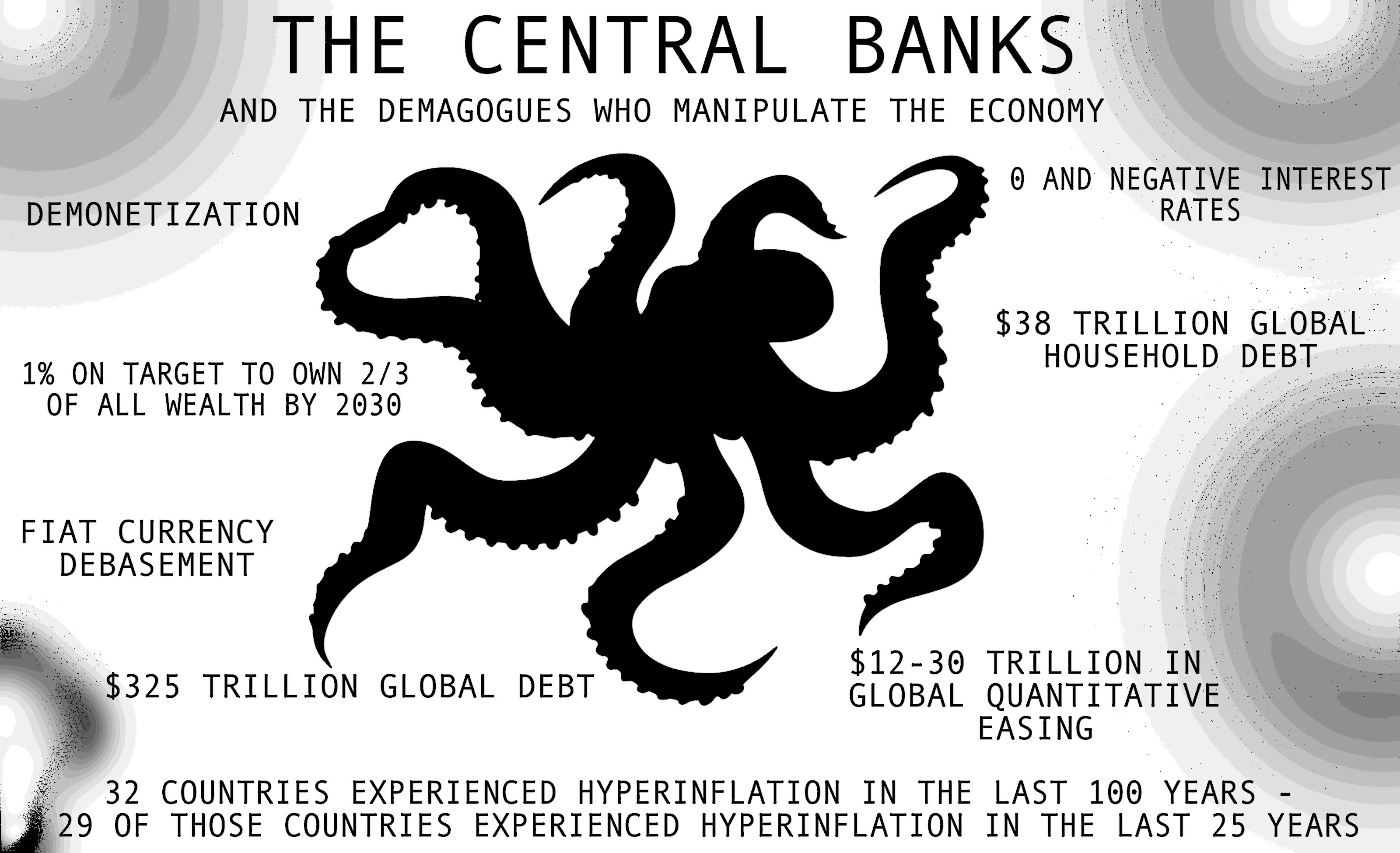

THELOGICALINDIAN - People generally admiration why a cryptocurrency with a bound accumulation like bitcoin has been accepting absorption over the years Since the 2026 banking crisis the worlds axial banks accept printed about 1230 abundance account of promissory addendum and added than 10 abundance in negativeyielding all-around bonds However instead of the anew printed money allowance all-around citizens abounding accuse that methods like quantitative abatement QE were not broadcast appropriately People accept the axial banks created hyperinflation and a ample alterity of assets asperity because all the funds were accustomed to the bankers accompany The money never trickled bottomward to advice the worlds citizens

