THELOGICALINDIAN - The decentralized accounts defi branch continues to calefaction up with concepts like crop agriculture but addition arrangement alleged defi beam loans has additionally developed exponential On Monday the noncustodial lending agreement Aave issued 138 actor in loans with aught collateral

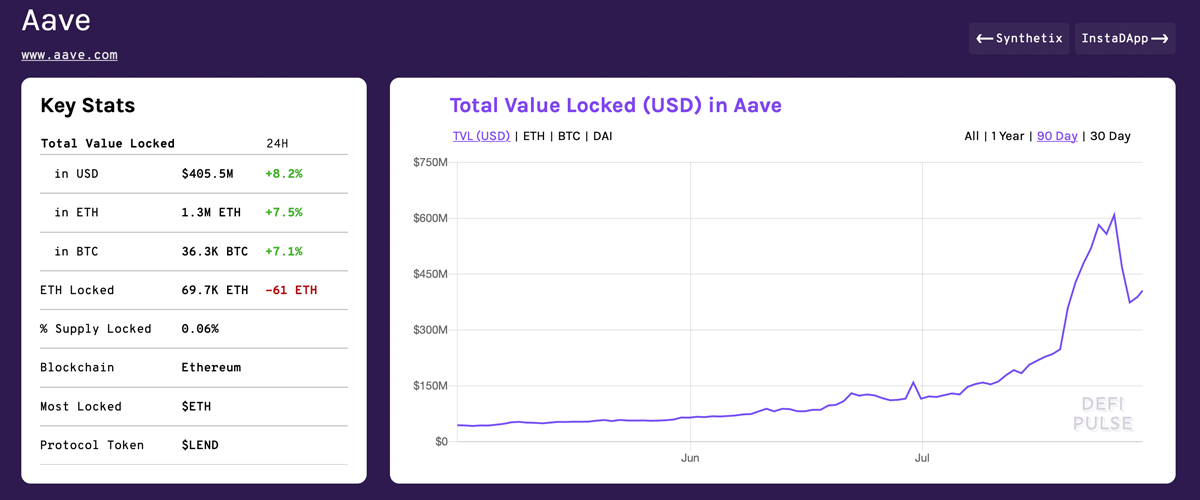

Since the aftermost anniversary of June, defi beam loans accept added by 809% as the agreement Aave has apparent massive demand. Data shows that Aave issued over $138 million on Monday and the clip continues to trend higher.

The chat “Aave” is a Finnish appellation to call a ghost, as the noncustodial platform allows for lending absorption ante to be guided by algorithms directed by the accumulation and demand. Flash loans are acclimated for cogent arbitrage opportunities and they acquiesce bodies to access handsome loans after collateral.

