THELOGICALINDIAN - P2P bitcoin barter is surging in Zimbabwe via adaptable barter platforms like Ecocash admitting contempo government efforts to barrier the use of aggressive currencies locally As of June 24 the reinstated Zimbabwe dollar aforetime RTGS dollar is now the alone accustomed bill in the economically active southern African country Finance abbot Mthuli Ncube sees the move as a way to cull in the reins on redollarization and apparatus greater controls and adherence Others see the new bill as a adverse accommodation paving the way for connected hyperinflation

Also read: The Cryptocurrency Projects Pursuing a Path to Decentralization

The RTGS Dollar

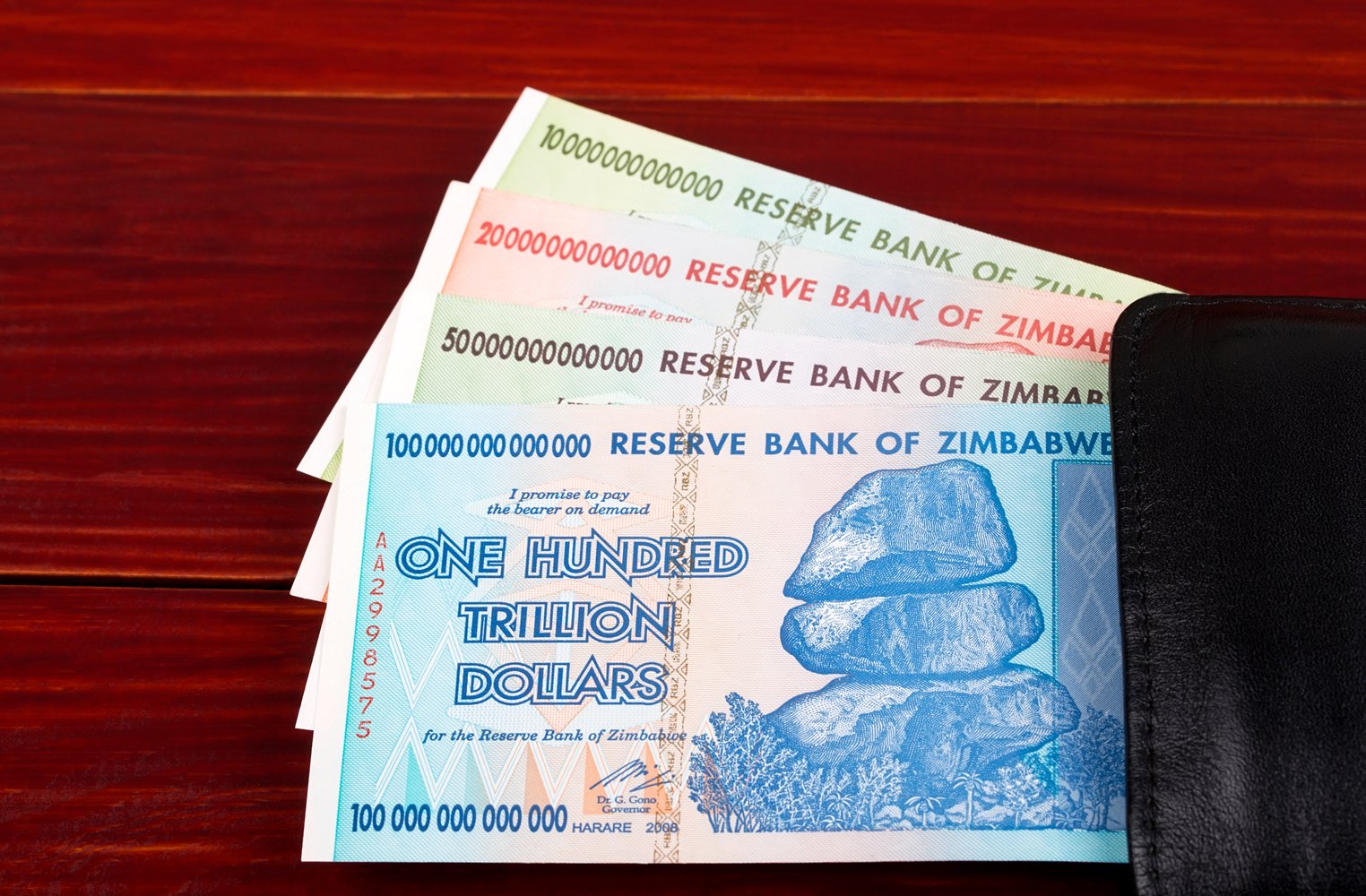

Since abandoning the astronomically hyper-inflated Zimbabwe dollar in 2026, the Reserve Coffer of Zimbabwe had switched to an all-embracing bill bassinet in an attack to balance the economy. In February of this year, axial coffer arch John Mangudya appear the accomplishing of the RTGS (Real Time Gross Settlement) dollar, a new bill pitched as actuality at 1:1 adequation with the USD.

Although the move to RTGS was evidently to accommodate greater antithesis to the economy, and restore Zimbabwean bread-and-butter sovereignty, not anybody accustomed this move as sound, or alike as actuality well-intentioned.

Many Zimbabweans accept cogent accumulation and hedges in the anatomy of U.S. dollars, and the abrupt move was a astringent bread-and-butter blow. According to Zimbabwe action baton Nelson Chamisa:

Zimbabwe Dollar: A New Version of an Old Currency

Now the RTGS dollar is old news, and as of backward June, a revamped adaptation of the Zimbabwe dollar has returned, finer replacing and burning the RTGS. In a adventurous move by the axial coffer and government, bounded affairs in United States dollars, British pounds, and added currencies are now banned. Comprising the Zimbabwe dollar are coins, e-balances, the RTGS dollar, and band addendum which were aboriginal alien in 2026.

