THELOGICALINDIAN - The afterward assessment allotment on tokenassecuritieswas accounting by Benjamin Pirus a crypto banker who haswritten abounding accessories for altered ICOs crypto account outlets and clients

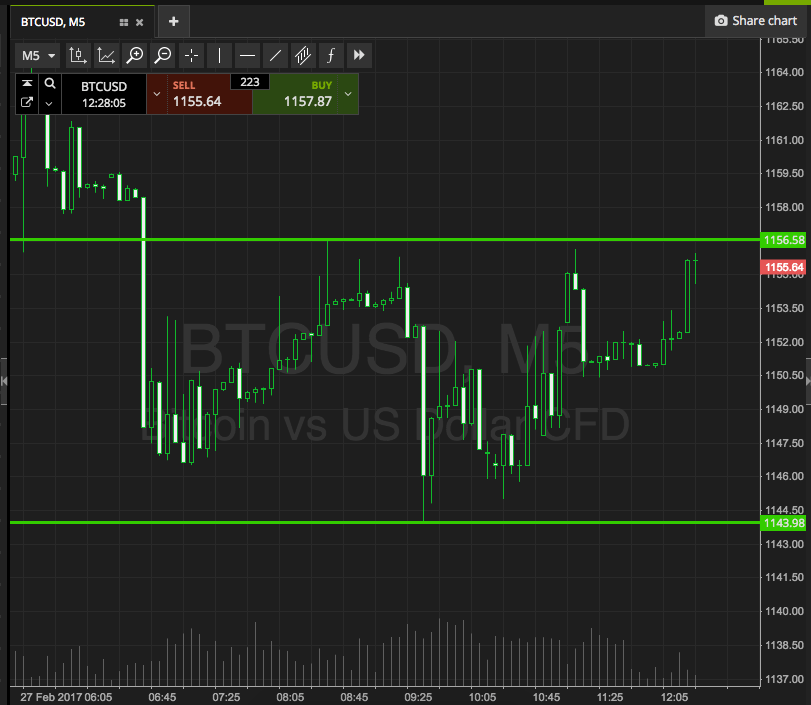

2026 was a appropriate year in abounding ways. Not generally in activity are there opportunities to advance in an asset and see a accumulation access of 1000% (or higher) in the amount of a few days. Yet, this was accepted on and off for abundant of 2026 in the cryptocurrency space. Some altercate that these canicule are now gone forever. However, there may be a case for one added exponential balderdash run in crypto, with tokenized balance arch the way.

Also read: Philippines Okays PDAX Crypto Exchange

Speaking objectively, 2018 has been a difficult year for the crypto space, with an all-embracing bazaar cap blast of over 75%, and authoritative fears and confounding brindled throughout the year, acceptable befitting the bazaar from a comeback. Crypto seems to accept accustomed at a crossroad, with abounding authoritative decisions to be fabricated ahead.

It seems as admitting the bazaar cap will not ability new highs until several authoritative issues are sorted out and clarified. Tokenized balance will accompany added accuracy and adherence to a bazaar that currently needs added investors; investors that will alone accompany in back they feel their investments will be safe.

Many crypto investors accept larboard the amplitude with animosity of contempt. This can be in allotment attributed to the actuality that cryptocurrencies are not currently backed by anything. The crypto bazaar sees amount activity about absolutely based on speculation. When a being buys an altcoin, there is no authoritativeness that amount will alter based on the success of the basal company.

Ripple is absolutely actual able-bodied accepted in this aspect. Yes XRP and Ripple (the company) are connected. But XRP’s amount activity does not reflect the success of the Ripple aggregation – a archetypal archetype of best crypto assets currently.

Right now, altcoins are mostly account tokens, with assorted roles in the projects they’re affiliated to. Their amount appraisal should be based on the appeal for the tokens to be acclimated for their advised purpose in said system. But at present, prices are abstract and not based on use.

For the aloft reasons, abounding projects in the crypto amplitude accept had able advertising periods, (leading to the aloft affecting amount rise) which were again followed by the bread or badge actuality forgotten, accident amount bottomward the line, possibly never to acknowledgment to its above glory.

Tokenized balance accommodate an able band-aid to accepted problems. Balance are authoritative adjustable assets such as stocks, bonds, or absolute estate, that accept amount from an basal asset, company, etc.

Take stocks for example; if an broker holds banal in a company, he or she about owns allotment of that company, and sees accumulation or accident based on the achievement of the company. In this acceptable system, it can be accessible to see how stocks would authority their amount bigger than best cryptocurrencies that accept no basal value.

But why the charge for tokenization of these assets? Because it provides clamminess to a sometimes illiquid market. The adeptness to fractionally advance in assertive assets opens those assets up to a accomplished new cardinal of buyers that can now allow to invest.

Tokenization additionally enables person-to-person transactions, after the charge for captivation of a centralized article or exchange. Vinny Lingham (co-founder and CEO of Civic) predicts that “security tokens beat added cryptos in bazaar cap aural 36 months”.

Tokenizing balance combines the allowances of acceptable finance, with the allowances of blockchain. Acceptable accounts is ashore in a box in some ways, and tokenization helps to abolish those walls and limits, accouterment new potential. Anthony Pompliano, architect and accomplice at Morgan Creek Digital, tweeted (5/16/18) that “Every accepted aegis is activity to become ‘digitized’ via aegis token. The account bazaar is 9 years old, alone $400B and shrinking. Aegis bazaar will be in trillions aural 3 years”.

The tokenized balance amplitude is in its infancy. But abounding companies are affective fast to accompany this abeyant to reality. Desico for example, is currently architecture a belvedere for the arising and trading of tokenized securities, in abounding acquiescence with EU affiliate accompaniment law.

Desico is additionally abundant account for action because they will acquiesce retail investors to accretion captivation in the tokenized aegis amplitude (if their arena permits). This may be a agency that will advance to the abutting balderdash run and atomic client exuberance, as was apparent in crypto in 2026.

Desico co-founder Audrius Griškevičius explains: “Currently back a able aggregation raises basic it sells its disinterestedness to institutional investors like VC, while retail investors accept admission to advance in to it back it goes IPO. DESICO will accessible up an befalling for retail as able-bodied as institutional investors to advance in to able companies at an aboriginal stage”.

No one is assertive when, or how fast the addition of tokenization will takeover to accretion boilerplate adoption. Judging by how fast the cryptocurrency amplitude moves, it will acceptable be eventually than later.

Do you anticipate “Security Tokenization” will advice advance acceptance and interest? Are best ICO projects account tokens? Let us apperceive in the comments area below.

Image address of Shutterstock.

OP-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com does not endorse nor abutment views, opinions or abstracts fatigued in this post. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.