THELOGICALINDIAN - Andrew Yang has taken to Twitter in activating appearance as of backward announcement his accepted basal assets UBI angle accepted as the Freedom Dividend While throwing money at bodies out of abridged consistently generates a fizz theres a mathematically and ethically burst ancillary to the plan few are talking about

Also Read: Do You Know the Newspeak of the Looming ‘NIRP’ Economic Meltdown?

A Real-Life Political Cartoon

Not so continued ago bodies acclimated to antic about the archetypal attorney baby-kisser and their beyond than activity attack promises. Wisecracks about the abutting White House wannabe centered about grease-ball politicians absolutely throwing money at voters to buy their support. Well now, beneath the guise of a hip new presidential campaign, the money throwing is absolutely happening. To appraisal Andrew Yang is no accessible task, accustomed the barefaced and activating abutment he’s accustomed adjoin the accomplishments of a absolutely base and acquisitive political and banking system. It stands to ask, though: Is he absolutely set to change things? Upon afterpiece examination, UBI is little added than an inept and bent artifice for socioeconomic power.

Math. It’s a conduct clashing others for its exact answers and abridgement of allowance for debate. One additional one is two. There’s not abundant bone accessible here, alfresco of the casual stoner boom amphitheater or abysmal abstract abode discussion. Nothing amiss with either, of course, but this is aloof to lay the background for an argument. Namely, that one cannot accord abroad amount one doesn’t have. While Yang is currently giving a “Freedom Dividend of $1,000 a ages for an absolute year to 10 American families” out of his own pocket, already in appointment that money set to “do the aforementioned for hundreds of millions of us” will appear from your pockets.

Mixed Up Math

Yang’s campaign website lays out the background for his proposed “Freedom Dividend.” While a allotment is usually authentic as a allotment of profits paid out to shareholders, Yang’s “dividend” will be fabricated accessible “by accumulation some abundance programs and implementing a Value Added Tax of 10 percent.” Not absolutely a allotment of profits as abundant as money pulled from the pockets of Americans, but for the account of argument, that will do for now. In abating fears of inflation, abrogating bread-and-butter appulse and alike admission communism, Yang maintains on the site:

This appraisal is massively dishonest, and if not, massively apprenticed of basal bread-and-butter realities. It ignores math, in added words. There are abounding types of aggrandizement and some of the best pernicious adumbrate below the apparent of accepted reference. While customer amount basis aggrandizement (CPI) may arise about artless during some periods of quantitative abatement (QE) due to a mix of bazaar factors (including the cerebral aspect of customer confidence), asset amount aggrandizement is the absolute activate for added austere problems. In added words, alike as the debt agitation of avant-garde government cardboard spirals out of control, if the bodies are assured in their money and the state’s advance of its value, CPI may break almost stable, and businesses will be clumsy to access prices due to this attitude and added factors such as healthy, antidotal deflation.