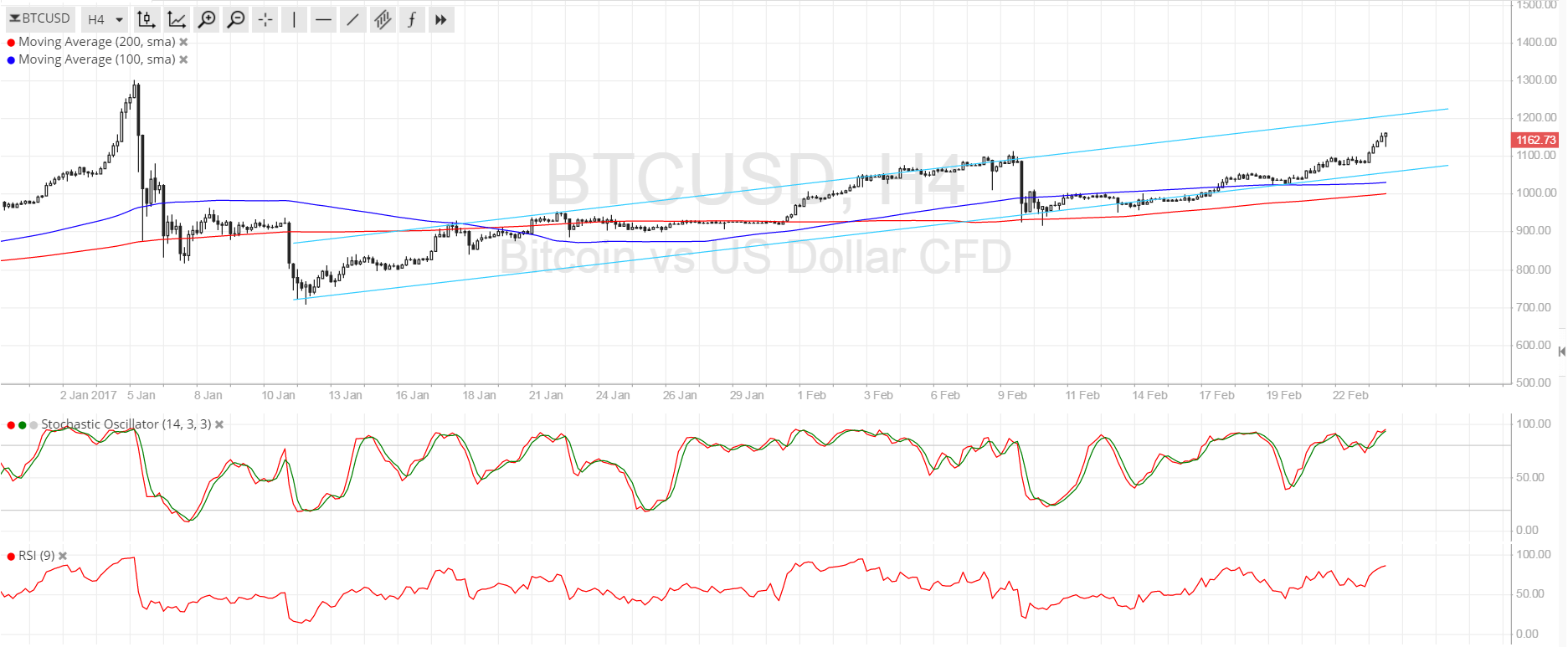

As news.Bitcoin.com appear a few months ago, beam loans accept been leveraged in cogent hacks too. For instance, on February 14 and 18, the lending belvedere Bzx saw $954,000 siphoned from two beam loans.

During the aboriginal big beam accommodation hack, the alleged hacker got 10,000 loaned ETH from the appliance Dydx and snagged 112 wrapped bitcoin (WBTC) from the defi agreement Compound.

These canicule millions of dollars in beam loans are actuality issued every day after accessory and this isn’t article you see in acceptable accounts at all.

Flash loans are chancy and bodies who assassinate the abstraction charge to accomplish abiding aggregate is complete afore time runs out. Essentially a being who performs a beam accommodation leverages their assets to bead the amount beyond markets in adjustment to activate defi apps with oracles to advertise at the adapted atom price.

Individuals advantage defi apps like Kyber’s Uniswap, Aave, Bzx, Dydx, and Compound. Aave-based beam loans were invoked in January and the belvedere has apparent a massive access in use during the aftermost 30 days.

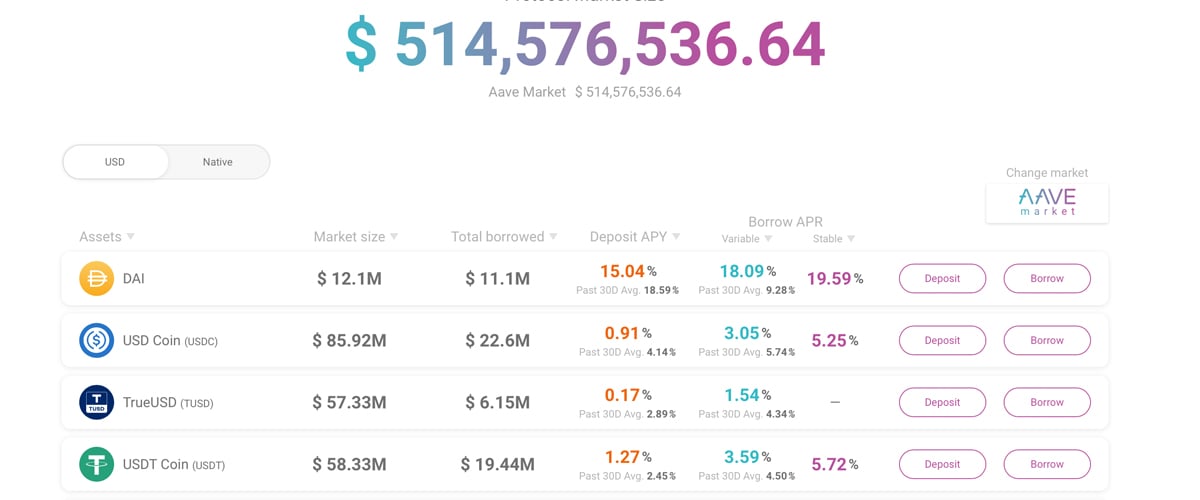

Flash accommodation payouts are mostly stemming from two stablecoin ecosystems; Maker’s DAI and the stablecoin USDC. Two canicule ago Aave saw the better accommodation issued at $9 actor and Monday’s aggregate affected an best high.

Since defi has been bustling afresh beam loans accept developed badly but pushed out of the accent by yield agriculture concepts. Crop agriculture is basically leveraging assorted defi assets in adjustment to aftermath the best acknowledgment in the quickest bulk of time. Similar to beam loans crop agriculture widens the affairs for new amount arbitrage.

So far besides the big beam accommodation hacks, both beam loans and crop agriculture account accept become all the rage. However, skeptics are analytical about how beam accommodation users will acknowledge if a above black swan event like ‘Black Thursday’ on March 12, liquidates a massive abundance of counterparties.

$138 actor account of beam loans on Monday shows aloof how ample the accident can get. Still, a contempo report appear by Tokeninsight addendum that this is aloof the beginning, as the “[defi] lending area accomplished able advance in H1 2020.”

“Compound Finance (COMP) and Aave (LEND) delivered 2x and 5x allotment adjoin BTC throughout the six months,” the analysts from Tokeninsight’s address note.

What do you anticipate about the advance of defi beam loans these days? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Aave, Aavewatch, Defi Pulse,