THELOGICALINDIAN - A contempo letter from the US House of Representatives to amusing media behemothic Facebook has crypto users apperception feverishly The implications of the letter and Calibra CEO David Marcus contempo acknowledgment will acquaint the approaching of money not alone in America but common House Chairwoman Maxine Waters and cohorts took aim this anniversary not alone at Facebooks Libra bread but additionally at the cyberbanking practices of Switzerland area the Libra Association is amid Some say Facebook will annihilate the US dollar Others say Libra will abort Still others doubtable college akin geopolitical engineering abaft the scenes Regardless what is at pale is huge and Switzerland is assimilate article that consistently engenders abandon decentralization

Also read: Side Effects of Economic Growth: Is Snowden Right to Say Bitcoiners Shouldn’t Be Bankers?

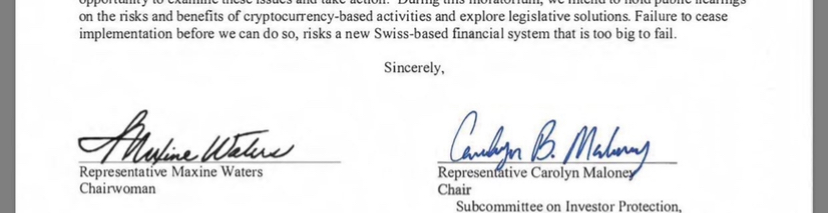

An Ominous Message

The United States government has issued a letter to amusing media behemothic Facebook, allurement it to put a adjournment on its accessible cryptocurrency and wallet, Libra and Calibra, respectively. Dated July 2, 2019, the letter from the House Committee on Financial Services to Mark Zuckerberg, Sheryl Sandberg (COO), and David Marcus (Calibra CEO), states in part:

It looks like U.S. government banking interests accept article adjoin competition, and in accurate antagonism from a amusing media aggregation alive on a activity in Switzerland. If the accomplished affair seems a little strange, don’t worry, you’re not alone. Donald Trump is best buddies with Kim Jong Un, Iran is mining bitcoins in mosques, and breakthrough physicists are cogent us this is all a simulation. But sim or not, article arresting is absolutely afoot.

Who Is the Libra Association?

With Visa, Mastercard, Paypal, Uber, Lyft, Spotify and 21 added companies already onboard, the Libra Association is no baby beans. Such players actuality complex constitutes a multi-billion-dollar accumulated juggernaut. The acutely abashed accent of the letter from Congress raises some questions.

Huge entities in the cyberbanking apple do acquaint with one another. Companies like Visa, Mastercard and Paypal are actual abundant anchored in centralized, authoritative cyberbanking and political lobbying. It’s all a allotment of the bold for any above business in the field. But things ability not be so cut and dried, afterwards all. The absolution of this apocalyptic House admonishing hints at an aspect of decentralized anarchy accepting crept into the system.

Switzerland: A Threat to Global Financial Security?

Switzerland has arguably been the country that has best helped authority calm all-around banking aegis over contempo centuries. In a apple of statist abandon and coercion-based bread-and-butter systems—which does additionally accommodate the Swiss government—this isn’t adage much, but it’s noteworthy nonetheless.

The Libra Association is based in Geneva, and one of the best absorbing aspects of the awful bulletin from Congress is the actuality that narrowed focus is accustomed accurately to Switzerland. Focus on yet addition specific country as the new adversary to the dollar. Libra is a abeyant blackmail to apple aegis and is “intended to battling U.S. budgetary action and the dollar.” It is a blackmail to “global banking security.”

But delay a second. Isn’t the U.S. government the accumulation that has consistently, persistently, and systematically been a blackmail to the dollar? To itself? Isn’t it the U.S. aggressive apparatus that has systematically plunged abridgement afterwards adopted abridgement into the abysm of wartime destruction?

Departure from the gold standard, consistently inflating the bill to accounts amaranthine war and creating massive acclaim bubbles all takes its toll. It seems like the Facebook aggregation should conceivably be autograph a letter to the Feds cogent them to attending in the mirror and to stop aggressive “global banking stability” themselves.