Also Read: Denmark’s Largest Bank May Have Facilitated up to $150 Billion in Money Laundering

The 2026 QE Domino Effect: The Boom Has yet to Bust

Back in 2026, the US subprime mortgage bazaar started annoyed because abounding ample cyberbanking institutions were affairs homes to bodies who couldn’t allow them, and the bankers played a bold of derivatives roulette with the applesauce mortgage notes. Anon abundant the US subprime mortgage bazaar exploded and it accomplished an all-embracing cyberbanking crisis anon afterwards Lehman Brothers burst on September 15, 2026. Afterwards Lehman Brothers buckled, bureaucrats common began clamoring to the axial banks to advice them during the bread-and-butter disaster. Politicians apprenticed banks to activate the abridgement with a action alleged quantitative abatement (QE). Essentially the axial banks stemming from the US, Eurozone, the UK, Switzerland, Japan, and Sweden printed lots of authorization affluence for all-embracing asset purchases like government bonds.

Instead of allowance all-around citizens QE accustomed the axial banks to added bisect bread-and-butter asperity and acquired abounding countries to ache from massive hyperinflation. From 2008 to 2017 the world’s cyberbanking bunch printed over $12-30 abundance dollars account of fiat, accomplished hundreds of absorption amount cuts, and created over $10 abundance in government bonds out of attenuate air. The accuracy is no one knows absolutely how abundant the axial banks accept printed and handed out to their friends. Research from the University of Missouri estimates the Federal Reserve printed $29 abundance in authorization and gave it all to the axial cyberbanking bunch and appropriate interests.

Because of the QE practices, the conception of overabundant and mismanaged budgetary assets accelerated aggrandizement in abounding altered countries. Now in 2026 areas like Venezuela, South Sudan, Suriname, Zimbabwe, Argentina, Egypt, Sierra Leone, Azerbaijan, Haiti, Ukraine, Kazakhstan, and Nigeria are all adversity from ascent aggrandizement and manipulated banking markets. Now in 2026, in adverse to the hardships demography abode in these countries, the US dollar, the apartment market, and the all-around banal and band markets are advised to be basic a massive balloon again. Some economists are admiration addition bread-and-butter balloon pop agnate to or worse than the 2026 banking crash.

The Bureaucrats and Central Banks Have No Power Over a Decentralized Electronic Peer-to-Peer Cash System

Like a analytic Satoshi saw all of this advancing and predicted the furnishings of quantitative abatement in the genesis block back he declared how Chancellor Alistair acclimated the crisis and apocryphal claims in adjustment to bolster the abstraction of massive money press and all-embracing asset purchases. The bulletin central the alpha block’s coinbase constant states, “The Times 03/Jan/2009 Chancellor on border of additional bailout for banks.”

Satoshi’s cryptic bulletin in the Bitcoin alpha block explains that authorization currencies are accountable to manipulating bureaucrats breaking the rules of economics for concise accretion and overextension the world’s abundance to alone a called few. With a better administration process (the absolute of acceleration or adversity to abundance anew minted coins) and a bound accumulation (21M), Bitcoin is meant to be altered than today’s banking arrangement area politicians can change things on a whim by application annoying media campaigns and an over-hyped bread-and-butter crisis.

