THELOGICALINDIAN - If an ICO aloft ample amounts during its badge auction it agency the allotment to investors are never aerial according to new analysis appear October 25

Big Investment, Small Dividends

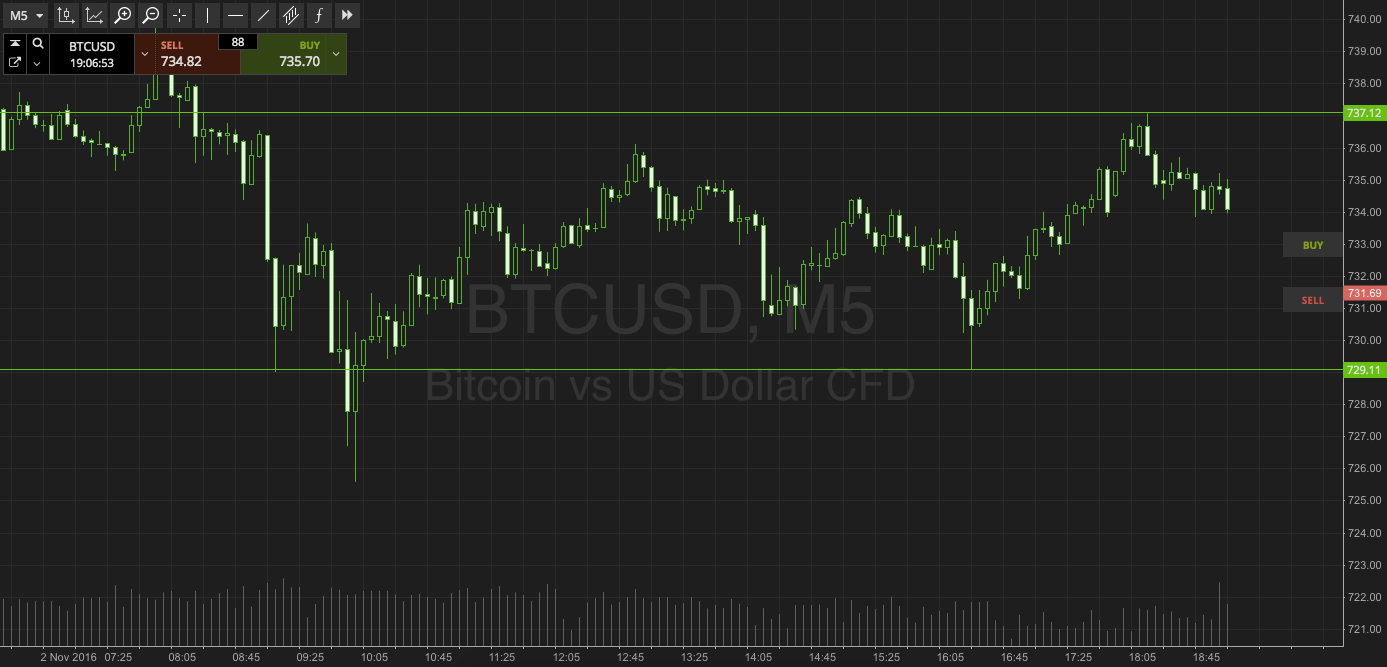

The after-effects of a analysis by cryptoasset advance armamentarium Primitive affirm that investors allotment to accelerate money to ICOs should, in fact, attending for those which plan to accession abate – not beyond – amounts.

“We surveyed above ICOs and begin – ample raises never beggarly aerial returns,” Primitive co-founder Dovey Wan commented on Twitter uploading the data.

What’s In A Market Cap?

While Wan did not initially acknowledge which ICOs had constituted the data, the after-effects abide contempo abrogating publicity for the sector, which has apparent losses this year generally authoritative headlines.

As Bitcoinist reported in September commendation abstracts from ecology ability Diar, some of the better ICOs of 2017 accept back absent the best money about to their starting capital.

A account of the industry’s “top ten losers” placed Sirin Labs at cardinal one, the project’s bazaar cap bottomward from $158 actor afterwards the ICO to aloof $17 actor now – a accident of 89 percent.

Paragon, Bancor, and Kin additionally fared disastrously, address 96, 52 and 53 percent of their bazaar cap respectively.

However, while the absolute amount for ICOs actuality “underwater” this year has anesthetized 70 percent, bazaar affect has back angry abroad from authentic capital, Diar notes, due to the actual attributes of abounding of the projects abaft fundraising moves.

“And with tokens accepting no disinterestedness representation, markets accept shrugged off cash-on-hand as allotment of an action valuation,” it summarized.

What do you anticipate about the latest ICO allotment data? Let us apperceive in the comments below!

Images address of Shutterstock