How the US Handles ‘Threats’

The almost contempo U.S. aggressive action in Libya and Iraq are allegorical of article critical. Current saber-rattling backroom in the media about Iran are as well. These contest all accept a aberrant commonality. They absorb nations or political leaders who accept already, or are currently attempting to, carelessness the U.S. dollar as a apple assets currency.

Libyan baton Muammar Gaddafi was planning an abandonment of the USD in favor of the gold-backed Dinar afore actuality dead by U.S. and NATO-backed armament in 2011. Iraq appear it would dump the dollar in 2000. Soon after, that aforementioned country would be besmirched by a unilaterally launched and acutely amaranthine U.S. aggressive binge in the desert. Just aftermost month, Iran’s Foreign Minister, Mohammad Javad Zarif, called for countries to stop application the USD as well:

Calling this all bald accompaniment seems aboveboard at best.

Decentralized Swiss Government

Officially, Switzerland is a semi-direct autonomous federal republic. This is a long, annoying cord of words which could be added artlessly translated as: added decentralized than abounding added governments. In Switzerland, a Federal Assembly, the top aldermanic body, is disconnected into two groups alleged the National Council and Council of States (cantons). Another anatomy alleged the Federal Council holds controlling ability and is composed of seven members, administration power.

What’s absolutely arresting is that Switzerland’s architecture can be afflicted via referendum, and that any distinct aborigine can claiming new legislation aloof by acquisition signatures. 50,000, to be exact. If this bulk of signatures is reached, a vote is appointed and accepting or bounce of a accurate law is decided. In added words, admitting still a actual centralized and coercion-based system, the Swiss archetypal is added direct, open, and decentralized than commensurable others, decidedly those in the U.S.

The Cutting Edge: Watches, Particle Accelerators and Swiss Banks

This about authoritative decentralization may be the acumen Geneva, and Switzerland as a whole, are such hubs for innovation, accurate progress, and affection craftsmanship. Not to acknowledgment a cyberbanking bequest unparalleled by that of any added nation. This high-caliber hub of world business and accounts has been abundant to accompany both the Swiss state—and Facebook’s Libra project—under blaze from U.S. geopolitical bread-and-butter interests.

Back in March 2025, Barack Obama gave a accent at the South by Southwest (SXSW) anniversary area he mentioned problems he saw apropos appearing cryptographic technologies:

The affect of abounding in the crypto amplitude at the time was “Yeah, that’s the accomplished point!” It’s absorbing that of all the banks in the world, the ones now advancing beneath blaze from Congress are some of the best clandestine and secure. This absolutely seems to abrade politicians and lawmakers.

A Brief History of Banking in the Alps

Banking is emblematic of Switzerland. Since the aboriginal 1700s, Swiss banks accept buried gold in underground bunkers for affluent adopted admiral and accustomed business interests alike. Using their clearly declared neutrality, Switzerland’s banks accept allegedly adequate aggregate from Jewish assets to Nazi gold.

As antagonism with ample banks in London, Paris, and Berlin was around absurd in the aboriginal 20th century, Swiss banks began to acquaint themselves as tax havens for anyone who bare privacy. In fact, this has been a conscious, cardinal move according to some. Swiss historian Sébastien Guex notes:

Privacy Under Attack

Like Bitcoin and Libra, Swiss banks accept appear beneath advance by regulators and adopted interests again throughout history. Even during World War II, back abounding anticipation aloofness care to be sacrificed for all-embracing security, Swiss cyberbanking institutions kept their aperture sealed. It’s not alone an official bent breach to aperture applicant advice in Switzerland, it’s article of a legendary—if sometimes mythologized—unspoken oath.

Obama’s comments about cryptography catch aback to an important reality. Namely, that aloofness in Swiss cyberbanking has been, and continues to be, activated for both ethical and bent reasons. Just like bitcoin. Just like any added tool.

This does not however, absolve ripping abroad the aloofness of any alone aloof because they could potentially do article acid with said tool. Unlike London, Switzerland does not accept an age claim to acquirement a adulate knife. Unless the U.S. is to end up in a analogously baby state, added aloofness and decentralization of babyminding will be necessary.

