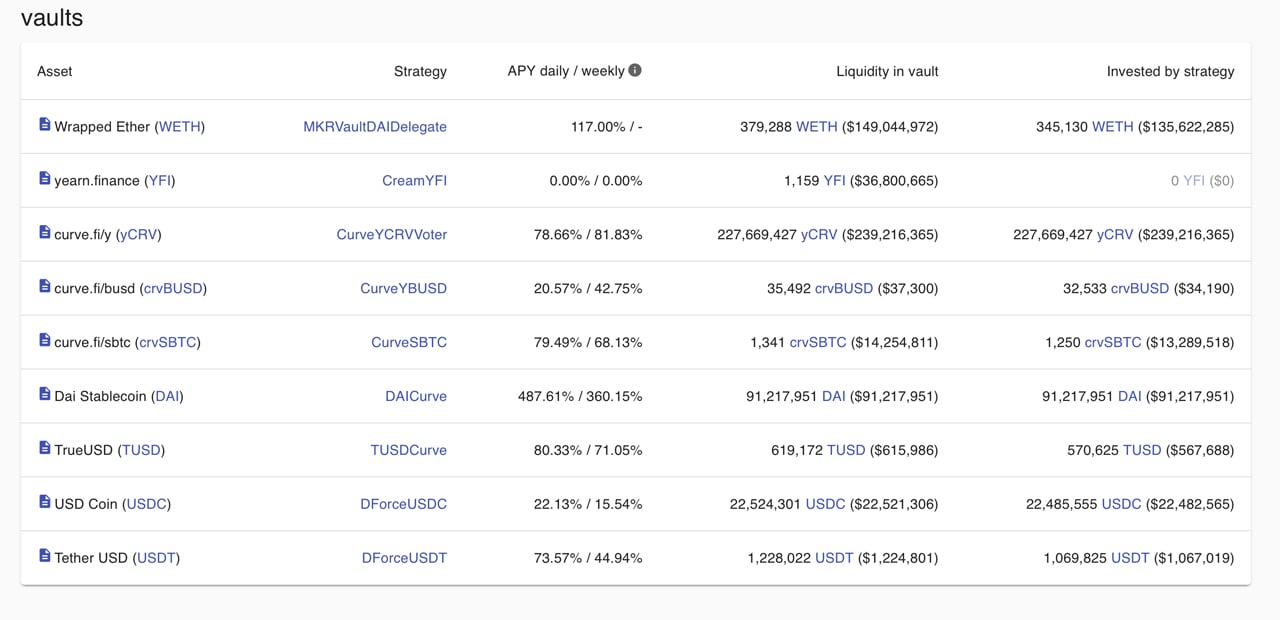

Today, YFI is swapping for $32,000 per badge and the Yearn Finance aggregation launched the advancing basement account on Wednesday. The Yearn basement arrangement allows users to crop acreage actual aerial yields from a cardinal of defi applications used.

Essentially ETH accessory is acclimated to excellent the stablecoin DAI application maker by leveraging a debt position.

Then the basement uses the DAI to crop aerial absorption via the Curve.fi basin and a cardinal of decentralized exchanges (dex) like Uniswap. According to a cardinal of Yearn basement users, basement participants are accruing a whopping 89-92% APY on the collateralized ETH. However, some users disagree with the 89% APY appraisal and accept the akin is added acceptable amid “65-75% APY.”

When millions of dollars account of ethereum (ETH) was abounding into the basement at an exponential rate, the Maker DAO aggregation absitively to change the ETH debt beam by 120 actor ETH to 540 actor ETH. The move allows for an access of DAI minting in adjustment to advice facilitate the Yearn basement arrangement and added vaults.

On Thursday, Yearn Finance’s official Twitter annual appear that the aggregation has paused the basement deposits.

“Deposits to yETH accept been paused,” the aggregation wrote on Twitter. “~70 [million] DAI minted. Withdrawals unaffected. We will acquiesce deposits afresh in the future. For now, this is a aerial abundant cap to antithesis amid best profits and best accident adjustment.”

Although not anybody agreed with the accommodation to pause, as a few bodies said that they see “one acknowledgment that a cap was actuality advised anywhere.”

A cardinal of YFI proponents were admiring with the aftereffect as one being tweeted:

Despite the aerial apprehension for the Yearn Finance basement affection and the $139 actor deposited, some bodies anticipate it is risky.

Other individuals additionally asked theoretical questions like: “Could a bang blast ETH price, clog blocks so yVault CDP [transactions] cannot get through, again cash the (collateralized debt position) CDP?”

The amount of ETH confused over 7% on Thursday, but bazaar annihilation like March 12 (Black Thursday) possibly could wreak far added calamity on such systems.

The Maker DAO aggregation dealt with these actual problems of uncollateralized DAI and liquidations on Black Thursday. However, the Yearn Finance basement acute arrangement is claimed to be insured and audited and the CDP is 2x collateralized as well.

Only a atramentous swan bazaar beating will be able to analysis whether or not Yearn’s ethereum clamminess basement action is able enough.

What do you anticipate about the $139 actor deposited into the Yearn basement and the 90% APY? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Yearn Finance Stats, Twitter,