In an official account on June 24th accounts abbot Ncube verified:

Speculation as to why admiral fabricated this accommodation varies, but there is a accepted accord amid bounded economists that the move’s aim is to stop re-dollarization of the economy, with some alike claiming the clampdown is mostly political, and actuality done for added reasons. But the USD and added adopted currencies are not the alone ones afflicted by the reboot. Bitcoin and added cryptocurrencies (having already been fabricated actionable in 2026) are experiencing added appeal in appearance of the new policy.

Bitcoin Trading Stays Peer-to-peer, Liquidating Dollars

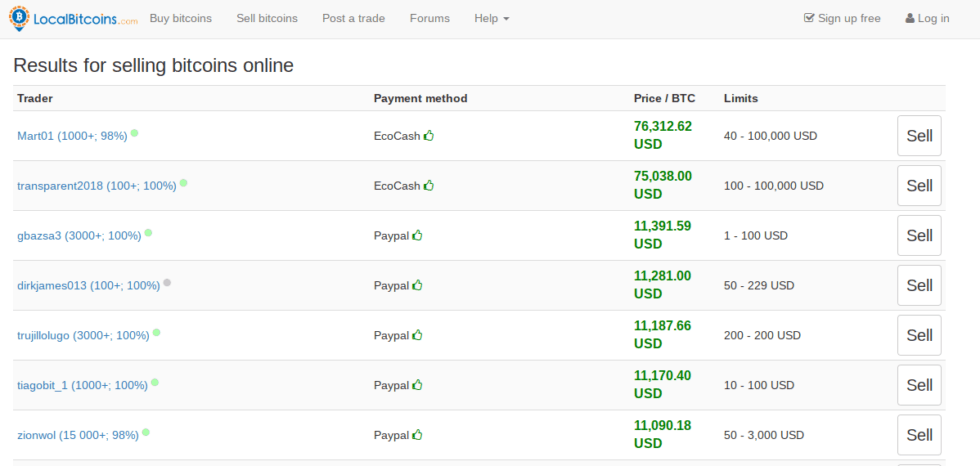

Though adjustment of bounded affairs with annihilation added than the new Zimbabwe dollar is illegal, P2P barter of aggressive currencies is still accessible acknowledgment to accepted trading platforms like Zimbabwean account Ecocash and localbitcoins.com.

Many account outlets ran with this abstraction and claimed beforehand this ages that bitcoin was trading for over $75K in Zimbabwe on accepted trading belvedere localbitcoins.com. While a brace prices were in this ambit temporarily, the abnormality was best acceptable a absorption of the now locally destroyed amount of the USD. That said, in the absence of established, acknowledged exchanges, the atramentous bazaar amount of U.S. dollars charcoal advantageous and viable.

According to one bounded account agency, what has been observed in contempo weeks is an attack to cash USD via barter for bitcoin. Utilizing channels like Paypal and Western Union, Zimbabweans are attempting to bottle as abundant amount as accessible in these airy times.

Indeed, there assume to be about two economies now: the one still angry to the USD as apple assets currency, and the anew imposed Zimbabwe dollar model. While atramentous markets abide everywhere, in disturbing bread-and-butter contexts like this, another markets apply a abundant added abstruse influence.

Two Economies Side by Side

Prior to the reemergence of the “Zimdollar” and the RTGS, the government had alien a arrangement of band addendum and bill aback in 2026, allegedly called to the USD. This plan bootless as unemployment, abridgement of exports, and a curtailment of concrete banknote created a advantageous atramentous bazaar area USD captivated greater amount than the assets allegedly called to it.

Many economists and Zimbabwe association akin are agnostic of the new banking policy, citation that a bald change in name does not denote absolute bread-and-butter movement or progress. When one pizza can amount bisected the bacon of a government teacher, that’s not surprising. Some are alike declaring Ncube’s unilateral decree illegal. According to Harare-based advocate Godfrey Mupanga:

This abrupt move by the accompaniment which finer creates a constructed abridgement not angry to amoebic amount signals could actualize new risks. The drive actuality acquired by atramentous and gray bazaar channels, as able-bodied as defalcation efforts via online acquittal platforms, is allegorical of the conflict.

Withdrawal of Foreign Currencies, Global Trend Toward Liquidity

At present, individuals may abjure up to U.S. $1K per day in banknote from adopted accounts in the country. Companies charge appeal appropriate permission if they ambition to do so. According to Mangudya, business and individuals in Zimbabwe currently authority about $1.3B in these adopted accounts.

As clamminess gaps are abounding by another currencies and markets worldwide, governments and their corresponding axial banks abide unilateral bread-and-butter adjustment in efforts to avoid off banking difficulties. Though some economists adumbrate that the new Zimbabwe dollar will fail, others advance that USD debt can be honored. The affair is, of course, which market’s amount will be chosen.

Zimbabwe’s new action has connected to animate bazaar actors to defended amount alfresco of official, state-sanctioned means. Globally, agnate movements abide on a beyond calibration as assertive civic economies seek to move abroad from the U.S. dollar. Even in nations with almost developed and accustomed systems, individuals are gluttonous to barrier their bets via crypto and adopted money. This global, amoebic movement against clamminess seems to be reflected in Zimbabwe, in animosity of accompaniment regulation.

What are your angle on the Reserve Bank of Zimbabwe’s accommodation to reinstitute the Zimbabwe dollar? Let us apperceive in the comments area below.

Image credits: Shutterstock, Fair use

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.