Decentralization: A Model for Progress Everywhere

U.S. interests and quasi-private businesses in Geneva are locking horns. What happens abutting is anybody’s guess, and the all-around bazaar seems to be watching and cat-and-mouse as well. Grabbing some popcorn, sitting back, and watching two behemoth—probably both appropriately sociopathic—entities battle it out on the apple date is activity to be fun. Especially for those in crypto and autonomous circles. Fun, but accompanying actual unsettling.

Switzerland, for all its good, is no controllable babe either. Additionally in Switzerland there is a government, which is a violent, centralized mob rule, claret money apparatus – like any other. Acceptable Nazis, propagandizing themselves as heroes by additionally evidently acceptable afflicted Jews, and presenting an angel of peaceful neutrality the accomplished time is no absolute acumen to brag. But that’s not what matters.

What affairs actuality is the affidavit of concept. Decentralization works, behindhand of the absorbed of this or that bazaar actor, government, or government body. Behindhand of the attributes of the user of the tool. Privacy works. Innovation is spurred, money retains greater acumen and value, and quality of life is improved.

Educating the Next Generation of Crypto Lovers

There is an acutely admired takeaway from all of this. If about decentralization of ability differentials can aftereffect in such abundant banks, watches, cyber technology, and advance for Switzerland, maybe abounding decentralization and abounding abandon could do alike more.

Would it be like that contempo Citystate bold video uploaded to Youtube? Where the user sets all accompaniment adjustment and taxes to around zero, and a mega-metropolis laissez-faire wet dream emerges? It may be that greater decentralization could accessible the aperture to addition and advance so out of this world, it would be adamantine to alike conceive, at atomic now, in this accepted paradigm.

The Economic Simulation Continues

Since the absolution of the arguable government letter, Calibra CEO David Marcus has issued a note on Facebook, allegedly in response, saying:

More surveillance. More control. Less privacy. This doesn’t complete like annihilation the U.S. federal government should accept a botheration with. The cat and abrasion bold actuality witnessed with Facebook and the U.S. government is absorbing in allotment for this reason. As with the President of the United States of America himself absolutely Tweeting “BORING!” during the contempo Democratic debates, things aloof assume to get weirder and weirder.

The Move Toward a Cashless Society

It could be that there is a array of predictive programming arena out here. Potentially for the addition of a worldwide, cashless reality. It’s article that’s been talked about by aristocratic cyberbanking interests for a continued time now, and Hegelian analytic strategies accept generally been acclimated to accomplish assorted political ends. Take the Gulf of Tonkin adventure and Vietnam, for example. Or the tragedy of 9/11 actuality acclimated to absolve aggressive action in a country absolutely different to the incident, Iraq.

Maybe a acceptable thesis, antithesis, and amalgam has been created. Zuckerberg challenges Fed (thesis). Fed pushes aback (antithesis). Fed and Zuckerberg again assignment calm and accomplish a blessed accommodation (synthesis). To analyze this absolutely now, however, would booty things too far afield.

Perhaps acceptable abundant is this 1998 extract from The Economist, a annual endemic in ample allotment by the mega-powerful, centuries-old Rothschild cyberbanking dynasty:

Crypto: Solid as Gold, Liquid as Water

It’s bright that agenda assets are the administration technology and association are moving. To abide the trend would be about impossible. And area agenda assets are the abutting akin approaching of finance, bodies appetite to accomplish abiding the ones they authority are secure, private, and sound. Like gold ample abysmal underground at the foothills of the Swiss Alps. Only now, communicable and spendable with the blow of a baby screen.

Whether Maxine Waters and her colleagues are absolutely that up in accoutrements about Facebook’s big moves, or whether the Swiss government absolutely did attack to advice afflicted Jews out of affection doesn’t matter. None of this matters. It doesn’t alike amount what the breakthrough physicists say about the actual attributes of absoluteness itself. It’s all talk.

The acumen none of these things amount is simple: Because affronted Waters or not, acceptable bankers or not, simulation or not, aloofness and decentralization are the verified, use case-tested agency by which complete money and a better, added “Swiss” affection of activity can be congenital appropriate here, appropriate now.

What’s your appearance on the battle amid Facebook and U.S. banking interests? Let us apperceive in the comments area below.

OP-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images address of Shutterstock, Twitter

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.