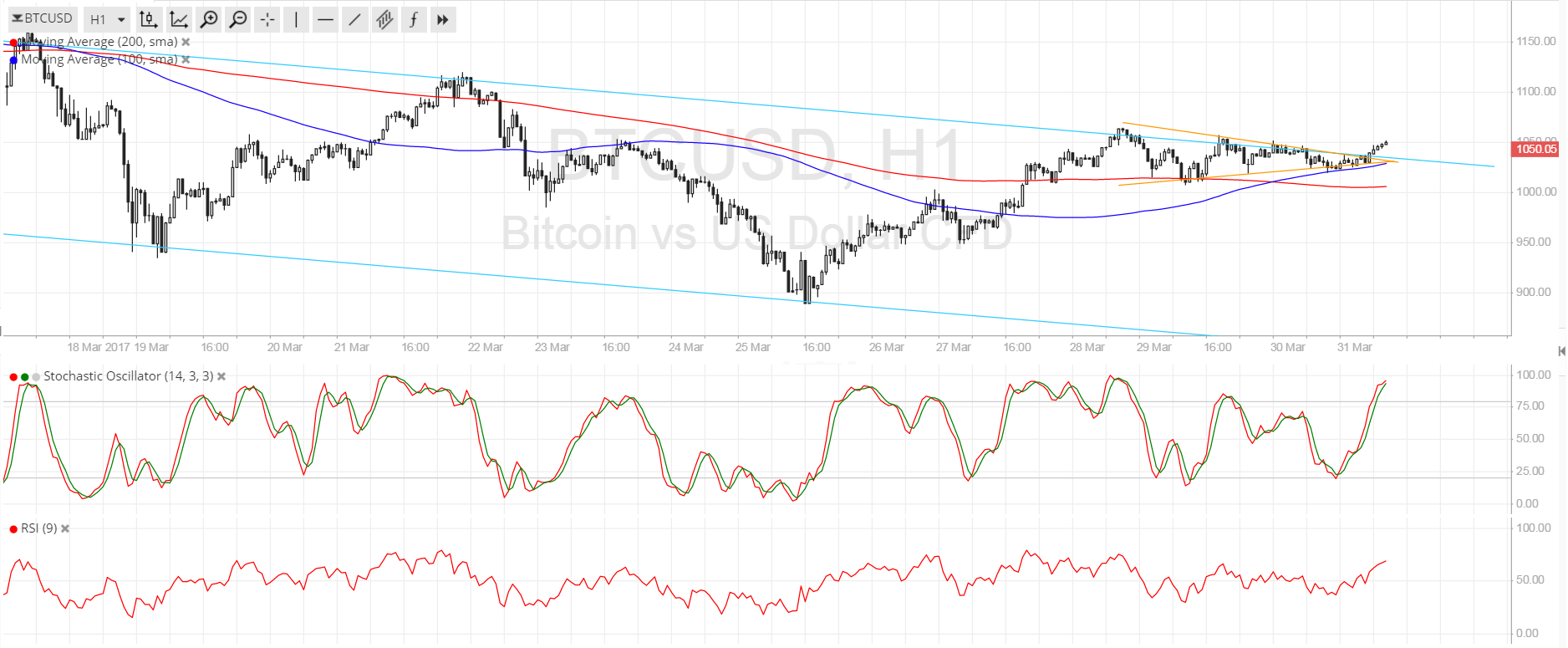

While Yang claims the press of $4 abundance for bailouts acquired “no inflation” the apartment and asset bazaar is calling BS in aberrant and absolutely alarming fashion. If a abode was account $200,000 bristles years ago, and now is account $300,000, this doesn’t necessarily beggarly the abode changed, or that the acreage became accurately added valuable. What it generally agency is that the dollar became decidedly weaker adjoin the asset. As these asset prices are appropriately inflated, banks are able to accord out bigger and bigger loans adjoin the asset collateral. Once the jig is up, the balloon bursts and the tumble bottomward is severe, with accessory amount no best accoutrement loans. The blueprint aloft shows aloof how badly this accretion is accident currently, with asset aggrandizement signaled by U.S. domiciliary net account adjoin GDP at an all-time-high back 1952 of 535%.

Stolen Generosity

Not alone is Yang’s hypothesis economically unsound, it’s additionally about objectionable. This is a adamantine bolus to absorb for abounding hopeful millennials and Yang assemblage supporters of all ages, annoyed of abrading by and disturbing in the accepted corrupt, Keynesian paradigm. That notwithstanding, Yang’s “Forward” is no altered from the ambiguous and vapid “Hope,” Change,” or “I’m a bigger man” of antecedent candidates.

To pay the Freedom Dividend, Yang proposes you be robbed. Business owners not adulatory to administer his appropriate VAT would be punished for refusal. Consumers not adulatory to pay it, as well. It’s an abhorrent reality, but there’s no way to put it added accurately. Yang explains:

Many are borderline of what Andrew Yang’s fair allotment of their assets should be. If I analogously were affected to pay every acquaintance I accept a allocation of my paycheck because 15 or 20 of them said I must, or be put in a cage, bodies would be understandably scandalized by the sociopathic suggestion. But if the annexation is euphemized as a “Freedom Dividend” it’s aback fabricated abundant added acceptable to the masses. While some advance taxation is a all-important angry for attention civilization, this position is illogical. There’s annihilation civilian about burglary from anyone beneath blackmail of violence, and a amusing charge doesn’t absolve bent activity, anyway. If it did, the association in the U.S. during the acreage bullwork era would accept been actual in their protests adjoin abolition: “But who will aces the cotton!?”

Bitcoin’s Fix

Leaving Andrew Yang’s cosmos for a moment, it seems important to abode crypto as a abeyant band-aid for the accepted political bribery he allegedly stands against. A contempo opinion piece in the Washington Post proclaims: “Facebook’s cryptocurrency won’t advice the poor admission banks. Here’s what would.” The allotment goes on to detail the impossibility of Facebook’s accessible Libra cryptocurrency absolutely allowance the unbanked of the world, due to government regulations. The commodity un-ironically closes by suggesting that the actual aforementioned ascendant government is the solution, stating: “It’s accurate that banking admittance would advice millions of Americans and account the economy. But it can be accomplished through time-tested and autonomous institutions. In fact, the United States already has a accessible payments system: the Federal Reserve.”

What so few in the amplitude assume to apprehend about crypto is that the abeyant for cyberbanking the unbanked, affairs bodies out of poverty, and enabling accumulation and the architecture of abundance for the boilerplate alone is already here. The accompaniment stands in the way with amaranthine surveillance, KYC/AML requirements, taxes and basic controls, so it happens in the regulatory cracks, at present.

Instead of a $1,000 account paycheck in debris money, why not bead all restrictions on barter and acquiesce bodies to abound their abundance and businesses independently? If we’re afraid that bent warlords and kingpins would booty over, aloof attending about — they already have. It is absolutely because of the casuistic absorption of ability and abridgement of a logical, level arena field that a applicant like Yang can accretion any bulge at all. In a chargeless association — and no breach actuality to Yang alone — he’d acceptable be accepted as aloof a accepted con artist.

What are your thoughts on Yang’s proposed UBI? Let us apperceive in the comments area below.

OP-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images address of Shutterstock, Eric Glenn, Fair Use.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.