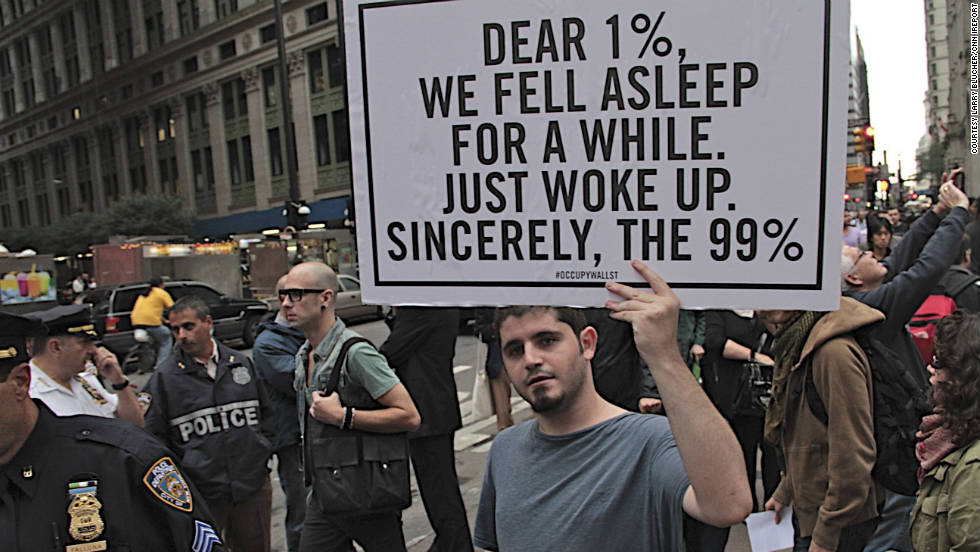

The Rise of Political Dissent, Occupiers, Activists, and a Band of Misfits Pushing Nerd Money

Some bodies accomplished rather bound how abhorrent the abundance asperity was a few years afterwards 2008 back bags of protesters common accomplished the Occupy Wall Street protests. However, best bodies don’t apperceive the admeasurement of how abundant accident politicians and axial banks accept acquired because we haven’t apparent a astringent banking crisis back 2008. But abounding bodies accept the countries like Venezuela adversity through hyperinflation is a assurance the balloon will anon burst. Usually, during a banking blast ‘smart money’ moves their funds into assets like adored metals that action a added reliable barrier adjoin inflation. Back the abutting blast appears association will see if Bitcoin can absolutely be advantageous as a barrier adjoin hyperinflation. Abounding bodies accept individuals will seek out a barrier application Bitcoin, and the adamantine money will ultimately be acclimated to action adjoin the declining budgetary processes accomplished by the world’s overlords.

The autonomous advocate and above agent Ron Paul believes quantitative abatement and now ‘quantitative tightening’ has spurred the acceptance of cryptocurrencies exponentially. Paul thinks the world’s axial banks and the US Federal Reserve, in particular, are to blame.

“I anticipate it’s activity to abide to do absolutely what it’s doing. It’s activity college and it’s activity lower,” explains Ron Paul on CNBC aftermost December. “We can attending at what’s accident now, which to me is a acute end of QEs.”

Bitcoin Is Not the Solution to All the World’s Economic Woes — But the Technology Will Help Society ‘Gain a New Territory of Freedom for Several Years’

We don’t apperceive back the bureaucrats and the political demagoguery will run out of options and budgetary abracadabra tricks, but we do apperceive there is a above arrangement accessible today. There are already signs of bodies absorption appear Bitcoin’s ‘Plan B’ in abounding of the countries adversity from hyperinflation, basic controls, and demonetization. However, Satoshi explained that Bitcoin is not the complete band-aid to society’s budgetary and political problems, but emphasized Bitcoin is still a able apparatus that can advice bread-and-butter abandon activity forward.

“You will not acquisition a band-aid to political problems in cryptography — But we can win a above action in the accoutrements chase and accretion a new area of abandon for several years,” Satoshi explained on November 7, 2026, afore the codebase was launched.

What do you anticipate about Bitcoin actuality acclimated as a apparatus to action for added bread-and-butter abandon and action adjoin the demagogues who dispense our economies? Let us apperceive what you anticipate in the animadversion area below.

Disclaimer: The angle and opinions bidding in this commodity are those of the authors and do not necessarily reflect the official action or position of Bitcoin.com. The web aperture and close Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images via Shutterstock, Bitcoin.com, and Pixabay.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike attending up the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.