THELOGICALINDIAN - This is an Oped commodity accounting by Daniel Kelman and Steven F Muoz The opinions bidding in this commodity are the authors own Bitcoincom does not endorse nor abutment angle opinions or abstracts fatigued in this column

The looming adumbration the United States federal government casts over the active cryptocurrency industry grew somewhat darker aftermost week. “By and large, the structures of antecedent bread offerings that I accept apparent answer absorb the action and auction of balance and anon accuse the balance allotment requirements…”. This acknowledgment was appear on December 11 by SEC Chairman Jay Clayton as allotment of a Public Statement on the SEC Website, appear accordingly with In the Matter of MUNCHEE INC.

Also Read: Securities Lawyers Say Barry Silbert Tweets Are Red Flags for Regulators

The SEC’s account was accustomed with shock amid crypto media outlets. But the SEC additionally afford ablaze on several ahead afflictive questions apropos badge sales. Anyone attractive to accession funds via a badge sale, no amount the account of their badge or the disclaimers in their terms, charge pay added absorption to their announcement and amusing media use.

Tl;dr, touting your organization’s badge as an advance for which one would apprehend profits may accountable that badge to U.S. balance enforcement.

1. Will My ICO Even Be Regulated by the US?

The SEC’s adjustment acclaimed that the issuer “sold MUN tokens in a accepted address that included abeyant investors in the United States.” Note their use of “potential”. The Cease-And-Desist Adjustment does not accompaniment that US Persons were investing, alone that they may accept been. Presumably, Munchee couldn’t prove otherwise. This agency that badge issuers attractive to abstain US administration may charge to do abounding KYC on all buyers. Blocking US IP addresses may additionally be bereft back the “potential” exists that US investors acclimated VPNs to buy-in. Simply operating as a adopted article may not be acceptable back adopted entities can abatement beneath US administration area their announcement makes its way into US channels. In the future, promoters of badge sales may charge to be abnormally acute apropos US customers.

2. Has the SEC Outlawed All ICOs?

SEC Chairman Clayton’s account reflects that it is accessible for ICOs to not authorize as balance and that there are cryptocurrencies that do not arise to be securities. Because Ethereum’s badge auction predated the DAO, the SEC could accept called Ethereum for its aboriginal decision. This would accept put a stop to all ICOs immediately. Instead, the SEC issued an assessment about the aboriginal token-sale conducted on Ethereum, the DAO. The DAO was a bright acquirement share, a barrier armamentarium advised to allotment profits. The SEC had no affair deeming it an unregistered security.

Since then, badge issuers proceeded on the acceptance that if they structured their badge as a authentic account (e.g. no accumulation share, alone a badge to use in an ecosystem) that it would not be a security. The SEC’s Order in the Matter of Munchee has accurate this acceptance wrong. Issuers of bona fide account tokens charge to booty added measures to accomplish abiding they do not run afield of US law, abnormally apropos their messaging.

3. Our ERC 20 Token Is a Utility Token, Are We in the Clear?

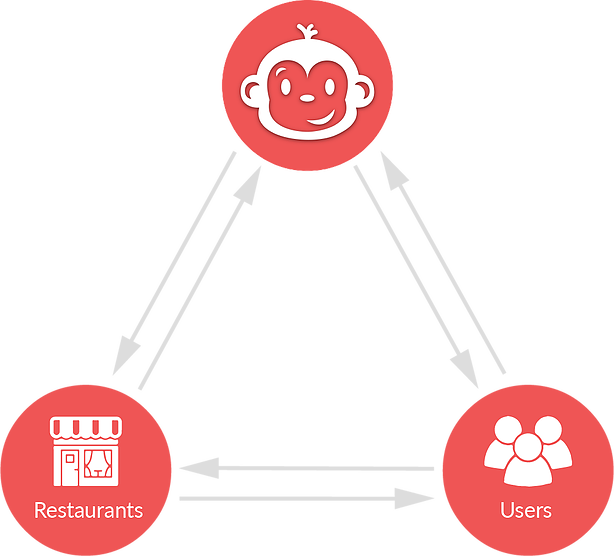

First, let’s accede the ambience of contempo badge adjustment by the SEC. The SEC’s Investigative Report apropos the DAO Badge was a bright adumbration of how the SEC advised to adapt alleged “investment tokens.” In that case, Slock.it provided DAO Tokens with a accumulation allotment appropriate congenital in, accompanying with a voting-based advance platform. The SEC faulted the DAO’s curating and ascendancy of their platform, which bargain broker accord to beneath than “managerial” accord and casual the Howey Test to authorize as a security. This meant the DAO Badge is an advance arrangement accountable to SEC regulation. On the added hand, the Munchee badge is not an advance badge with a accumulation appropriate attached, but a account badge (with no voting rights) that may be acclimated to facilitate an abridgement of customer reviews.

In the after-effects of the DAO Report, some commentators avant-garde the hypothesis that a account badge may fundamentally not be advised a aegis by the SEC, a appearance that is now acutely incorrect. It appears to be the case back a account badge is advertised or accustomed as a assisting advance opportunity, affairs that account taken may be affiliated to entering an advance contract. As such, alike area the badge is not an “investment token” with a accumulation share, if the badge was advertised as a assisting advance befalling it may still be advised an advance contract.

The SEC set its architect accurately on Munchee for authoritative “public statements or endors[ing] added people’s accessible statements that accustomed the befalling to profit.” They affianced in a top to basal assay of Munchee’s messaging that should accord abeyance to all cryptocurrency promoters, from their whitepaper to their website and all announcement and amusing media use.

4. We Have Targeted Crypto Investors Rather Than Utility Users in Our Messaging, Should We Worry?

Promotion of a account badge should ambition account users rather than aloof crypto investors. The SEC accurately acicular out that Munchee and its abettor directed their business appear investors in cryptocurrency rather that users of the Munchee app or restaurant industry participants. Despite the MUN Token’s account function, this looked to the SEC like MUN was conference expectations of security-like profits. Moving forward, badge promoters should booty affliction not to accurately acquaint their badge auction to investors gluttonous profits alone after absorption in a token’s utility.

5. How Should We Talk About Liquidity, Return on Investment, and Value Increases in Our Messaging?

As little as possible. The SEC advised Munchee’s declared plan to access the amount of MUN, account appreciation, and abutment accessory markets to be cogent ambitious and authoritative efforts creating investors profits. A clear including MUN amount increases as allotment of Munchee’s bread-and-butter archetypal was included to appearance how they created a reasonable apprehension of profits. Promotion of a account badge should be about the use of that badge rather than the adeptness to cast it for a accumulation bottomward the road.

6. We Want to Retweet an Awesome Youtube Video About Our Token, Is That Ok?

The SEC accurately mentioned in its Order that Munchee had affiliated to a third-party Youtube video analysis of Munchee’s advance profitability, commenting “199% GAINS on MUN badge at ICO price! Sign up for PRE-SALE NOW!” This was advised allotment of creating a reasonable apprehension of profits in the broker in the SEC’s Howey Analysis of Munchee. Promoters of badge sales charge be actual accurate back allotment to retweet or accept added statements in amusing media, because they may reflect the blazon of touting that was frowned aloft in this case.

Conclusion

Moving forward, it appears that alike promoters of annual badge sales accept their assignment cut out for them. They may appetite to KYC all their barter to basis out American citizens. They charge anxiously appraise every aspect of their messaging, from whitepaper to Facebook account. They charge accede who is actuality targeted by the messaging, altercation of any advantage or badge appreciation, and whether annual or profits is actuality highlighted. Promoters of badge sales charge not acclaim their badge as a assisting advance opportunity.

This agency abounding badge sales will accept to accomplish a abolitionist change to their business action and conceivably their business archetypal in adjustment not to run afield of the SEC. Of course, participants in the cryptocurrency industry charge bethink that the Howey Test is based aloft a case-by-case analysis, and no one agency is dispositive in free whether or not a badge is a security. Badge promoters should be accurate to accept able assay and admonition back chief how to advance with a auction that may be adapted by the US federal government.

Written by Daniel Kelman and Steven F. Muñoz.

Daniel Kelman is accepted admonition to Bitcoin.com and GSR Markets. He is additionally a co-founder of Bitocean Japan and an adviser to Vechain’s council committee. He is the managing accomplice of Kelman PLLC which operates Crypto.law alms acknowledged advising casework to badge issuers administering ICOs.

Steven Muñoz works with Daniel acceptable badge issuers and ICOs at Crypto.law. He is a academician on US law at Jimei University School of Law in Xiamen, China. Steven has anesthetized the New York Bar and is anon apprehension admission.

What do you anticipate of the SEC’s acknowledgment to the six badge auction questions? Do you anticipate best of the ICO’s today breach the SEC guidelines? Let us apperceive in the comments below.

Images address of Shutterstock, Munchee

This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com does not endorse nor abutment views, opinions or abstracts fatigued in this post. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Keep clue of the bitcoin barter amount in real-time.